In the days immediately following 9-11, markets understandably fretted that consumer spending would collapse as people would be too scared to go out. In fact, spending picked up – even the author’s usually frugal spending increased. I was just about to launch my own company and was conscious that I would be travelling a lot, so I did buy that sportscar just in case…. Faced with the thought that the future might be short, people apparently decided to spend more in the present. The incident, although extreme, showed us that there can be hard-to-predict discontinuous shifts in the consumer spending function that can upset conventional forecasting models.

In general, people have wanted to spend increasing amounts over the last thirty years. The fact that productivity trends have been weak, and that median real income growth has therefore been minimal, has not stopped people spending. Instead, either consumers themselves borrowed (remember all the borrowing in the 2000s to extract equity from the housing market?) or, more recently, governments have borrowed on their behalf so that tomorrow’s incomes could be consumed today. Maintaining expenditure growth despite weak income trends not only caused low savings rates, but rising debt to GDP ratios almost the world over. Credit was integral to the process.

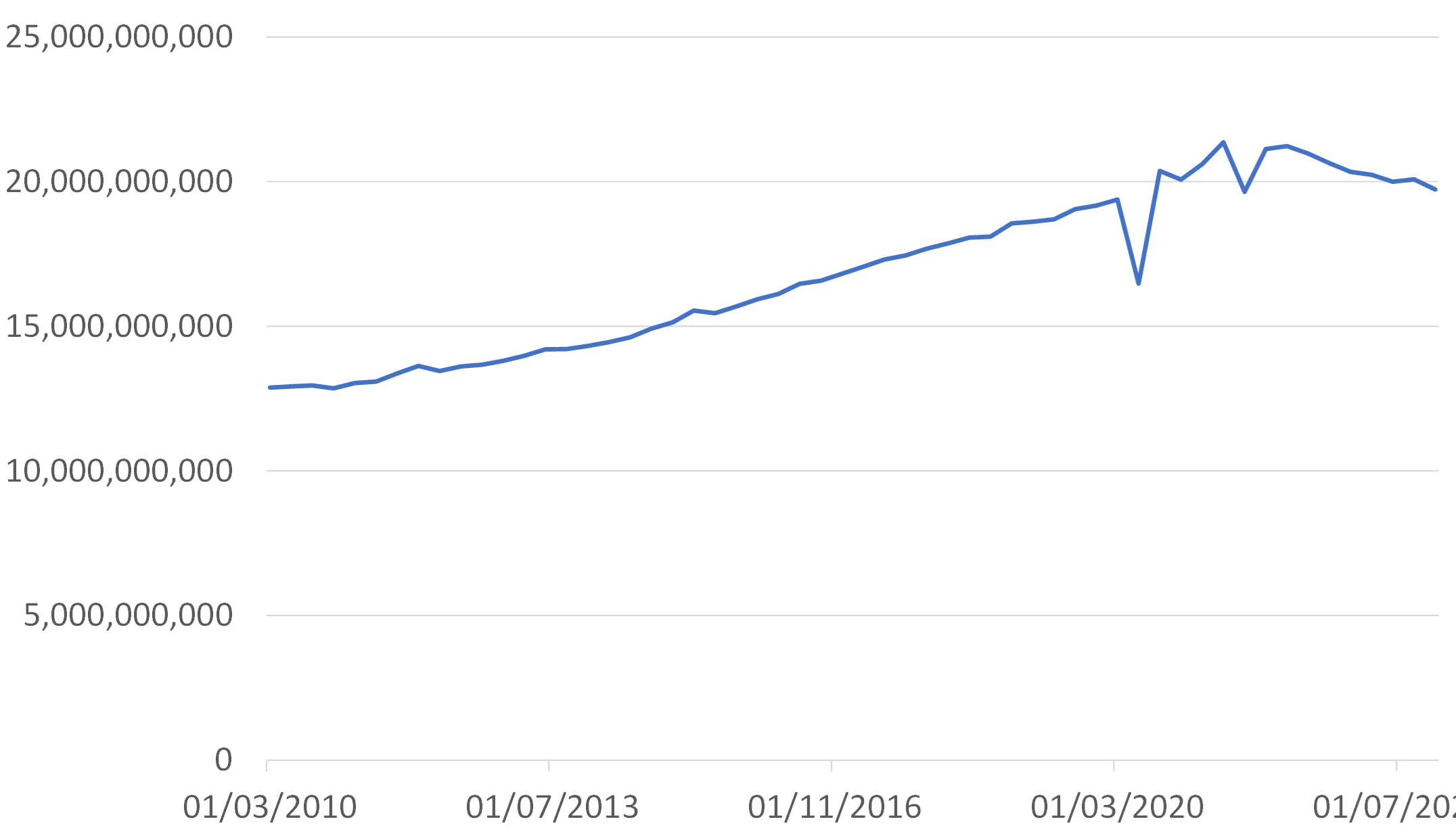

Global Non Financial Debt

% GDP at market values, source BIS

Borrowing in order to finance current consumption (or even excess investment) really only makes sense if the borrower holds one or more of three possible “beliefs about the future”. The first belief could be that the world will be a better place (i.e. richer for them) in the future. We suspect that more than a few commodity producing countries extrapolated rising commodity rents into infinity and therefore decided that they might as well spend some of that infinite future now, by borrowing money.

A second belief could be the rather morbid one that the future might be short or tragic, so one should maximize life now. We would hope that only very few people employed such a rationale. Finally, people may simply have believed that interest rates would stay low for ever and they would never be required to pay the money back - rather like the old British Consols.

The World has however changed. China, which was the engine of global growth for much of the last 20 years, has stalled. The Peace Dividend from the 1990s seems to be reversing. Politics globally looks less than pretty – today, we have problems and an absence of faith in our leaders. There has been a pandemic and a rise in long term chronic illness rates. Infrastructure problems seem to affect us all. Inflation, higher rates, and credit supply issues that we have not really witnessed on a sustained basis since the 1980s are back. Finally, many people seem to remark that spending and consuming just isn’t as much fun anymore…

At a very top-down level, the future for most people probably looks less bright and for many it probably looks poorer. It would therefore make little sense to borrow income now for a future that looks poorer. Indeed, credit growth has slumped.

This is why we suspect that New Zealand recent economic performance may offer foretaste of what is to follow elsewhere. It seems that Kiwis have decided that they are now likely to be less affluent in the future and therefore they are borrowing (much) less from the future and probably trying to save more now - at least those that can afford to. Naturally, this saving rather than spending behaviour has resulted in very weak domestic demand trends. It is our sense that this sea change in behaviour is spreading – Australia, parts of the US household sector, core Europe and even the UK seem to be following NZ's lead.

New Zealand: Real Retail Sales Index

Central banks seem not to have noticed this change. During the immediate aftermath of the Pandemic, most policymakers attempted to stimulate demand despite the fact that their economies’ ability to supply goods and services had been compromised. Unsurprisingly, the authorities boost to demand soon resulted in inflation. Some of this inflation appeared immediately – disrupted supply chains caused goods prices to soar within weeks of lockdowns ending.

However, some of the inflation has taken longer to come through. Years of QE hamstrung insurance companies and capacity has left the industry, leaving the survivors with pricing power. A lack of investment for decades in infrastructure has left us paying more for utilities and other essentials. This inflation is the result of events that occurred three, four or even ten years ago; it is just that the lags have been long. We would argue that we will simply have to endure the inflation in these things and that it would be incredibly unwise for central banks to seek to control headline inflation rates by forcing the prices of other things to fall. We would never advocate policy-driven deflation and certainly not in today’s highly indebted economies.

Unfortunately, central banks were so scarred by their negligent propagation of inflation in 2021/22, and their political masters so focussed on the headline Consumer Price Indices (which in reality are just mathematical units of measurement that are used to quantify the effects of things that happened months or even years ago), that policymakers seem to be missing the fact that households are undergoing a step-wise shift in their spending behaviour and that global growth is slowing rapidly.

Ultimately, the latter risks being deflationary and so we have the uncomfortable prospect of central banks being too focussed on the maths of current inflation measurement and therefore remaining too tight into a building global slowdown. Ultimately, we can expect a sharp U-turn and falling short term rates around the World, but in the near term we may suffer some discomfort markets in this new less spendthrift environment.

Disclaimer: These views are given without responsibility on the part of the author. This communication is being made and distributed by Nikko Asset Management New Zealand Limited (Company No. 606057, FSP No. FSP22562), the investment manager of the Nikko AM NZ Investment Scheme, the Nikko AM NZ Wholesale Investment Scheme and the Nikko AM KiwiSaver Scheme. This material has been prepared without taking into account a potential investor’s objectives, financial situation or needs and is not intended to constitute financial advice and must not be relied on as such. Past performance is not a guarantee of future performance. While we believe the information contained in this presentation is correct at the date of presentation, no warranty of accuracy or reliability is given, and no responsibility is accepted for errors or omissions including where provided by a third party. This is not intended to be an offer for full details on the fund, please refer to our Product Disclosure Statement on nikkoam.co.nz.