The broader markets reacted immediately to Donald Trump's US presidential election victory and Japanese equities were no exception, with stocks initially rising on the vote outcome. The immediate impact of Trump's election on the Japanese market is expected to fade relatively quickly; the realisation of what was perceived as a major political risk event may even provide some relief over the short term. However, it may be a nervous lull, with the market waiting for Trump's upcoming statements.

While the market prepares for Trump's return to the White House, his policies under his first presidency, notably his approach to NAFTA, could come back into focus. Corporate Japan has been concerned about Trump's protectionist trade stance, which may lead to new tariffs on goods the US imports from Japan. There is also a possibility that Japanese corporations (such as makers of semiconductor manufacturing equipment) could face pressure from the Trump administration with regard to their trade ties with China.

That said, Japanese firms, such as exporters, are likely to have partially anticipated a Trump win and are unlikely to be caught completely off guard if his administration pursues protectionist trade policies. Still, Trump's first 120 days in office bear watching. This is because Trump may issue a series of executive orders during this “honeymoon period” that could affect Japanese exporters. Japan, however, may not be too high on Trump's trade agenda. In addition, Japan's manufacturers may draw some comfort as many are engaged in production within the US itself and are major sources of employment.

It is worth noting that US equity-positive developments which Trump could pursue, such as tax-related initiatives, may only have a limited impact on Japanese equities. Tax cuts and tax breaks could increase US consumption, which in theory would also boost demand for goods imported from Japan. However, such tax-related initiatives could be coupled with aggressive tariffs and a drive to encourage consumers to buy US-manufactured products rather than imported goods, which would not favour the Japanese export sector.

One of the other potential areas of concern associated with a second Trump presidency is the security treaty between the US and Japan, which Trump may seek to alter. Concerns regarding security, in addition to worries related to US tariffs, may temporarily dampen sentiment. Still, the trajectory of Japanese equities is expected to remain unchanged over the longer term given the current health of corporate Japan.

Japanese equities gain in October on weaker yen, monetary policy outlook

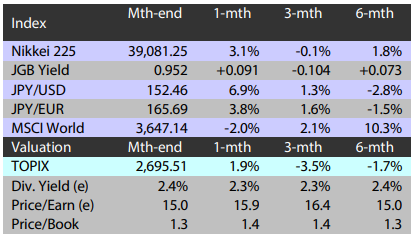

The Japanese equity market ended October higher with the TOPIX (w/dividends) up 1.88% on-month and the Nikkei 225 (w/dividends) rising 3.07%. Equities were weighed down by investors' rising risk aversion amid escalating tensions in the Middle East involving Israel and Iran, in addition to political uncertainty in Japan following the unexpected results of the lower house election. However, overall the market was supported by the depreciation of the yen against the US dollar and resulting expectations for exporters' strong earnings against a backdrop of Federal Reserve (Fed) Chair Jerome Powell's remarks that overall the US economy is in solid shape, a receding outlook for the Bank of Japan to introduce additional rate hikes in light of remarks by Prime Minister Shigeru Ishiba, and diminishing expectations regarding the Fed's rate cuts.

Of the 33 Tokyo Stock Exchange sectors, 20 sectors rose, with Banks, Pharmaceuticals, and Electric Power & Gas posting the strongest gains. In contrast, 13 sectors declined, including Iron & Steel, Pulp & Paper, and Chemicals.

Exhibit 1: Major indices

Source: Bloomberg, 31 October 2024 |

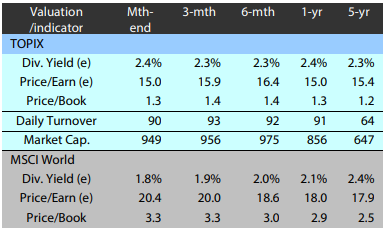

Exhibit 2: Valuation and indicators

Source: Bloomberg, 31 October 2024 2024 |