The focus in the media and amongst most analysts has centred around tariffs and a possible fiscal tightening in the USA – although we would argue that on a cash basis the latter is already happening quite aggressively. In some cases, it seems that even where the government has notionally incurred expenses, it does not seem to have distributed funds to its suppliers. This suggests to us that the tightening has already begun and this, along with the rise in policy uncertainty would explain why the economy seems to be slowing quite rapidly.

In theory, a significant fiscal tightening should lead to the depreciation of a currency (the inverse of the 1980s’ Reaganomics effect that caused the USD to soar) and the new Administration has talked simultaneously of maintaining the dollar’s position as the reserve currency (if only so that its partners can be “crammed” with more Treasury bonds) while at the same time depreciating the currency to aid US industrial growth.

Meanwhile, other forecasters are forecasting that the effect of tariffs will be to strengthen the USD, as other countries seek to offset the tariffs by depreciating their currencies and higher US import price inflation leads the FOMC to hold off cutting interest rates. Both are plausible and, as ever with economists, you can have the choice of two views…

We however would argue that there are bigger forces at work and that the fate of the USD – and indeed the global financial order – is being determined as we write.

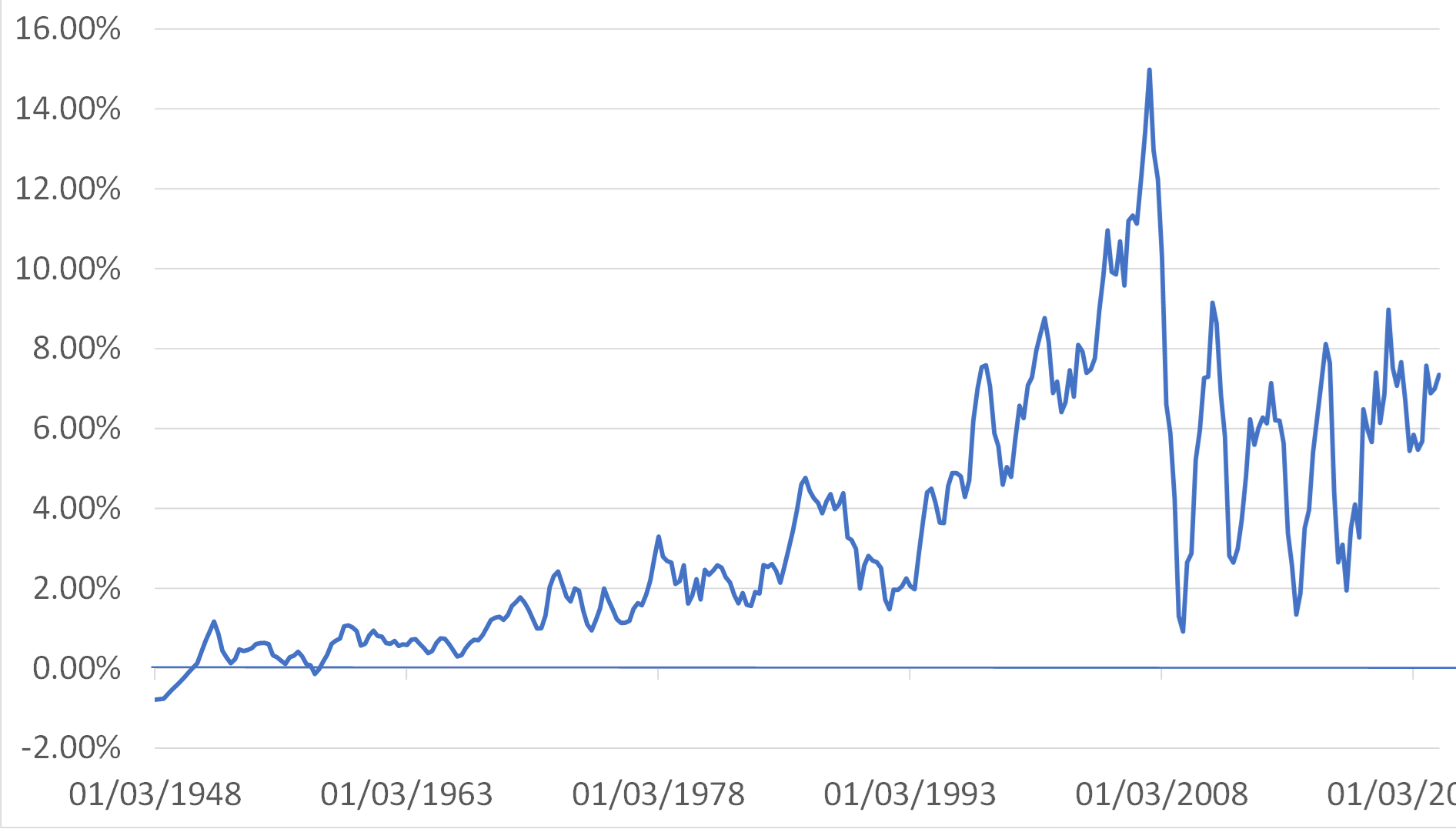

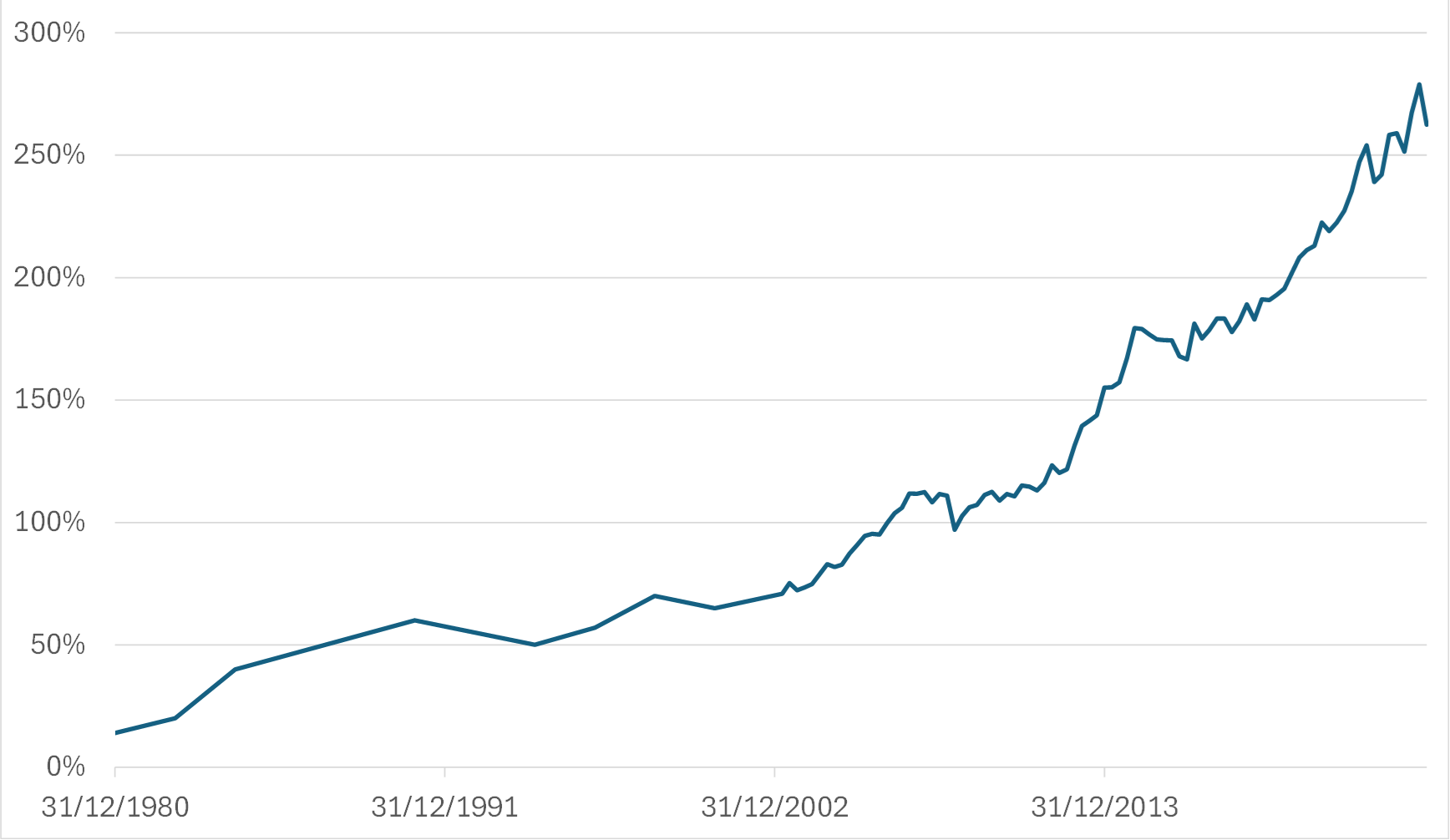

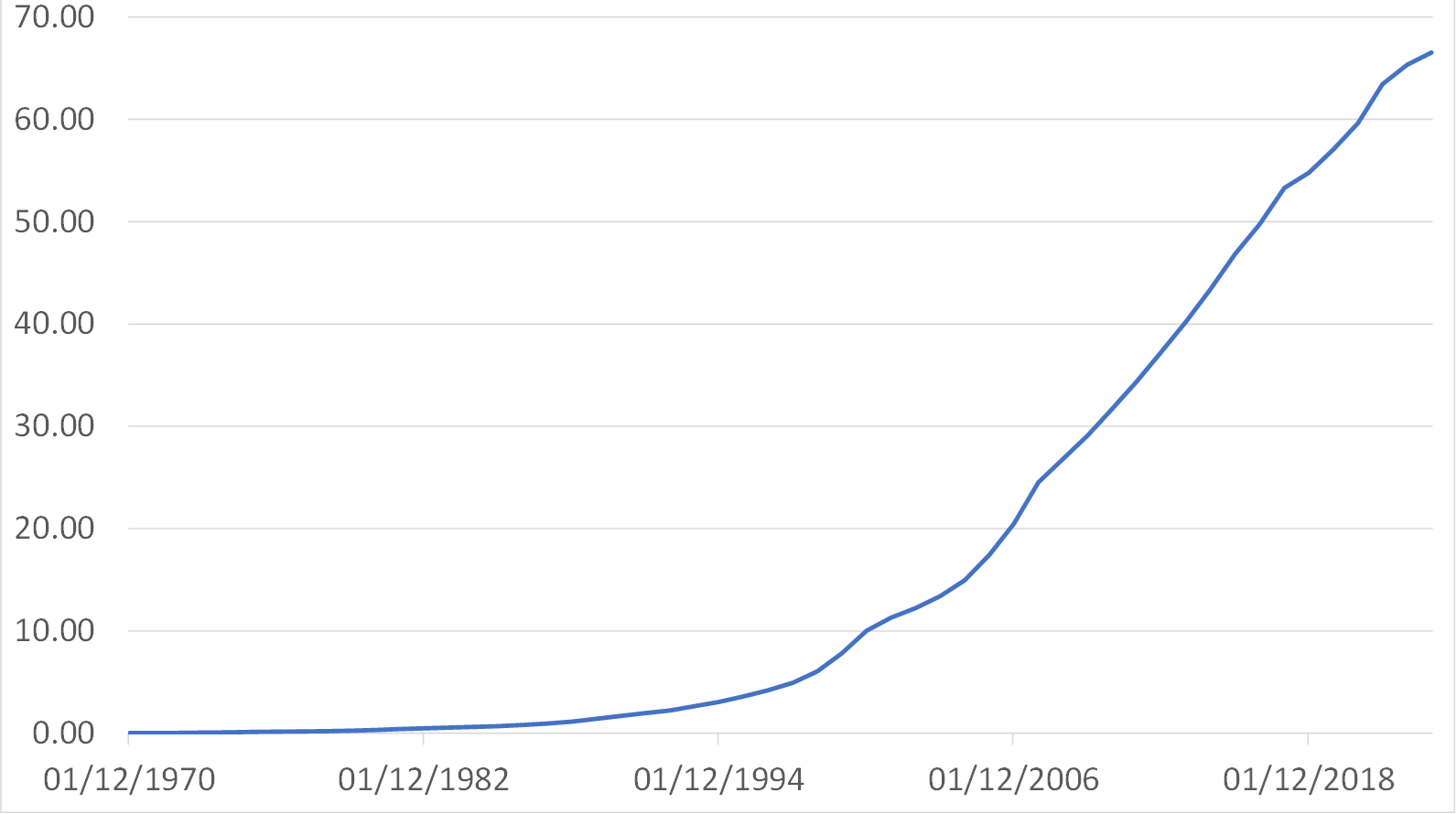

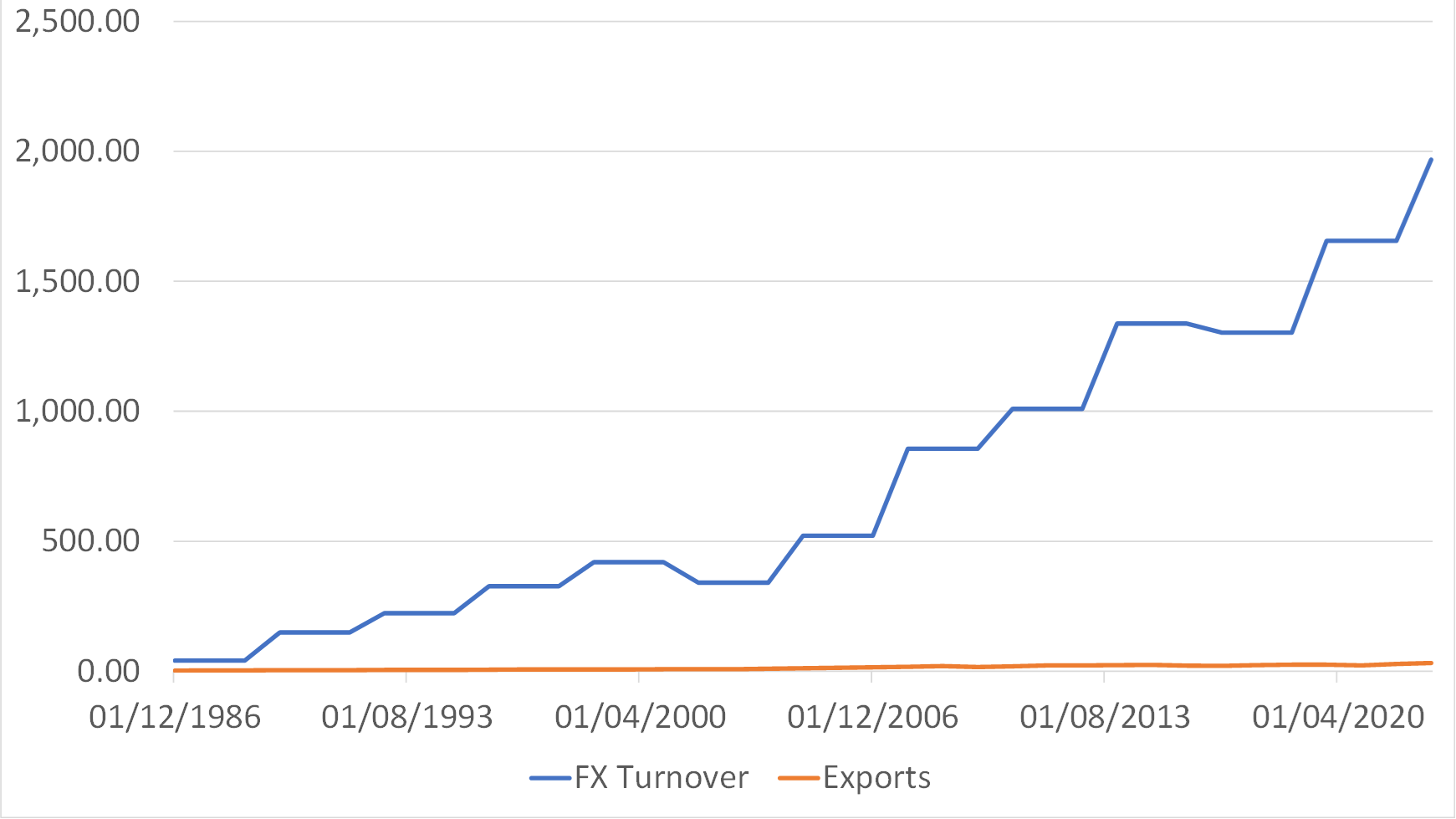

Since the financial deregulation of the early 1980s and then the successive currency accords of the mid-1980s and since, there has been an explosive growth in global capital movements – the flows have got ever larger relative to the underlying economies and the stocks of each countries’ claims on one another have exploded in what we might describe as “an orgy of financial innovation and financialization”. We offer a few flow and stock charts below in order to emphasize our central point. Each of the charts offers a broadly similar message – capital flows rose in prominence from the mid 1980s onwards and their relative growth became extreme during the early 2000s.

USA: Capital Inflows

% GDP 4qma

Japan: Foreign Assets

% GDP

Global Cumulative Long Term Capital Account Flows

USD trillion since 1970

World Exports & FX Turnover

Annual data, World Bank USD trillion

Quite simply, the stock of most countries’ holdings of assets in, and claims on, other countries has risen massively relative to the underlying economies and this has been the overriding feature of the “modern world” – greater foreign involvement in the equity markets is the obvious feature but less obviously countless governments have been able to rely on foreign funding for their outsized and otherwise unsustainable deficits, property booms around the Pacific have been exaggerated by foreign investors, and even supported by domestic mortgages the funding for which has been raised from foreign investors. Even much of the internal “financialization” of economies that has occurred has only been made possible by the glut of foreign capital flows.

In practice, virtually all of our lives have been touched by the expansion of global capital flows and it is of no coincidence that the names of the intermediaries that facilitated these flows now adorn many of the tallest buildings in our CBDs, along with the accountants, consultants and lawyers that have been required to assist in arranging these flows.

To hold assets in a far-off land requires a degree of trust. Some may of course distrust their own governments and even their own monetary authorities, but to invest abroad one must trust “strangers”, be confident in new legal systems, believe that FX markets will not create “landmines” for unsuspecting investors, and in the case of the EM, one must believe in relatively new countries. One also must trust any new governments that come along and threaten a changed regime.The original Plaza Accord that occurred back in 1985, and the sight of the various G5, G7, G8, G20 and even UN meetings that have occurred since undoubtedly gave rise to a lot of trust between 1985 and 2024. This faith in the system, along with what were in truth remarkably accommodative monetary policies in the US and elsewhere for much of the last forty years, were instrumental in creating the capital-flows dominated financial architecture in which we now operate. This was the World that global policymakers created, the desire for the globalization of capital markets was even more keen than their desire for the globalization of supply in the real economies. Whether this was a world that favoured the median household is open for debate – hence the current political instability around the World.

By implication, the trillion-dollar question for investors today is a simple one but the answer will determine investment strategies for the medium term. Have recent political events around the World so diminished trust in foreign countries to such an extent that people will be less inclined to invest abroad, or might they even start unwinding their holdings and return to home shores?

If the World continues along the path that it has followed for the last four decades, and capital flows are unaffected by recent events, then we can expect continued modest growth, continued wealth inequality, and probably some inflation in the debtor countries, with generally stable currencies (i.e. range-bound). If we are however moving to a World of diminished capital flows, then the current account surplus economies such as China will likely see stronger currencies and perhaps a modest stimulus to their growth. In a World of increased fear and therefore wholesale repatriations of capital, however, the currencies – and most likely domestic inflation rates of the net saver countries will likely soar to uncomfortable levels.

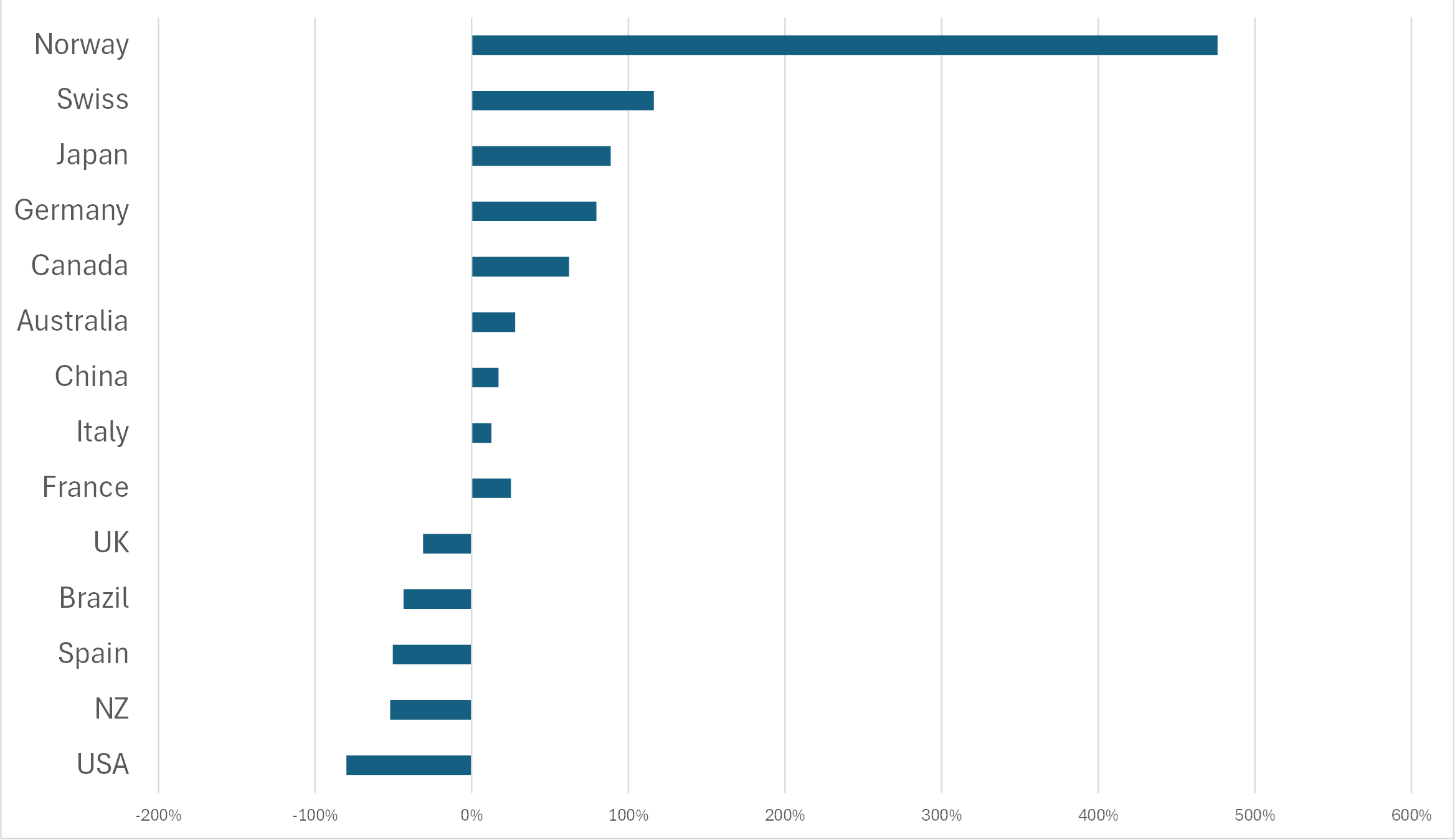

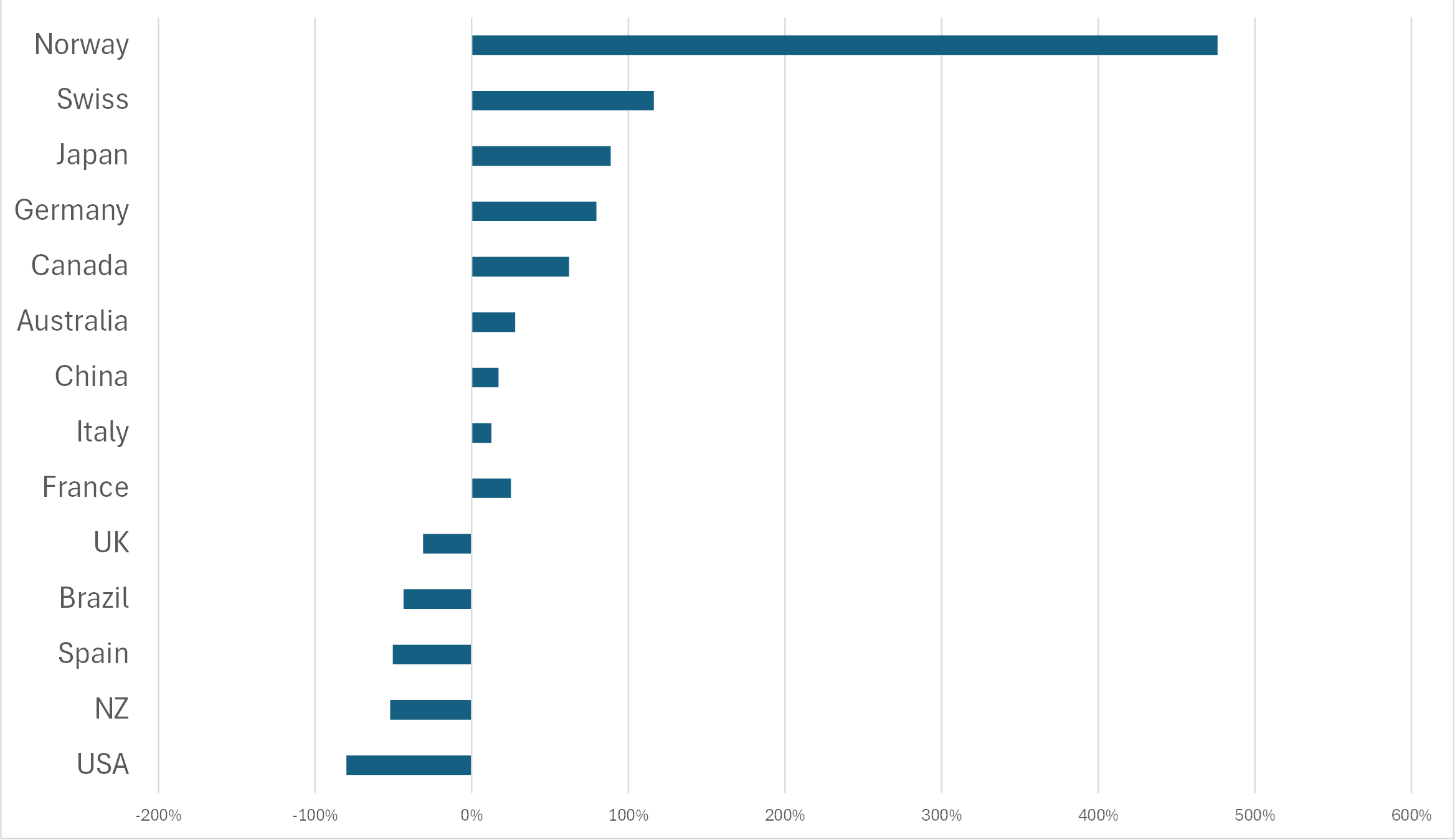

International Investment Positions

% domestic GDP

% domestic GDP

This then is the question that we must ask ourselves when we watch the news. Is what we are seeing on our screens enough to send foreign investors scurrying for the door? If it is, then our World is going to change and the precedents and history of the last 40 years will count for very little - and it will “never” be too late to buy Gold. Many are worrying about whether current account balances will be re-jigged by tariffs and currency moves but history suggests that they rarely are altered meaningfully but capital account balances can change in a heartbeat with dramatic consequences not just for the way in which we invest in markets but also how our economies function.

Disclaimer: These views are given without responsibility on the part of the author. This communication is being made and distributed by Nikko Asset Management New Zealand Limited (Company No. 606057, FSP No. FSP22562), the investment manager of the Nikko AM NZ Investment Scheme, the Nikko AM NZ Wholesale Investment Scheme and the Nikko AM KiwiSaver Scheme. This material has been prepared without taking into account a potential investor’s objectives, financial situation or needs and is not intended to constitute financial advice and must not be relied on as such. Past performance is not a guarantee of future performance. While we believe the information contained in this presentation is correct at the date of presentation, no warranty of accuracy or reliability is given, and no responsibility is accepted for errors or omissions including where provided by a third party. This is not intended to be an offer for full details on the fund, please refer to our Product Disclosure Statement on nikkoam.co.nz.