Our outlook and key themes for 2025

- US economic growth will continue in 2025 amid expectations of fiscal stimulus. At the same time, inflation is still above the Federal Reserve (Fed)'s target, increasing the fat tail risks associated with disruptions in the US Treasury market.

- The dollar will continue to hold strong but the currency may face sudden disruptions. Dollar-supportive "carry trades" could increase if yield differentials widen in favour of US Treasuries. However, these trades will become increasingly vulnerable to surges in risk aversion. There remains the risk of sharp and sudden yen appreciation on such surges.

- The Bank of Japan (BOJ) will continue to hike interest rates. The pace of its tightening will be dictated by domestic factors but will also be influenced by any prolonged yen weakness on imports, which in turn affects core inflation with a lag.

- China will walk a domestic stimulus tightrope as it has to respond to immediate pressures from struggling consumers while preparing for tariff measures the US could impose on the world's second largest economy.

- European growth may have bottomed out, but any recovery could be weak due to potential US tariff risks.

- Global central bank policy will become more disperse. Some central banks could try to counteract the impact US tariffs may have on growth by easing policy. Others could tighten policy to manage inflation stemming from either the US or a rise in dollar-priced commodities.

A round up of 2024: strong growth delays Fed's monetary easing

Compared to the previous year, the economy in 2024 is on course to end on a stronger note. At the end of 2023, the market was worried about a potential recession. However, solid data on US consumption and employment, accompanied by gradual disinflation offered a boost early in 2024, leading the Fed to delay its interest rate cuts until September. The US yield curve was inverted for most of 2024 and the dollar was in high demand, even as accommodative financial conditions kept credit and equity markets well-supported. US Treasuries offered weak diversification to risks in US equities, a market which was dominated by the "Magnificent Seven" large-cap technology stocks.

Outlook and themes for 2025

US growth seen continuing, lofty market expectations a risk

As we near the end of 2024, anticipation of growth-enhancing policies associated with Donald Trump's return to the US presidency are boosting equity markets. Prior to the US election the stock and bond markets had priced in contrasting economic scenarios, with bonds pricing in a significant growth slowdown yet equity valuations getting increasingly richer. In the short term, Trump's win put an end to the speculation that weak underlying growth would spur aggressive and rapid rate cuts from the Fed. However, caution may be warranted as already stretched US stock valuations have continued extending, even as the US debt-to-GDP ratio has effectively reached historical highs of 120% (Chart 1). Nikko AM's Global Investment Committee (GIC) had, prior to the election, judged that tail risks, such as disruptions to the US yield curve, have risen. The unexpectedly strong mandate that US voters gave the Republican Party has meanwhile lowered the risk of near-term Congressional conflict over the debt ceiling, and at the same time, increased the tail risks inherent in the combination of anticipated fiscal easing and an already stretched US fiscal position.

Chart 1: US debt, current account balance as percent of GDP

Source: Nikko AM, St. Louis Fed, IMF

Greater-than-expected support for US Republicans in not only the executive branch but also in both houses of Congress was received favourably by markets, against the backdrop of an already resilient US economy. Specifically, the markets are now anticipating near-term fiscal stimulus and have shown generally positive sentiment over yet-to-be-specified deregulation measures. Firstly, because both growth and inflation have been firmer than anticipated, we do not foresee an imminent US recession. However, we go into 2025 with a degree of caution: equity market valuations have outpaced policy announcements and the market is therefore vulnerable to potential disappointments. These may come in the form of softer-than-expected earnings announcements, weakening US consumption or jobs data and fiscal and regulatory policy announcements that fail to live up to markets' lofty expectations.

US yields: orderly markets are our central scenario, but Treasury market's resilience could be tested

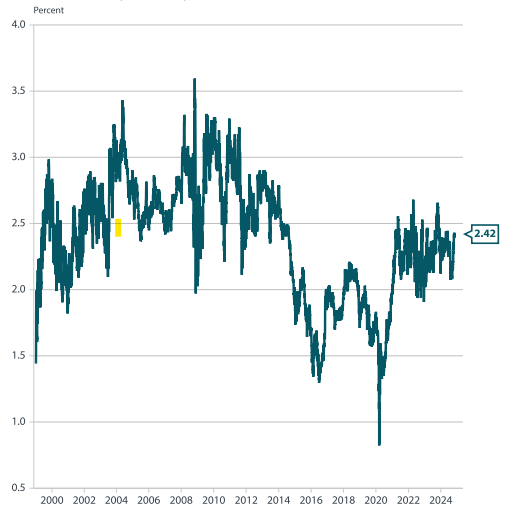

The Federal Open Market Committee (FOMC) turned data-dependent soon after initiating its interest rate cut cycle as it removed its forward guidance alongside its rate cut of 25 basis points (bps) in November 2024. In keeping with the central bank's independent stance, Chair Jerome Powell declined to offer any guidance on potential responses to fiscal policy measures until such measures are specified. However, the Fed may be required at some point to respond to fiscal expansion expectations by issuing a higher inflation outlook. We therefore continue to watch the 5-year/5-year US Treasury breakeven inflation (BEI) for any signal that the BEI's current anchoring below the 2.5% level may become unmoored (Chart 2).

Chart 2: US 5-year/5-year BEI

Source: Nikko AM, Federal Reserve

The US economy's resilience has been impressive, but it is likely in the late stages of its expansion cycle. Regarding the role of stimulus in this expansion, it is unusual that such large current US budget deficits have endured for the expansionary part of this cycle. In our central scenario, we anticipate the adjustment in US Treasury yields to proceed in an orderly fashion. However, the probability of a more disruptive adjustment, while still small, has increased in our view. In particular, the Fed's interest rate cuts could prompt external creditors funding the country's twin deficits to question whether US debt offers a sufficient premium. Such a risk should not be ignored, especially if Washington introduces sweeping trade barriers, which would curb the benefits of trade partners exporting to the US. The risk of such barriers has risen since the US election.

Although not our central scenario, the Fed's capacity to fight inflation may be challenged as we approach the end of Powell's term in 2026. The dominant view in markets is that the US Treasury market is too large and liquid and US seigniorage too deeply entrenched to undermine the central role of Treasuries in global central bank reserves. However, the confluence of US policies may test the limits of Treasury market resilience. Therefore, it may be prudent to purchase insurance against the albeit lower risk of a disorderly spike in US long-term yields.

Dollar to stay firm but may hit bumps; yen to offer good hedge against volatility

As long as risk appetite persists, the dollar is expected to continue drawing support from yield differentials thanks to higher US interest rates—especially if the Fed's cut cycle is shorter than anticipated. The rally in gold prices thus far has been less about risk aversion and more about the frantic search among global investors for an alternative to US Treasuries, particularly one that can be held as foreign reserves and serve as a hedge to risk portfolios. The inversion of the US yield curve made dollar cash alternatives attractive, given that even short-term paper offers a healthy premium over many other developed and even some developing market currencies. Thus, the carry trade has remained viable in orderly foreign exchange markets; however, this could be suddenly disrupted by any rise in implied volatilities. Although the comparatively low-yielding yen remains a preferred funding currency, we expect it to appreciate sharply on any surge in volatility. Therefore, the Japanese currency, despite the unfavourable comparative yields, may offer a hedge against tail risks associated with investing in risk asset markets.

Japan's "virtuous circle" seen continuing

In a multi-asset portfolio, an investor has options for yen allocations other than cash. In fact, we see additional value in Japanese stocks both on an absolute basis in the short term, and on a relative basis in the longer term. As long as the US equity rally continues, we believe that a combination of cyclical factors—including the carry trade, the yen's weakness and risk tolerance—is likely to continue buoying Japanese stocks. Furthermore, we see Japan's relative fundamentals remaining attractive even when the US growth cycle eventually slows.

We expect Japan to offer good diversification and downside protection primarily because of its solid structural reflation credentials. These include labour supply shortages (which are driving real wage gains as well as investment in software), as well as steady improvements in corporate governance, profit margins and return on equity. These factors are gradually penetrating the domestic side of Japan's economy. The longer the rebound in domestic demand growth continues, Japan is more likely to offer value through a shift from export-oriented large manufacturers to smaller-cap, more domestically oriented firms. For Japan to remain resilient even if US growth eventually loses momentum, it will be crucial for smaller firms to continue absorbing wage rises and passing on costs to customers.

BOJ to weigh healthy consumption vs. inflation

The BOJ fulfilled its promise to keep its policy "behind the curve", allowing core inflation to rise above its target rate of 2%. Inflation remained above the 2% target for two years before the central bank started to remove stimulus in March 2024. As a result of Japan's ongoing domestic resilience, the BOJ has committed to gradually withdrawing stimulus until it reaches some measure of "neutral" rates. However, if "neutral" implies long-term real interest rates of near zero (or even mildly negative), positive inflation expectations are likely to drive further rate hikes. Meanwhile, the BOJ has highlighted the relationship between yen weakness, import prices and consumer prices. All else being equal, this means that a trend toward yen weakness could bring forward BOJ rate hikes. Assuming global growth holds up, it would be feasible to expect the central bank to continue gradually withdrawing stimulus until overnight rates reach 1% and possibly beyond, dependent on future inflation expectations.

China seen delivering significant stimulus if faced with aggressive tariffs

China's 5% annualized growth target appears elusive for now, as it struggles to spur private investment and export growth to offset weakness in domestic consumption and a backlog in the residential pipeline. Recent stimulus measures focused on monetary easing and bond swaps. The latter measure is designed to replace the liabilities of local government financing vehicles, which have been capped at Chinese yuan (CNY) 10 trillion over the next five years. Markets so far have been sceptical about whether measures to date can deliver lasting support to China's ailing growth. However, it is rational to expect China to keep some of its fiscal powder dry, as Beijing may soon have to react to protectionist measures, such as the imposition of sweeping tariffs by Washington.

If aggressive, across-the-board tariffs are placed on its exports, we see China delivering significant additional stimulus measures. The measures may include increased fiscal stimulus and steps to weaken the yuan, particularly if US trade tariffs threaten industrial exports. Such reactive stimulus would be more political than economic. Compared to other economies where incumbents can be ousted if inflation erodes households' standard of living, China has incentives to pay a premium to preserve social stability.

China bonds: environment favours an "issue, baby, issue" approach

Chinese stocks have struggled to capitalise on gains made in late September 2024 following the announcement of China's stimulus plans. On the other hand, Chinese government bond yields have declined steadily, with overseas and domestic investors demonstrating ample demand for the country's debt. Demand from some of China's regional bank investors was so strong that the Chinese government had to ask them to restrain their purchases.

Chinese bonds have proven to be one of the few genuine diversifiers against concentration risk in US equity portfolios as the deep, liquid US Treasury market has failed to provide its usual degree of buffer against market risks. These conditions created an environment ripe for China to re-enter the dollar bond market thanks to abundant demand. Late in 2024 China sold dollar bonds for the first time in three years, issuing the debt in Saudi Arabia, another dollar reserve-holding country.

The current market appears to favour the issuance of Chinese bonds, which may help Beijing finance new measures to shore up domestic growth should it be prompted by protectionism from overseas. At the same time, Chinese domestic demand stimulus may have positive knock-on effects on trade partners which have some degree of export reliance on China, such as those in Asia and Europe.

ECB may keep supplying stimulus well into 2025 while monitoring geopolitics

China will not be the only economy keeping an eye out for trade protectionist measures the incoming Trump administration may impose. The euro zone, like China, has been dealing with weak domestic growth, although the bottoming out of industrial indicators has provided the region with some support.

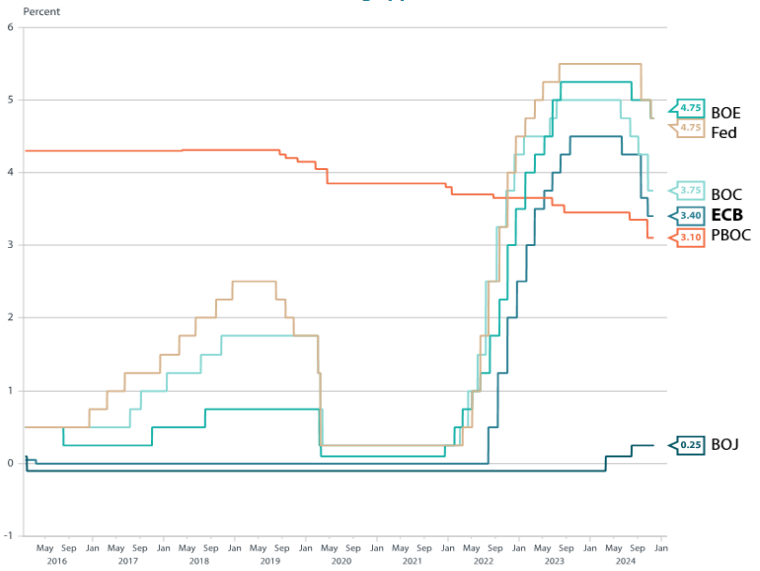

The European Central Bank (ECB) has so far maintained its easing approach (Chart 3). Though disinflation and unemployment in Europe are not severe, soft manufacturing and private investment, coupled with the prospect of upcoming trade barriers may prompt the ECB to continue supplying stimulus well into 2025. At the same time, European governments may enact limited fiscal stimulus to counteract pressures from US tariffs that the Trump administration could implement, though many remain constrained by existing debt burdens.

The euro zone's domestic growth may remain weak in 2025. However, we do expect economic growth to stay positive. Households continued to build savings even as real incomes improved over recent quarters, but the ECB's rate cuts will reduce incentives to save among households and their spending could keep growth in positive territory. US tariffs targeting China may intensify competition between China and the euro zone. However, the single currency bloc may also benefit from Beijing's fiscal stimulus if Chinese authorities, in a bid to allay the pressures from US tariffs, are successful in bolstering domestic demand growth.

Chart 3: The ECB has maintained its easing approach

Source: Nikko AM, ECB, BOC, BOJ, PBOC, BOE and Federal Reserve

Global central banks may have to make trade-offs as they grapple with US tariffs

Like China and Europe, many other US trade partners are expected to keep a close watch on potential tariffs or other protectionist measures that the Trump administration may deliver in 2025. The correlation between the US Treasury market and many other global bond markets has persisted (with the aforementioned Chinese bonds being an exception). As we look towards 2025, markets could still price in a higher probability of inflation stemming from tariffs imposed by the Trump administration and tax cuts in the US.

Global central banks are likely to be sensitive to whether the negative impact of tariffs on domestic growth will outweigh the inflationary impact of imported dollar strength. For example, dollar strength has proven to be a significant consideration for the BOJ. The Bank of Canada (BOC) is another central bank likely to have to weigh both sides of the growth and inflation equation. Meanwhile, Canada has been singled out prior to the start of the Trump administration, alongside Mexico and China, as a target economy of US tariffs. Canada shares an extensive border with the US and is therefore more exposed to inflationary pressures from its southern neighbour than other countries that do not border the US. Consequently, there is a higher probability that Canadian tariffs may be absorbed by US downstream producers and consumers, providing the US economy continues to grow robustly.

The BOC remains on a rate cut trajectory but its easing path could face obstacles if inflationary pressures rise unexpectedly. Apart from the BOJ, which is gradually withdrawing stimulus, many central banks are positioned at the same time to continue lowering interest rates. That said, some of these central banks, at some point, may have to make a trade-off between softer growth—for example, due to pressures from US trade tariffs—and stickier inflation, which could cut short their rate cut trajectories. The momentum seen in some regional risk assets may falter in 2025 if their central banks are forced to make such a trade-off.