Summary

- DeepSeek has injected some liveliness into the Chinese market, and China's tech has been the comeback story so far in 2025, some five years after regulators began a sweeping crackdown on the sector. Beyond that, there is strong potential for growth and recovery in China, as we expect the policy environment to remain supportive, with further policies ahead helping to rebalance the economy towards consumption. We are also seeing early signs of stabilisation in the real estate sector, and the stock market is becoming more active as tech has rallied from a low base.

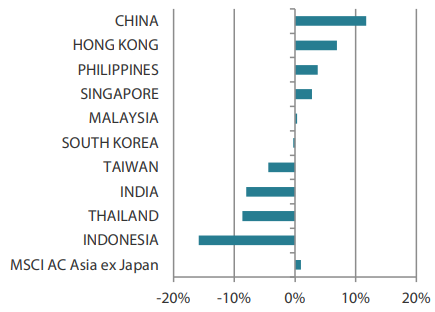

- While US equities stumbled in February amid some soft economic data, Asian ex Japan equities saw a modest gain over the month, helped by continued positive momentum in Chinese tech stocks. China (+11.8%) and Hong Kong (+6.9%) outperformed the region while Indonesia (-15.8%) and Thailand (-8.7%) lagged.

- In addition to China's supportive policies fostering confidence, another reason to be constructive on Chinese equities is the country's positive liquidity dynamics. The country's record trade surplus in 2024 and elevated household savings deposits mean there is plenty of money in the system looking to be deployed. Elsewhere, while Indian companies have slipped into correction territory, supportive consumption policies and structural reforms will likely enable them to recover in the year ahead. In ASEAN, amid current mixed rate cut trajectories and uncertainties regarding structural reforms, we believe that fundamental drivers of change remain in the region.

Market review

Markets grapple with the timing and scope of Trump tariffs

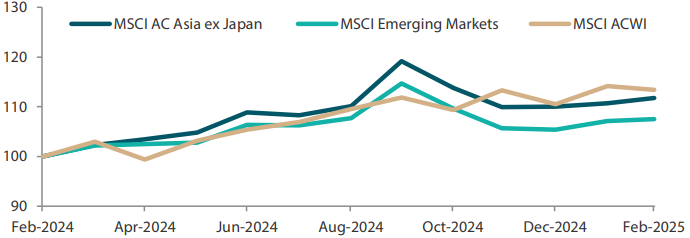

Markets across Asia ended the month on a mixed note, as investors reassessed the potential impact of tariffs imposed by the new US administration. In a month when US equities sputtered amid economic jitters, the MSCI Asia Ex Japan Index rose 1.0% in US dollar (USD) terms in February, propelled by China, where DeepSeek and the tech sector provided some much-needed lift to sentiment.

Chart 1: 1-yr market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

Rescaled to 100 on February 2024.

Source: Bloomberg, 28 February 2025. Returns are in USD. Past performance is not necessarily indicative of future performance.

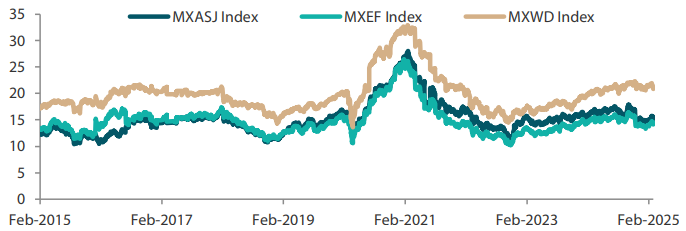

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 28 February 2025. Returns are in USD. Past performance is not necessarily indicative of future performance.

China rallies on the back of Chinese AI developments

China—the top performing market with a gain of 11.8% in February—saw investor interest in its technology capabilities reignited, boosted by homegrown artificial intelligence (AI) upstart DeepSeek's breakthrough and upbeat earnings by big tech companies. Externally, the US-China trade war escalated as Beijing hit back against the introduction of further tariffs by Washington with countermeasures of its own. Shares of Hong Kong companies rallied 6.9%, also fuelled by optimism surrounding China's technology sector.

Indonesia, Thailand and India were the worst performers in February. Concerns over a stronger US dollar and a lack of domestic catalysts sent shares in Indonesia (-15.8%) and Thailand (-8.7%) tumbling. Central banks in both countries continue to face a growing dilemma: protect their currency or loosen policy further to prop up economic growth. To this end, Bank Indonesia kept rates unchanged at 5.75% to arrest the rupiah's decline. In contrast, amid repeated government calls for further easing, the Bank of Thailand trimmed its benchmark interest rate by 25 basis points, pointing to a weaker growth outlook. Elsewhere, a deceleration in corporate earnings growth and uncertainty regarding US tariffs dragged the Indian market (-8.0%) to its fifth straight monthly loss. Meanwhile, the Indian government announced personal tax cuts in its annual budget to boost consumption, while the Reserve Bank of India cut its interest rate to 6.25% to provide further stimulus to the economy.

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way.

Chart 3: MSCI AC Asia ex Japan Index 1

For the month ending 28 February 2025

For the year ending 28 February 2025

Source: Bloomberg, 28 February 2025.

1 Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market Outlook

Reasons to remain constructive on Chinese equities

Market volatility has increased since the start of the year due to the unpredictable nature of US President Donald Trump's protectionist policies and their inflationary and disruptive effects. Against this backdrop and also due to underlying geopolitical tensions, the Chinese authorities have redoubled efforts to jumpstart the domestic economy and revitalise the stock market. We expect the policy environment to remain supportive, with forthcoming policies helping to rebalance the economy towards consumption. In our view, policymakers will likely continue to focus on ways to lift domestic consumption, given how effective the trade-in subsidy program has been to date. We are also seeing early signs of stabilisation in the real estate market, and the stock market is becoming more active as tech has rallied from a low base. If these developments continue due to more government support, the positive wealth effect generated will be crucial in lifting consumers' confidence.

Another reason to be constructive on Chinese equities is the positive liquidity dynamics in China. The country's record USD 992 billion trade surplus in 2024 and household savings deposits mean there is plenty of money in the system looking to be deployed. Low government bond yields are a symptom of this positive liquidity dynamics and could lead domestic institutions to redirect their capital to equity markets for better returns. The securities regulator is further encouraging more investments in the equity market by unveiling measures for state-owned insurance firms to invest 30% of annual premiums from new policies in the domestic A-share markets. Despite short-term uncertainty stemming from US tariffs and retaliatory measures from Beijing, there are encouraging signs that a provisional truce could be reached, given that Trump said a trade deal with China was “possible”. In our view, this “grand bargain” will be the proverbial icing on the cake to our scenario, but we do not consider it a base case.

Expect Indian companies to recover lost ground

We believe that India remains a compelling long-term investment opportunity despite facing short-term challenges and a year-to-date index decline exceeding 7%. The Indian rupee is seen weakening further after hitting a new low earlier this year, as interest rates are expected to be cut to lift economic growth. Supportive consumption policies and structural reforms will likely enable Indian companies to recover in the year ahead. We see the current market correction as a healthy occurrence that hopefully presents investors with opportunities to invest in some high-quality companies at much more reasonable valuations.

Several companies in South Korea and Taiwan already adapting to shifting trade patterns

Despite the recent political turmoil characterised by leadership instability and public protests, South Korea has delivered close to a 10% index return so far this year on the back of strong corporate results and the “Value-Up” programme. South Korean companies continue to grow globally and deliver good returns at reasonable valuations. The stock markets of South Korea and Taiwan are among the most sensitive to trade disruption, and we observe several companies already adapting to limit those risks.

Structural drivers of fundamental change still exist in ASEAN

With mixed rate cut trajectories and uncertainties regarding structural reforms, ASEAN has underperformed China significantly year to date. However, structural drivers of fundamental change still exist. Under the Trump administration, we anticipate added impetus for "China plus one," as manufacturers—including those from China—continue to seek low-cost and low-tariff production locations. We believe this will continue to benefit most ASEAN countries. China, as a counterweight to US policy, may also direct and look to its private companies to increase the country's outbound direct investment, with the aim of developing better trading relationships with its neighbours.

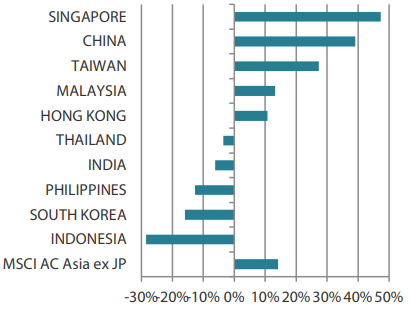

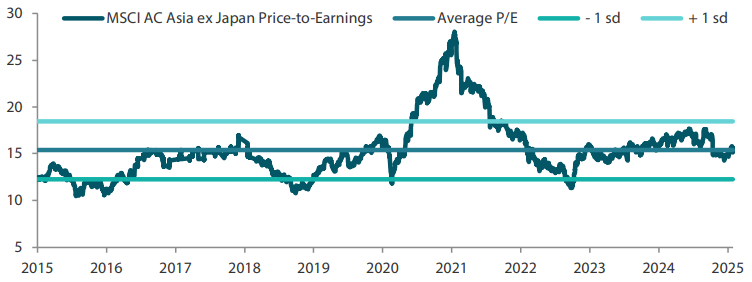

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 28 February 2025. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

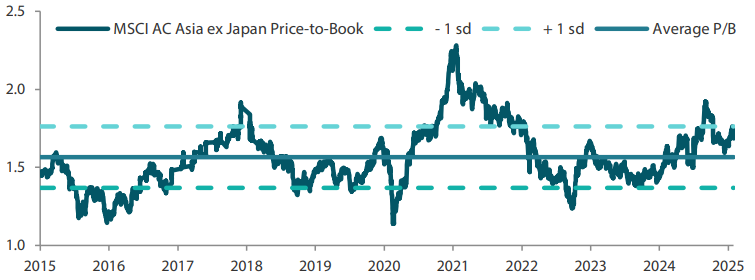

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 28 February 2025. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.