Rise in delistings reflects efforts to create a more attractive market

It was recently reported that 94 companies were delisted from the Tokyo Stock Exchange (TSE) in 2024. This reduced the total number of listed firms to 3,842. The number of delisted companies was the highest since 2013—the year when the TSE merged with the Osaka Securities Exchange. This surge reflects an increase in management buyouts, mergers, and acquisitions amid calls by the exchange and investors for listed firms to enhance their corporate value.

Many of the delisted companies were part of the TSE’s Growth Market. However, they remained relatively small in terms of market capitalisation and had low trading volumes. This phenomenon can be partially attributed to the significant number of Growth Market firms that lack the growth narrative to utilise liquidity upon their initial listing.

The TSE appears to be striving to create a more attractive market by tightening the standards for companies to remain listed. This move, although resulting in delistings, seems to be an effort to uphold its reputation. The approach has both advantages and disadvantages if the TSE aims to foster a truly growth-oriented market and encourage companies to focus on growth. On the positive side, it could bolster the TSE's standing and prompt listed companies to concentrate more on enhancing their growth narratives. Conversely, it could diminish the number of investable companies.

The TSE's approach towards listing standards can also be perceived as a self-reformation effort. In the past, the TSE may have considered listed companies too much as customers. This deference to companies could have contributed to a perceived decline in the quality of Japanese exchanges. By adopting a stricter stance on listed companies and shifting its focus towards investors, the TSE has made a significant move towards reversing this decline and revamping its reputation.

From an investor's perspective, the TSE's stance is commendable. Its efforts to improve its standing are anticipated to increase the number of appealing listed companies in the long run, particularly within the Growth Market. This could continue to attract foreign investors to Japan, thereby creating a virtuous cycle in which improved dialogue with investors enhances the quality of Japanese corporate management, in turn sparking fresh interest. While a decrease in the number of listed firms may not seem like a positive development, an improvement in the quality of listed companies could outweigh any decline in quantity.

Merger of Japanese car makers may stimulate reforms beyond the industry

When news emerged in late December 2024 that Japan’s second- and third-largest automakers were discussing a merger by 2026, many were quick to interpret this proposed alliance as the latest sign of a broader decline in Japanese industry. Indeed, Japanese car manufacturers are bracing for challenges as the auto industry experiences a transformation of a magnitude seen once in a century, primarily due to the surging prominence of electric vehicles (EVs).

However, as with other business consolidations taking place in Japan, there are positive aspects to the proposed alliance of the automakers. One advantage is that a merger between these large automakers can reduce the excessive competition that has long existed in the industry. Competition became excessive as each manufacturer had affiliate firms that produced a multitude of parts specifically for the large leading company. Such networks of companies connected by close alliances and cross-shareholdings are known as "keiretsu" affiliations. The keiretsu system resulted in numerous companies manufacturing the same products, when only a few would have been enough to supply the entire industry.

A merger will mean that the keiretsu system, which has been criticised as unnecessary and wasteful because of the excessive competition it is associated with, will have to be reformed. As a result of the merger, some affiliate firms will likely need to break away from the keiretsu framework to stay relevant. True competition may emerge as the keiretsu auto parts manufacturers, no longer tied to large leading companies, strive to innovate and produce superior products to survive in a more open market.

While this is a microeconomic story within the auto industry, it is likely to have a macroeconomic impact as it could stimulate reforms of keiretsu systems in other industries, such as electronics. This is largely because automakers and their affiliates employ a significant portion of Japan’s workforce, and any changes in the industry could be perceived as positive signs of change for the economy as a whole.

As mentioned earlier, Japanese automakers are grappling with challenges, especially in penetrating the EV market. However, a merger between two large manufacturers could enable them to exploit economies of scale. The recent rise in popularity of hybrid vehicles, an area where Japanese automakers excel, may also provide the industry with some breathing space. It could allow companies to invest in the research and development of new technologies amid the shift towards electrification.

Japanese equities gain in December on allocation expectations, weaker yen

The Japanese equity market ended December higher with the TOPIX (w/dividends) up 4.02% on-month and the Nikkei 225 (w/dividends) rising 4.53%. At the latest Federal Open Market Committee (FOMC) meeting, the Federal Reserve indicated a cautious approach to rate cuts in 2025, which triggered US stocks to dip at times and therefore weighed down Japanese equities as well. However, this was outweighed by positive factors, including anticipation that Japan’s Government Pension Investment Fund (GPIF) would boost the allocation to Japanese equities within its assets under management after it announced plans to raise its return-on-investment target. Japanese stocks were also supported by expectations for exporters to deliver strong earnings amid the depreciation of the yen against the dollar as the outlook receded for the Bank of Japan to make additional rate hikes in the near term.

Of the 33 Tokyo Stock Exchange sectors, 28 sectors rose with Transportation Equipment, Marine Transportation, and Other Products among the most significant gainers. In contrast, 5 sectors declined, including Electric Power & Gas, Land Transportation, and Pharmaceuticals.

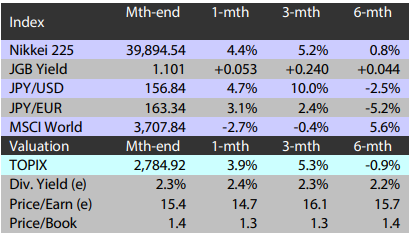

Exhibit 1: Major indices

Source: Bloomberg, 30 December 2024

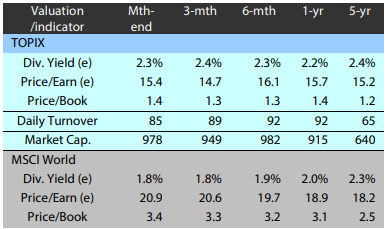

Exhibit 2: Valuation and indicators

Source: Bloomberg, 30 December 2024