What's changing in Asia: a broad outlook for the year ahead

As another year goes by, we are once again reminded that change really is the only constant. This reinforces our belief in our investment philosophy: identifying companies that exhibit the best blend of fundamental change, sustainable* returns and attractive valuations.

After three years of tightening monetary policy, central banks worldwide have begun to ease. While we do not claim to be macroeconomic forecasters, a sustained shift in the global monetary cycle would be a welcome boost for many areas within our investment universe. The Federal Reserve's decision to lower interest rates has allowed many Asian central banks to follow suit, although this is likely a shallow easing cycle. This environment is typically the most positive for twin deficit economies, such as India and parts of ASEAN, which have both fiscal and current account shortfalls and are more sensitive to the global price of money. This environment also favours less liquid parts of the market like small market capitalisation stocks (small caps) and highly interest rate-sensitive securities such as real estate investment trusts (REITs). We provide more detailed analyses within the separate sections of this report as well as links to our relevant insight pieces.

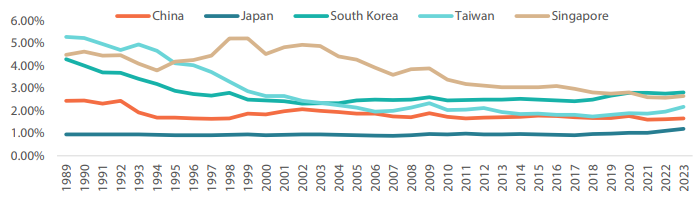

The potential benefits mentioned above may be somewhat tempered by the highly unpredictable nature of Donald Trump's second term as US president. Trump's election campaign once again focused on protectionism, "America First" and immigration, and there is likely to be increasing volatility across global markets. Predicting the Trump administration's next move is likely a fool's errand, but several fundamental changes look set to affect earnings and returns across Asian markets. The strongest impact could be felt in the energy, trade and defence sectors (Chart 1) as the US again turns inwards. For most of Washington's allies, unconditional US support is no longer a given (please see: If Trump wins: uncertainties and opportunities from an Asian equity perspective ) .

Chart 1: Defence spending as percentage of GDP

Source: SIPRI 2023

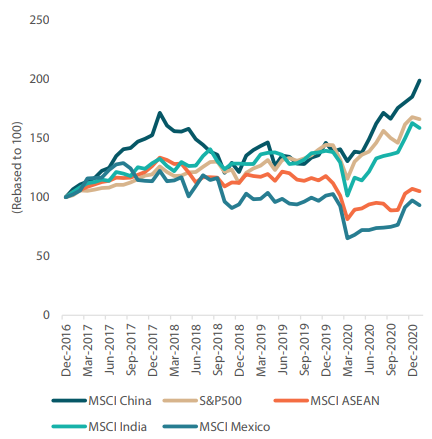

We would like to emphasise, however, that it is far from certain whether "Trump 2.0" will have a net negative impact on emerging and Asian markets. During Trump's first term (January 2017-January 2021), China outperformed both the S&P 500 and all the perceived "China plus one" beneficiaries (Chart 2).

Chart 2: Returns of major indices during Trump's first term

*USD-denominated

Past Performance is not a reliable indicator of future results.

Source: Bloomberg, MSCI

The key takeaway here is that Trump is not the only potential catalyst for fundamental change; in China's case, domestic policy will be paramount. We believe that, unlike during the first Trump administration, Chinese equities have already factored in a much higher risk premium for trade disruptions (please see the China outlook section below).

Opportunities in China likely remain in areas of self-sufficiency and industries that have undergone consolidation. We also see opportunities in Chinese companies with strong cash flow generation that can support organic expansion, dividend payouts and continued buybacks. Elsewhere, we are focused on supply chain diversification, particularly in Asian regions where trade balances with the US are still negligible and where countries offer a clear alternative to China-based production (Chart 3). India, in particular, appears well-positioned to capture further opportunities, as do parts of ASEAN.

We believe that investing in companies with the most competent management teams, forward-looking strategies and adaptability to change helps mitigate risks and seize new opportunities. Several portfolio companies have excelled in this regard since the onset of the original trade wars, particularly Samsung Biologics, Tencent and TSMC.

Chart 3: US trade deficit with Asia and Mexico as a percentage of total

Source: ITC, HSBC, 2023

India: growth with reservations

India, as we often say, is one of the richest sources of both sustainable* returns and fundamental change. However, the challenge lies in finding these opportunities at a good price. Fortunately for patient investors, such an opportunity may be emerging. While US elections took centre stage in 2024, there was also an election in India, the world's largest democracy. This resulted in Prime Minister Narendra Modi returning for a third term, although this was notably as part of a coalition government rather than with a majority (please see: India's election and implications for equities ). This will likely limit Modi's ability to implement more significant positive structural reforms.

In contrast to other Asian economies, the Reserve Bank of India (RBI) and Securities and Exchange Board of India (SEBI) have been proactively regulating their respective markets, which could curtail growth in certain areas. Additionally, as the economy becomes increasingly digital, this fundamental change is profoundly impacting long-established traditional distribution channels and brand moats—elements that have benefitted several companies for decades.

Given the lofty starting point, some consolidation in local equity markets would be welcome. We will be ready with our wish list of high-quality stocks. Despite some short-term reservations, we believe that India remains one of the most compelling long-term investment opportunities in Asia. One area of the Indian market which tends to be overlooked but may be attracting interest is the IT services sector.

AI: are we transitioning to the next level of development?

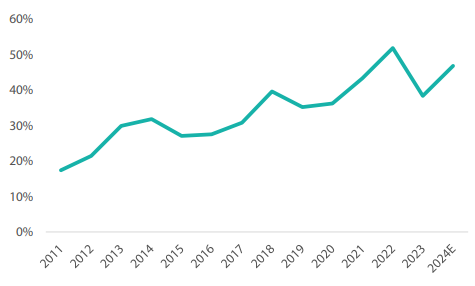

As staggering levels of capital expenditure are invested in generative AI development, the market has begun to rightfully question whether Big Tech's investment will yield the desired returns, and importantly, when? Looking at Big Tech's capex in relation to operational cash flow, we are not yet at unsustainable levels (Chart 4).

Chart 4: Big Tech's capex/operating cash flow*

*Data for 2011-2013 drawn from Meta, Amazon, Microsoft, Baidu and Tencent; data for 2014-2024E drawn from Meta, Google, Amazon, Microsoft, Baidu, Alibaba and Tencent.

Source: UBS and company data, September 2024

Reference to any particular securities or sectors is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way. There can be no assurance that any performance will be achieved in any given market condition or cycle. Past performance or any prediction, projection or forecast is not indicative of future performance.

Moreover, AI appears to be fuelling competition among tech giants as they encroach on each other's territory. This is a race they cannot afford to lose, and their spending is not disproportionate to the current cash generation or stock. This should be positive for Asia's AI "picks and shovels" companies, which have been benefiting for some time (please see: A Fundamental change for AI ) . The greater fundamental changes from here, however, are likely to emerge in the form of applications, new tools and businesses that can best harness these technological advancements.

Where does AI hold the most potential for fundamental change in Asia? Beyond hardware technology, we are increasingly focusing on the areas of eGaming, software and IT services. According to a recent Gartner survey, the number of US chief executive officers who think AI will impact their businesses has surged from 21% in 2023 to 75% in 2024 (please see: CEO Stance on AI: How Your CEO Is Thinking About AI ) . Several Asian companies, like Tata Consultancy Services, Infosys, Tech Mahindra and Wipro, are addressing this growing demand and have been named partners for NVIDIA's AI agent program for specific industries (please see: Consulting Giants Team With NVIDIA to Transform India Into Front Office for AI Era | NVIDIA Blog ) Together, these companies are training half a million staff on generative AI models like Nemo and GPT.

Changing energy markets

Unlike past technological "leaps", the impact of AI is being felt across many more areas of the economy, particularly on power demand. Our outlook for 2024 emphasised how resource-intensive generative AI has become. Combined with growing demand for energy security and transition, numerous strains and bottlenecks are appearing across the energy sector and the capex spectrum related to it. Big Tech, however, will not sit idly and wait for resolutions. In recent months we have witnessed the revival of nuclear demand. Tech giants such as Google, Amazon and Microsoft are expanding research into small modular reactors (SMRs) and reviving mothballed nuclear plants. In Asia, several governments are reevaluating their stance on nuclear energy, driven by concerns over energy security and the needs of power-hungry industries.

Closer to Singapore, where our team is based, this shift in energy market dynamics has resulted in significant activity across the causeway in Johor, Malaysia. With the Malaysian government opening its doors to foreign investment, Johor is fast becoming ASEAN's global data centre hub, attracting both US and Chinese cloud computing and service providers. However, such growth also brings its own challenges in terms of power and resource consumption. We continue to see significant fundamental changes across the energy spectrum, and we are focusing on several subsectors where specific companies are well-placed to generate higher, sustainable* returns.

Asian small caps: beneficiaries of key growth trends worldwide

We have a favourable outlook for Asian small caps given key factors that highlight their resilience and potential for growth in the current economic landscape.

Many Asian small caps can weather economic fluctuations and geopolitical risks. The key competitive advantage of these firms stems from their scale of operations, which provides management with greater agility in responding to shifting trends compared to their larger peers. Additionally, many Asian small caps exhibit higher earnings growth than their bigger counterparts (please see: From beauty products to bicycles: the promising landscape of Asian small caps ).

Smaller companies in Asia also benefit from major global fundamental changes such as the rise of AI, an expanding MZ demographic (Millennials and Generation Z), energy transition and the nearshoring of operations due to ongoing global trade tensions. For instance, the economies of South Korea and Taiwan have a technology-focused legacy. Their companies are closely integrated into the industry's global supply chain and are well-positioned to benefit from the proliferation of AI applications and tools.

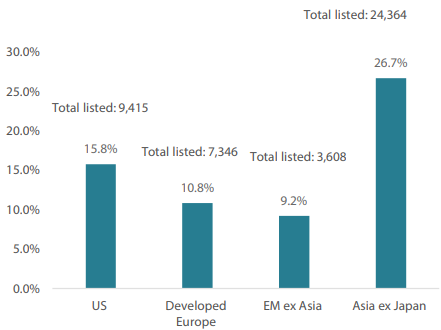

Globally, Asia ex-Japan remains the main area of opportunity for the small caps space. In the past five years, the region has had the largest percentage of new listings, indicating potential sustainable* return opportunities for long-term investment (Chart 5). However, it is worth noting that small caps in Asia face near-term challenges, such as macroeconomic uncertainties and weak market sentiment.

Chart 5: 5-year percentage change in listed companies as at end-June 2024

Source: Bloomberg

Asian small caps represent a compelling opportunity, characterised by strong growth potential and adaptability. Their ability to leverage emerging trends and navigate economic uncertainties favourably positions them in the market. They may face challenges, but their long-term performance history coupled with current supportive conditions suggest that Asian small caps will continue to thrive. A cursory glance at the performance of Asian small caps since 2000 shows that they have outperformed their larger counterparts more than half the time.

Those seeking diversification and exposure to high-growth sectors may want to focus on Asian small caps as they are likely to play a crucial role in shaping the economic landscape of the region in the coming years.

Asia REITs: rising potential and opportunities

Asia REITs have been growing in both depth and breadth as an asset class. With the introduction of new, specific sectors to securitise, more countries and companies have implemented REIT regimes and mandates in recent years.

Robust industry and asset fundamentals anchor the share price performance of REITs, making them a favoured asset class for investors seeking sustainable* returns over a longer time frame. We focus on sectors that are experiencing genuine fundamental change and offer multi-year structural growth. Such sectors include data centres, where rental yield appreciation has accelerated amid the lack of supply. Another example is India and its high-growth economy, which holds a unique position as a global office hub.

Singapore also stands out with its resilience across sectors thanks to regulatory support, particularly during the COVID-19 pandemic. This defensiveness is likely to persist, underpinned by healthy business sentiment and low future supply. As asset yields have started to show positive spreads over the cost of capital, we also see more opportunities for good quality acquisitive growth, with transaction activity expected to gradually increase. Valuations are not at demanding levels; they are below mid-cycle levels, offering sustainable* and attractive potential returns (please see: Prospect of lower rates makes Asian REITs an increasingly vibrant asset class ).

ASEAN: domestic polices to drive positive fundamental change

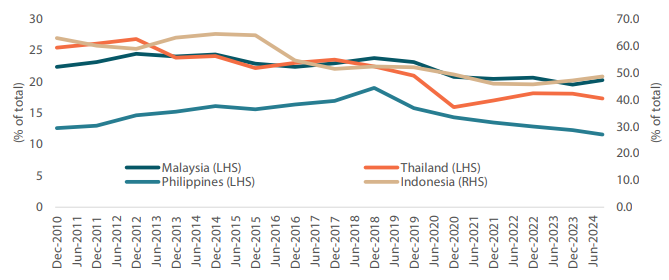

As ASEAN markets lagged the US, Asia ex-Japan and China during the first Trump administration, a casual observer may view the region's prospects under Trump's second term negatively. However, we note that US interest rates, which rose in the early years of Trump's first term, are currently trending lower. ASEAN also suffered during Trump 1.0 from the lingering effects of the 2014 collapse of commodity prices, but we do not expect this scenario to be repeated. In our view, many of the positives driving recent ASEAN performance are still underappreciated outside the region, as indicated by foreign ownership levels (Chart 6).

Chart 6: Foreign ownership levels of ASEAN equity markets

Source: HSBC, Bursa Malaysia, Indonesia Financial Services Authority, Stock Exchange of Thailand, Philippine Stock Exchange, CEIC

Buoyed by expectations of lower rates, ASEAN has already outperformed the US and Asia ex-Japan markets since mid-2024, and trails China only narrowly. Despite the likely onset of inflationary policies under Trump's second term, we believe that the US monetary easing cycle will continue in 2025. This is supportive for ASEAN markets, especially Indonesia, the Philippines and Vietnam.

Under the Trump administration, we see added impetus for China plus one as manufacturers, including those from China, continue to seek low-cost and low-tariff production locations. This will benefit most ASEAN countries, particularly Vietnam and Malaysia.

ASEAN is also integrated into the AI theme, especially Malaysia where a data centre boom is underway. This is positive for power producers, constructors, industrial landowners and data centre operators, thus broadening the range of sustainable* return opportunities for longer-term investment.

In addition to the aforementioned factors, we see favourable fundamental changes in the domestic policies of several ASEAN countries.

Malaysia's unity government has presided over a period of relative political stability and is expected to be more pro-growth over the second half of its political term. Additionally, stronger economic integration with Singapore should support Malaysia's manufacturing, technology, and tourism sectors.

In Indonesia, the government of President Prabowo Subianto has laid down ambitious plans to lift economic growth. Key policies include an ongoing push for downstream activity in the electric vehicle (EV) and commodities supply chains, and reduced fuel imports via higher biodiesel blending.

In Vietnam, newly-installed Secretary General To Lam is expected to implement more pragmatic and pro-business policies, which would be a significant departure from the ideology and centralised control wielded by his predecessor.

China: authorities committed to economic turnaround

China's equity markets are poised for a complex but potentially positive fundamental shift in 2025, driven by a combination of policy interventions and economic recovery signals. Recent fiscal measures, including a significant stimulus package estimated at Renminbi (RMB) 6 to 10 trillion, are aimed at stabilising economic activity (please see: Are China's stimulus measures enough? ). Such optimism is supported by an anticipated end to earnings downgrades, with a new upgrade cycle expected in early 2025 as earnings visibility improves and corporate buybacks continue.

As always, some headwinds remain. The labour market is still weak and deflationary pressures continue to curb domestic consumption, although targeted government measures may help to mitigate this. Geopolitical tensions, particularly regarding US-China relations, add another layer of uncertainty that could influence market dynamics (please see: If Trump wins: uncertainties and opportunities from an Asian equity perspective ). Despite these risks, a selective focus on high-quality sectors—particularly in consumption, energy, and healthcare—may yield favourable outcomes as valuations remain well below historical averages.

Overall, while low investor conviction is likely to result in volatility, the Chinese authorities' commitment to economic stabilisation and the potential for earnings recovery suggests that China's equity markets could experience solid returns in 2025. However, these positive outcomes are contingent on effective policy execution and a geopolitical environment that favours effective deal-making over zero-sum solutions. For a sustained improvement in the markets, we need to see household consumption pick up from depressed levels (Chart 7). For almost three years, households have been saving and paying down debt (Chart 8). Any positive turnaround in outlook for China could see such a trend change dramatically for the better.

Chart 7: China consumer confidence levels

Source: China National Bureau of Statistics, June 2024

Chart 8: household savings and deposits

Source: China National Bureau of Statistics, April 2024

Conclusion

Many may expect the incoming Trump administration's transactional approach to be detrimental to the geopolitical and macroeconomic landscapes. However, we believe that Washington's mercantilist stance should not prevent Asian markets from offering attractive absolute returns, as was the case during the 2017-2021 period under Trump's first term. Additionally, a shift to lower interest rates is expected to provide an extra boost, as it can benefit large parts of Asia by reducing the costs of capital and production. This is especially true if such a fundamental change is reinforced with government policy support and positive structural reform from Asia's leading economies. Lower interest rates and better economic prospects could once again favour growth over value—a trend we have not witnessed for over three years. While 2025 is likely to be anything but dull, we remain steadfast in our search for quality names with the most competent management teams, forward-looking strategies, as well as the versatility to mitigate risks and seize new opportunities. It is our core belief that companies possessing these characteristics will continue to thrive by harnessing change to deliver sustainable* returns under any macroeconomic backdrop.

*"Sustainable" refers to the durability of returns based on our fundamental assessment, not environmental sustainability