Key points

- Trust in Money is reliant on trust in the government that defines & guarantees it. Declining trust in governments and in the other institutions that form society leads us to believe that the threat of sustained higher inflation later this decade is rising./li>

- With global growth wilting by the day, the threat from deflation is rising over the medium term but this will trigger policy reactions that we believe will be inflationary over the longer term.

- The threat of Trump 2.0 is already stress-testing the weaker parts of the Global System and the political landscape, although still strong liquidity in the USA has offered some form of anaesthetic to markets in the short term. This liquidity salve will not always be there, we fear a “crowding out moment” next Spring that results in a lurch towards deflation with higher yields, and then a policy response that finally pushes the Knife Edge between inflation and deflation into Inflation.

Very thoughtfully, my father presented me with a compendium of newspaper front pages covering all 60 of my birthdays. There were two sections, one for a “broadsheet” and one for a “tabloid”. In 1964, the front page of the broadsheet was dominated by an informed discussion about the enacting by a Labour Party Chancellor of a shock 200 b.p. rise in the UK Base Rate in order to stabilize the pound. There was also an article on the pressure on the Federal Reserve’s gold reserves, which had caused the Fed to raise the discount rate. In addition to these, there were at least 10 other articles discussing aspects of the Cold War, hostage crises, African politics, and problems with Gibraltar’s border with Spain.

In contrast, the 2024 front page of the same newspaper carried four stories: threats of a cyber- attack from Russia (hardly news), a vote on assisted dying, and a prominent picture of a politician / soon- to-be reality TV star. The tabloid front page covered a different reality TV programme, an aging actor’s relationship with his daughter, and suggestions that a police force had “managed” the news over a stabbing incident.

Leafing through the book, it is only too clear how the nature of reporting has changed over the years; facts and analysis have been replaced with diversions and opinions, it is almost as though people are being less informed. Instead, people are implicitly be asked to take things “on trust” but, when things go wrong, the first casualty will be trust in policymakers and the media.

This was certainly true during the Pandemic. I am no COVID-denier or by any means an anti- vax-er but I was appalled by various governments’ lamentable and at times simply misleading use of statistics. Having looked at some of the papers used to justifying many responses, one could see obvious obfuscation and even faults in models that even a first-year econometrics undergraduate would have spotted. Today, we doubt that many people will have looked at the technical issues around the use of statistics during the Pandemic, but there is a widespread sense of scepticism and distrust over government health policies that seems to have led to a drop in the uptake of even tried-tested-trusted and necessary vaccines. Childhood diseases that were once rare are reappearing.

I would argue that had there been more analysis and more unbiased reporting at the time, policymakers might have been forced into making better decisions, or at least more informed decisions on a whole range of issues, not just during the Pandemic. There would still have been successes and failures but there would have been more understanding and perhaps more trust in the system. The responses to COVID – political, social and of course economic (inflation) have undermined trust in governments and the media.

Also, we suspect that many people are intuitively concerned by the power of monopolies & oligopolies in key sectors (some of whom seem to have a revolving door into politics for staff…), and by the direction of society in general. Of course, median real income growth has been poor for a generation and wealth inequality is at new highs, none of which breeds contentment or trust in the system.

Climate change naturally worries many households but all we have seen is grandstanding and ill- thought-out policy responses that have given us the diesel emissions and more recently the EV-are-not- so-green debacles. The bottom line of “Green Issues” is that until we do things better with the right technology, we will have to do less in order to limit global warming but no politician seems prepared to state the obvious even though most of us probably know this to be the case…. All this obfuscation of the obvious simply undermines credibility.

Similarly, the political theatre in France and the worrying events in South Korea do not engender confidence. Both governments are facing significant challenges in a changing World against the background of what are already weak economies. Rather than producing credible plans, we have political manoeuvring which we suspect is heightening anxiety levels amongst the population.

In the UK, the most recent budget, and signs that the PM does not really have a grip on the agenda are depressing confidence in the business sector, in part helped by sections of a partisan media. Having been elected on a platform for change, trust in the new government is evidently slipping. In the near term, these depressed animal spirits will hinder growth and perhaps add to the forces of dis-inflation / deflation.

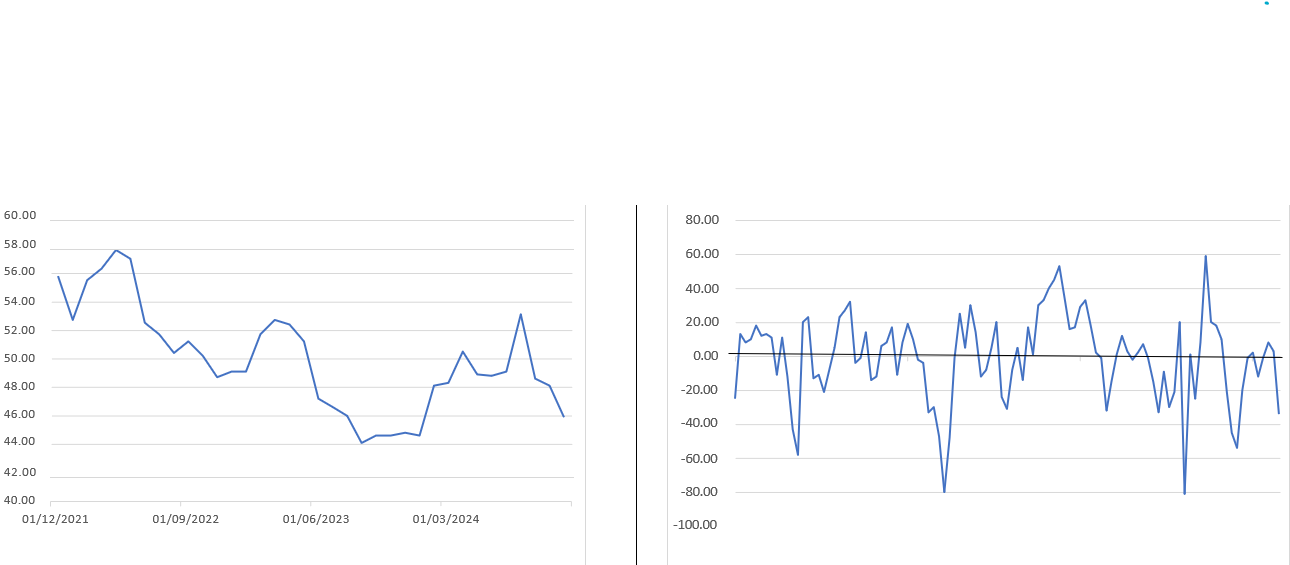

France: S&P Business Confidence index

UK: Service Sector Business Optimism CBI Index

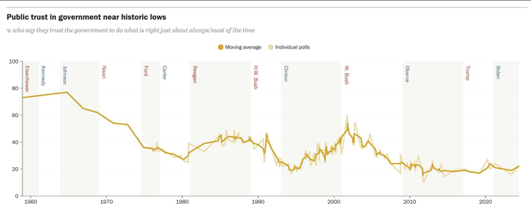

The US elections were an outlier in terms of its voter turnout but in many cases political apathy - or even antipathy - seems to be setting in as people lose faith and trust “in the system”, be it political, economic, corporate or even social. Trust is, however, a precious commodity in economic systems.

Public trust in government near historic lows

USA: Consumer Sentiment 5 year rolling average

Voter turnout in general elections and in the Brexit refer from 1918 to 2024

Deflation then Inflation?

Although it may sound like it, all of this is not simply the rantings of a G-O-M. As we have written before, trust in money is a function of trust in the state. We must trust the state to not change the unit of measurement of prices (i.e. the price charged for something is expressed in terms of continuous money – and we might wonder if Trump 2.0’s new-found enthusiasm for crypto imperilling this feature?). Secondly, we must trust the State to enforce contracts that are settled in money, and to determine what constitutes money. Most importantly, the state must defend the value of money and its crucial role as a store of value, safe from debasement, as well as seizure by internal or external forces. To trust money, people must trust the State.

In the earliest days of money, financial institutions were based near temples as a none-too-subtle attempt to gain credibility from higher powers. Today, governments still spend a fortune designing banknotes not just so that they cannot be forged easily, but also so that their inspire confidence through reference to the power of the state, important historical figures, and even deities. The artwork on a dollar bill is revealing and it is not there by chance – the physical appearance of the USD bill is to reflect the power and might of the State that issued it. Of course, when confidence in the state is lost or not yet earned, people tend to prefer forms of money that possess intrinsic value, such as precious metals.

We suspect that many have forgotten just why the Hong Kong dollar was Pegged so firmly to the USD; it was because the Hong Kong authorities were facing a confidence crisis that was making the HKD worthless. Countless EM use currency links not because they don’t want to have domestic control of interest rates etc and not because they want to become targets for currency speculators, but because they needto borrow monetary credibility from their anchor in order to avoid the inflation that emanates from a lack of trust in money. This was of course the rationale for Italy joining the EMS / EUR process. This is precisely why currency boards were so favoured by newly formed countries last century, and why they were so stoutly defended (i.e. the Baltics).

Gambling With Trust in the New World Order

Many EM are of course reliant for their growth on exports and for that they need free access to World markets and / or competitive currencies. The threat of tariff wars and trade restrictions is of course a threat to their growth (as such it is deflationary) but this threat will require a reaction. How many governments, that don’t yet have monetary credibility, will find themselves forced to abandon currency anchors in favour of competitive devaluations? If it turns out that their credibility levels are not sufficient, then people’s willingness to hold their particular money will fall, and this is usually a short cut to endemic inflation. Clearly, many countries in LATAM were not ready for the end of the Bretton Woods system, they did not possess the monetary credibility of trust with which to anchor their systems.

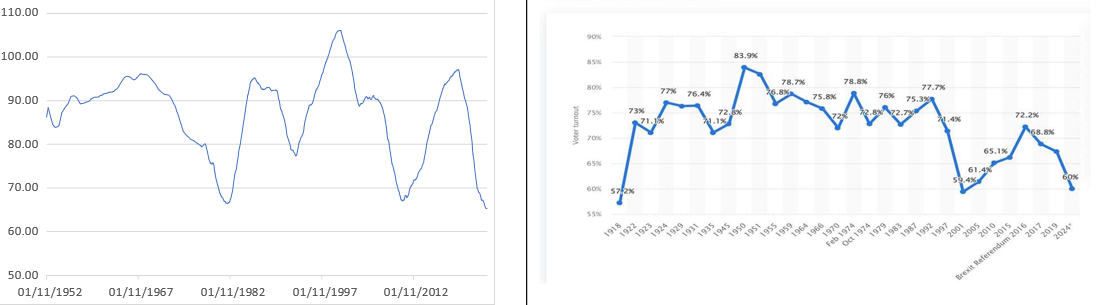

Chile: Currency per USD

Chile: CPI

In the case of EM, history is littered with such ill-advised events and we suspect that most readers will accept the threat of EM inflation under such circumstances as being a real one. More contentious would be the notion that even some Western governments or States now have the trust of their populations. They have certainly done little to earn it. We have spent some time attempting to model the Demand for Money over the long term in Developed countries, and it is noticeable that periods in which the authorities lost trust and people appeared to lose faith in the currency were associated with periods of higher inflation.

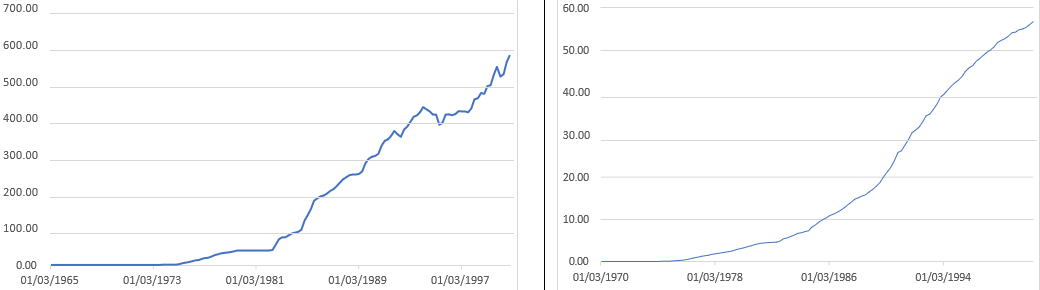

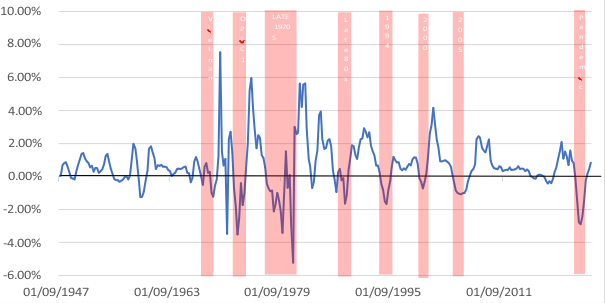

USA: Changes in the Income Demand for Money & Inflation

% Yoy based in estimated Broad Money Demand 1936-2023

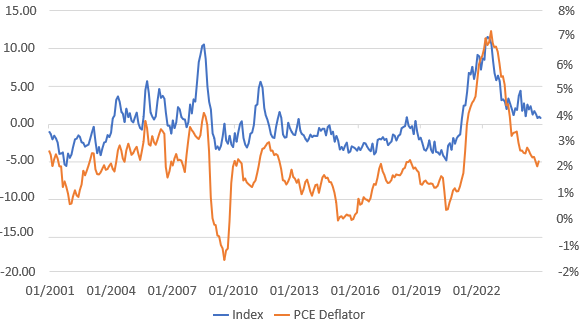

Moreover, we might suggest that now that they are faced with sluggish growth, unachievable politically motivated economic targets, there will be a tendency for the authorities to cut rates, return to QE-like regimes, and generally take the soft route towards economic stimulus rather than slump & deflation. If this policy switch occurs just as trust is being lost, then they will likely find that the growth / inflation trade off has altered to favour inflation rather than economic expansion. Friedman’s famous growth / inflation trade-offs will have shifted. In this regard, it is interesting to note that our composite measure of inflation expectations has been slow to decline even as headline rates of inflation have subsided. (We do not have much faith in market-derived inflation expectations indicators, the authorities hold too much influence over yields…)

USA: Inflation Expectations and PCE Deflator

% pa & Composite Index

Consequently, we fear that although the current forces that are marshalling within the Global System are generally deflationary, we fear that the policy reactions will tilt towards higher inflation over the medium to longer term. Bonds and we suspect currencies face a volatile period ahead.

UK Money – Correction

Until a few years ago, I manually typed the data into my Money Watch spreadsheets so as to experience “the feel” of the data but RSI was taking its toll so I had to switch to data feeds. At the weekend, something corrupted one of the feeds into the UK Money Watch (I am not tech savvy enough to know what but I do know that the spreadsheet won’t load anymore).

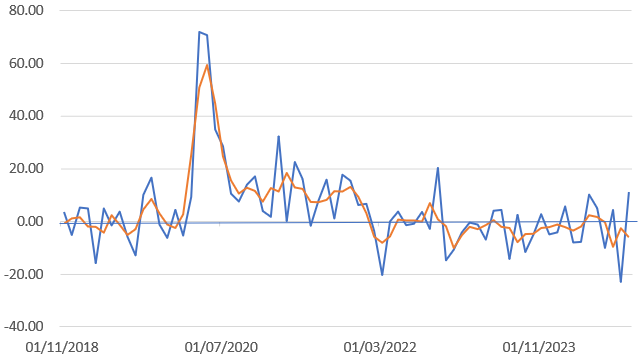

In the correct data, it turns out that UK commercial banks did but a few billion of public sector debt in October and that the public sector counterpart to money growth was positive that month following a poor September. Inasmuch as UK banks slowed their rate of lending growth to the private and foreign sectors, and instead acquired more Gilts, this is interesting in light of the collapse in business confidence that occurred at that time.UK: Public Sector Counterpart to M4 Growth

GBP billion monthly sadj

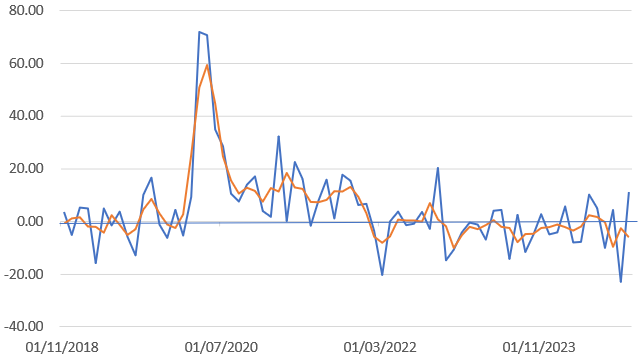

GBP billion monthly sadj

Nevertheless, we continue to believe that the markets are too sanguine over the outlook for Gilt issuance over the next 12 months (the budget forecasts look simply implausible) and so would not expect the public sector counterpart to remain positive – the three month average is probably more indicative of the outlook.

Disclaimer: These views are given without responsibility on the part of the author. This communication is being made and distributed by Nikko Asset Management New Zealand Limited (Company No. 606057, FSP No. FSP22562), the investment manager of the Nikko AM NZ Investment Scheme, the Nikko AM NZ Wholesale Investment Scheme and the Nikko AM KiwiSaver Scheme. This material has been prepared without taking into account a potential investor’s objectives, financial situation or needs and is not intended to constitute financial advice and must not be relied on as such. Past performance is not a guarantee of future performance. While we believe the information contained in this presentation is correct at the date of presentation, no warranty of accuracy or reliability is given, and no responsibility is accepted for errors or omissions including where provided by a third party. This is not intended to be an offer for full details on the fund, please refer to our Product Disclosure Statement on nikkoam.co.nz.