Rising JGB yields: a threat to equities or a misunderstood metric?

Long-term Japanese government bond (JGB) yields recently rose above 1.1%, marking a 13-year peak. The rise comes as the Bank of Japan is seemingly poised to further hike interest rates after ending its negative rates policy in March. Not surprisingly, this development has caused some speculation that higher JGB yields could adversely affect equities by reducing the appeal of dividend yields. However, such a perspective can neglect one important factor: that growth prospects for equities are ever-evolving. Dividend yields are not only indicative of the risk premiums associated with underlying stocks. They also offer insight into a company’s potential for growth.

Thus, when growth prospects are taken into account, the recently expanded gap between dividend yields and JGB yields does not serve as an effective gauge for equity performance. This notion was underscored earlier this year when the Nikkei Stock Average soared above 40,000, setting a new record. Semiconductor-related companies played a key role in the Nikkei's climb, as enthusiasm towards generative AI seemed to significantly reshape the growth prospects for these firms. In such instances, when stocks are propelled by a solid growth narrative, the lower dividend yields compared to JGB yields do not pose significant concerns.

In a corporate context, growth can be viewed on a nominal basis, which factors in inflation. Indeed, higher interest rates can exacerbate the financial strain on companies with debt. However, in the long run, this becomes less concerning if corporate profits rise in tandem with inflation. Comparing bond yields and dividend yields thus holds limited meaning when considering asset allocations for the long term.

It is worth pointing out that the ongoing rise in long-term JGB yields is taking place as capital expenditure (capex) by firms appears to be gaining further momentum amid a need to streamline operations and make them more efficient due to labour shortages. After some delay, the effect of recent wage hikes may finally be felt later this year as salaries catch up with inflation. Such circumstances would make it difficult to blame higher long-term yields for negatively impacting the economy.

Higher long-term yields may inevitably raise concerns about Japan’s fiscal discipline and credit ratings. However, it is worth remembering that Japan is among the few nations with a robust enough fiscal standing to implement tax hikes when necessary. This capability is expected to help maintain confidence in the country’s credit standing.

Potential upside for Japan's small- and mid-cap stocks

As we mentioned in the first section (“Rising JGB yields: a threat to equities or a misunderstood metric?”), the impact of wage hikes may come into play later this year. If salaries eventually catch up with inflation, consumer spending could get a much-needed lift. This in turn could shift the spotlight on to Japan’s small- and mid-cap companies, which to date appear to have trailed their large-cap counterparts. Small- and mid-cap names stand to benefit from increased consumer spending as these firms tend to have a stronger link with domestic demand than large caps, which often rely more heavily on export markets and foreign demand. As small- and mid-cap stocks often cater to other domestic companies with similar sizes, they are in a position to capitalise on increases in capex. For instance, Japan implemented a new consumption tax invoice system in late 2023, necessitating new sets of administrative tasks for taxable businesses. This is creating demand for new systems among small- and mid-cap companies, which other firms with similar capitalisations are seemingly meeting, with their local knowledge and know how proving to be strong points.

Small- and mid-cap stocks may begin attracting the attention of foreign investors if real wages turn positive, which would be necessary to boost consumer sentiment and provide talking points for the first-half earnings season. From the perspective of foreign investors, information regarding small- and mid-cap names can be scarce due to issues such as limited English language disclosure. While this presents a challenge, it is also an opportunity for investors to discover undervalued gems if they are willing to do the groundwork.

As with large caps, ongoing corporate governance reforms may influence small- and mid-cap companies. However, the growth narrative we discussed in the first section is likely to have an even bigger impact on small- and mid-cap firms given that they are more responsive to domestic demand.

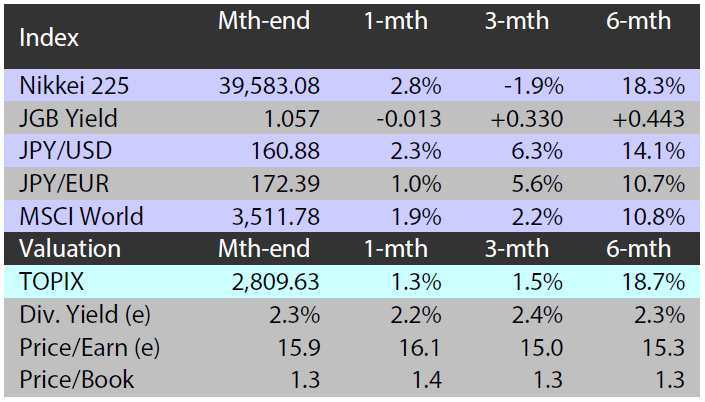

Japan equities gain in June on weak yen, robust US high-techs

The Japanese equity market ended June higher with the TOPIX (w/dividends) up 1.45% on-month and the Nikkei 225 (w/dividends) rising 2.99%. Rising risk-off sentiment among investors weighed down stocks somewhat amid uncertainty surrounding the direction of European politics as well as US economic indicators pointing to weakness in the US economy. On the other hand, expectations rose for Japanese exporters to deliver solid earnings as the yen further depreciated against the US dollar due in part to a receding outlook for the US Federal Reserve to slash rates. Another positive was the solid performance of high-tech stocks, especially chip-related, on the back of share price gains by a major US semiconductor firm, supporting Japanese equities to rise overall.

Of the 33 Tokyo Stock Exchange sectors, 14 sectors rose with Insurance, Warehousing & Harbor Transportation Services, and Services among the most significant gainers. In contrast, 19 sectors declined, including Rubber Products, Electric Power & Gas, and Marine Transportation.

Exhibit 1: Major indices

Source: Bloomberg, 28 June 2024 |

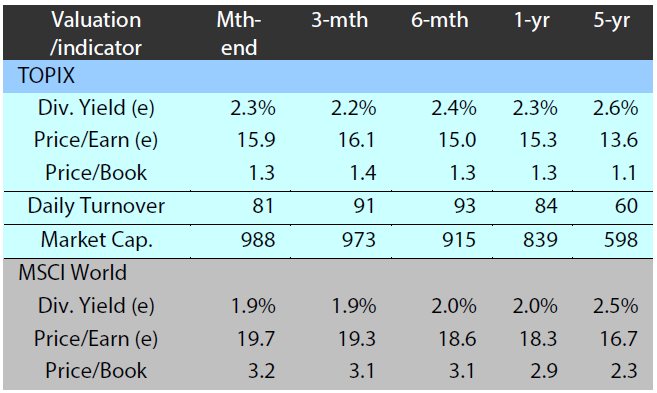

Exhibit 2: Valuation and indicators

Source: Bloomberg, 28 June 2024 |