Focal points for 2025

As 2024 draws to a close, we will evaluate the factors expected to attract attention in 2025 from a Japanese economy and equity market perspective. These factors are Donald Trump's second US presidential term, domestic politics, Bank of Japan (BOJ) monetary policy and domestic demand.

Trump's second term

Trump's upcoming second term as US president naturally brings uncertainties, and Japan will no doubt be impacted along with other countries. However, as with Trump's first term, any impact is expected to be limited to individual firms or certain corporate sectors, with the broader equity market and the economy less affected, if at all. Japanese exporters, for example, may face negative pressure if countries in which they are based and operate, such as Mexico, are targeted by US tariffs.

That said, if Trump's first term serves as a guide, any such negative pressure is unlikely to inflict irreversible damage to corporate sectors or slow Japanese economic growth. Japan will have the advantage of already having weathered Trump's first term. His first term was about the markets dealing with the unknown and the volatility triggered by the sudden and unexpected. This time, there is slightly more certainty after Trump's eight years of political networking, as evidenced by his swift cabinet appointments. Japanese exporters might experience turbulence after Trump takes office, which in turn could cause bouts of market volatility. However, due to the reasons mentioned above, Trump's second term is not expected to have a big impact on the Japanese economy as a whole.

Domestic politics

Japan entered a period of political instability in 2024 after Prime Minister Shigeru Ishiba's gamble to call a snap election, which was aimed at consolidating the power of his ruling Liberal Democratic Party (LDP), backfired. The LDP-led ruling coalition lost its lower house majority at the snap election, reducing Ishiba to leading a minority government. In 2025, attention will be focused on the upper house elections scheduled for the summer. The LDP will be seeking to avoid another election setback, and the party may try to replace Ishiba if it decides that doing so will improve its chances of victory. The LDP-led coalition also needs the cooperation of opposition parties to pass bills, adding a layer of uncertainty to government policies. Such political instability naturally increases political risk. However, political risk does not need to be conflated with market risk. This is because the opposition party the LDP-led coalition relies on, the Democratic Party for the People (DPP), advocates tax cuts (also discussed in the second section of this article). If implemented, the tax cuts could provide an extra boost to the economy, which is already stable due to rising wages and increasing capital expenditure (capex), allowing it to shift from export-led to domestic demand-led growth. Of course, there are risks associated with reducing taxes. However, the combination of rising wages and tax cuts could prove to be a very powerful driver for the economy.

BOJ monetary policy

The BOJ is seen continuing to raise interest rates in 2025, supported by a steady rise in wages. Recently released data indicates that regular income is increasing steadily, likely providing the BOJ with additional confidence as it looks to keep tightening policy in 2025. Rengo, Japan's biggest labour union, has decided to demand a base-pay hike of 3% or more for the second consecutive year at the annual wage negotiations scheduled next spring. This decision will reassure the central bank, which wants to see wages rise in tandem with inflation. Any policy tightening by the BOJ is expected to be gradual. However, the pace of its rate hikes could quicken if the aforementioned tax cuts, if introduced, significantly stimulate domestic consumption.

Domestic consumption

The focal point for domestic consumption in 2025 will be whether Japanese households, which are known more for their tendency to save than to spend, can gain enough confidence to begin consuming more robustly. Wages will need to continue rising to reinforce consumer confidence, and so far, the signs are favourable. Another key factor needed to support sustained consumption is capex, which has been increasing due to labour shortages. Productivity has been increasing as companies enhance their capex. This rise in productivity contributes to a positive cycle by making it easier for employers to increase wages. If implemented, tax cuts could serve as a powerful incentive for households to spend rather than save.

With latest stimulus, Japan could test Laffer curve theory with proposed tax cuts

In November the Japanese government approved a Japanese yen (JPY) 21.9 trillion yen (USD 146 billion) stimulus package to boost growth and tackle deflation. The package and its amount are not particularly surprising, as the government routinely compiles stimulus measures. However, it is noteworthy that this package includes measures proposed by the opposition DPP. One of the DPP's main policy agendas is to lift the ceiling on tax-free income from the current level of JPY 1.03 million, which is expected to stimulate consumption. Lifting the ceiling is also hoped to encourage part-time employees to work longer hours and help alleviate Japan's labour shortage. Generally, part-timers are seen to be less inclined to save, so lifting the ceiling could enhance consumption if the government can effectively communicate its intentions.

The downside of lifting the ceiling is that it would reduce revenue for a government already deeply in debt. The DPP's proposal brings into focus the Laffer curve. This theory suggests that cutting taxes can increase total tax revenue as consumers will spend the additional income, thereby stimulating economic activity, which in turn generates more tax revenue. The validity of the Laffer curve theory can only be determined once it has been tested in real life, and Japan appears to be on the verge of such an experiment. Despite the challenges this presents for the government, we think that Japan could rejuvenate its economy through tax cuts and eventually compensate for the tax revenue short falls over the long term. To achieve this, the government would have to rebalance its current spending. It would also have to depart from previous policies that did not encourage labour market liquidity and instead required funding for various subsidies.

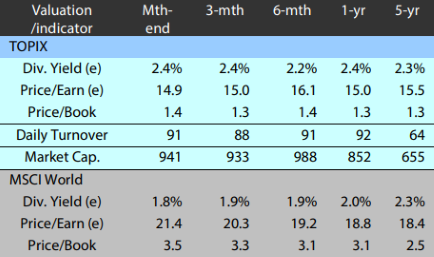

Japanese equities slip in November amid monetary policy and tariff concerns

The Japanese equity market ended November lower with the TOPIX (w/dividends) down 0.51% on-month and the Nikkei 225 (w/dividends) falling 2.22%. Japanese equities were supported by the rise in US stocks backed by economic indicators pointing to a solid US economy as well as expectations for the upcoming US administration to push for tax breaks and regulatory easing. However, this was outweighed by negatives, such as concerns that the BOJ could introduce additional rate hikes based on remarks made by its governor, in addition to deteriorating investor sentiment stemming from the US president-elect's stated plans to increase tariffs on goods from China, Canada and Mexico. Of the 33 Tokyo Stock Exchange sectors, 12 sectors rose, including Banks, Securities & Commodity Futures, and Textiles & Apparels, while 21 sectors declined, including Electric Power & Gas, Pharmaceuticals, and Transportation Equipment.

Exhibit 1: Major indices

Source: Bloomberg, 29 November 2024

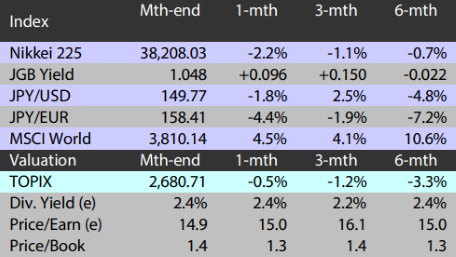

Exhibit 2: Valuation and indicators

Source: Bloomberg, 29 November 2024