Summary

- The early economic cycle dynamics and cheap valuations in Asia contrast starkly with the expensive late cycle dynamics in the West, and we expect this to provide good diversification options for global investors.

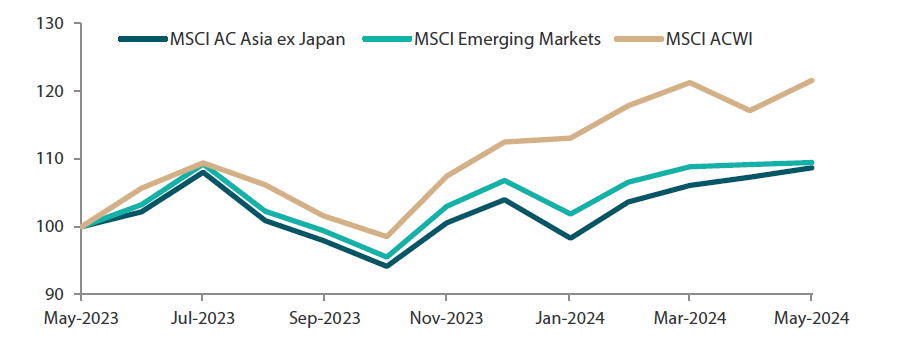

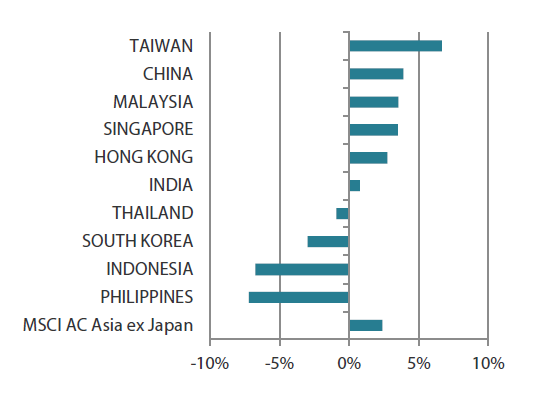

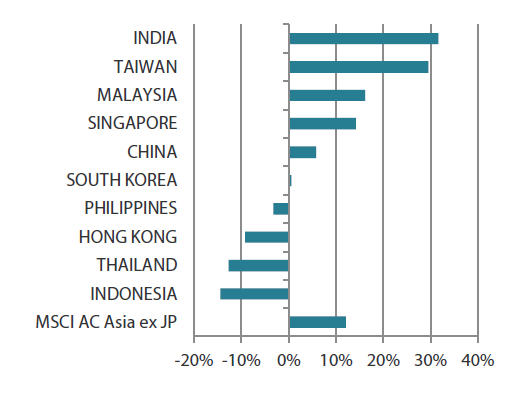

- In May, the MSCI AC Asia ex Japan Index climbed 2.4% in US dollar (USD) terms. Taiwan (+6.6%) and China (+3.9%) led the region, while the Philippines (-7.2%) and Indonesia (-6.8%) were the laggards. Stocks had a strong month on renewed investor confidence that inflation was easing, and that the US Federal Reserve (Fed) would cut interest rates this year, although the exact timing remains uncertain.

- With the market rebounding from its trough and authorities accelerating the pace of property easing to its most intense level yet, the improving dynamics in China have undoubtedly supported risk sentiments in the region. Whilst the jury is still out on whether the Chinese economy is truly out of the woods, what is evident is that there has been a clear rebasing of growth expectations in China. In our view, a stabilising Chinese economy, coupled with an accelerating pace of fiscal stimulus, should continue to enhance prospects for Asia.

Market review

Asian markets generally in the black

Global markets were back in positive territory in May, with the MSCI Asia Ex Japan Index gaining 2.4% in US dollar terms. Stocks had a strong month, bolstered by renewed investor confidence that inflation was easing and that the Fed will cut interest rates this year, although the exact timing remains uncertain. Surprisingly robust first-quarter corporate earnings also lifted sentiment.

Chart 1: 1-yr market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

Source: Bloomberg, 31 May 2024. Returns are in USD. Past performance is not necessarily indicative of future performance.

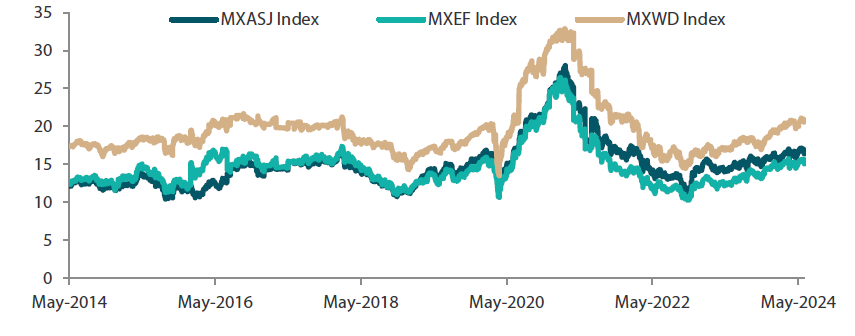

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 31 May 2024. Returns are in USD. Past performance is not necessarily indicative of future performance.

Investor sentiment towards Chinese stocks continues to improve

In North Asia, China (+3.9%) unveiled sweeping measures to support the struggling housing market, including removing the floor on mortgage rates, lowering downpayment and encouraging local governments to acquire homes to convert them into affordable housing. To support its economy, China also began selling the first batch of its Chinese yuan one trillion of ultra-long special sovereign bonds. Meanwhile, consumer spending growth unexpectedly cooled to 2.3% in April, while industrial production rose to a faster-than-expected 6.7%. Hong Kong gained 2.7%, as investors were encouraged by policy support from China. The Hong Kong economy also registered a 2.7% year-on-year (YoY) growth in the first quarter.

South Korea (-3.0%) continued to keep policy restrictive, maintaining the current 3.5% benchmark rate, while reiterating risks around inflationary pressures. Separately, the country unveiled a USD 19 billion support package to bolster its chip sector to compete in the global semiconductor market, amid soaring demand for advanced chips. Export growth continued in May, led by demand for semiconductors, as headline exports rose 11.7%. Elsewhere, Taiwan’s (+6.6%) trade-reliant economy is expected to grow at a faster pace in 2024 than previously forecast, due to high demand for AI applications abroad.

ASEAN markets lag their regional peers

ASEAN markets displayed mixed performances. Central banks in the Philippines (-7.2%), Indonesia (-6.8%) and Malaysia (+3.5%) kept their interest rate policies steady. Singapore’s (+3.5%) government kept its GDP growth forecast for this year unchanged at 1–3%, while confirming a 2.7% YoY expansion for the economy in the first-quarter. Thailand (-0.9%) is planning on a supplementary budget of USD 3.4 billion to finance its so-called digital wallet programme to stimulate its economy.

Indian equities rise over the period

Indian equities gained 0.8% as investors waited for the official results of India’s national elections where Prime Minister Narendra Modi sought a third term in power. S&P Global Ratings raised India’s sovereign rating outlook to positive from stable, citing the country’s strong economic fundamentals. India's annual retail inflation rate continued easing, albeit marginally, to 4.83% YoY in April, partly due to lower fuel prices, although food prices remained elevated.

Chart 3: MSCI AC Asia ex Japan Index1

|

For the month ending 31 May 2024

|

For the year ending 31 May 2024  |

Source: Bloomberg, 31 May 2024.

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market view

Asia’s early economic cycle dynamics and cheap valuations present a stark contrast to the West

With the market rebounding from its trough and authorities accelerating the pace of property easing to its most intense level yet, the improving dynamics in China have undoubtedly supported risk sentiments in the region. Whilst the jury is still out on whether the Chinese economy is truly out of the woods, what is evident is that there has been a clear rebasing of growth expectations in China. Slower growth expectations are now unanimously accepted as the market refocuses on fundamentals. In our view, a stabilising Chinese economy, coupled with an accelerating pace of fiscal stimulus, should continue to lift prospects for Asia. The early economic cycle dynamics and cheap valuations in Asia contrast starkly with the expensive late cycle dynamics in the West, and we believe this offers good diversification options for global investors.

Alpha generation in China will continue to be driven by bottom-up stock picking

In China, we are particularly encouraged that the central government is now taking a more active role in recent fiscal easing policies. De-stocking the housing market is also now a key focus for the regime, which could contribute greatly to stabilising the property market. While a lot more needs to be done for China to transition away from its reliance on property, the country is at least taking steps in the right direction. We expect longer-term reforms for the economy to be unveiled in the upcoming Third Plenum in July. In our view, alpha generation in China will continue to be driven by bottom-up stock picking, especially in companies that stand to benefit from positive, fundamental changes in the Chinese economy.

Start of a private capex cycle post-election expected to drive the next leg of growth in India

Following significant increase in infrastructure investments over the past few years, we continue to look forward to the start of a post-Indian election private capex cycle, which we expect will drive the next leg of growth in the country. That said, we are cognisant that valuations are fairly full in pockets of the small- to mid-cap space. We continue to favour companies exposed to the improving domestic infrastructure, as well as online consolidators. ASEAN countries like Indonesia also enjoy similar dynamics to India, but to a smaller extent. Economic activity remains robust, and central banks have the capacity to commence easing cycles.

Elsewhere, thanks to the structural wave of generative AI demand, technology companies in Taiwan and South Korea are well positioned to reap dividends as edge AI devices become more widespread. This trend could trigger another upgrade cycle as AI-capable devices such PCs and smartphones necessitate the use of newer, more powerful chipsets.

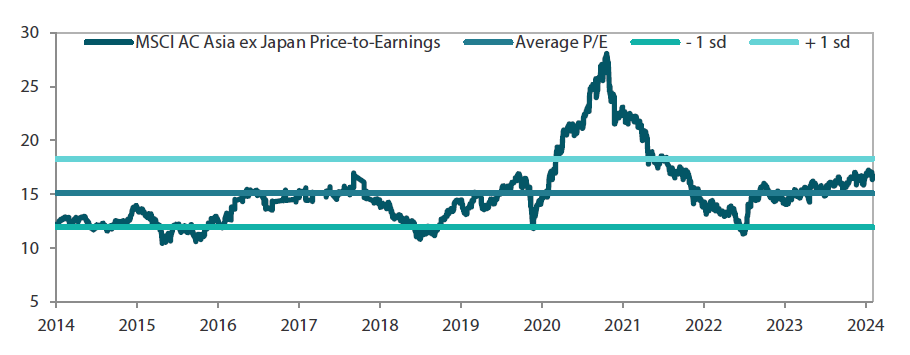

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 31 May 2024. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

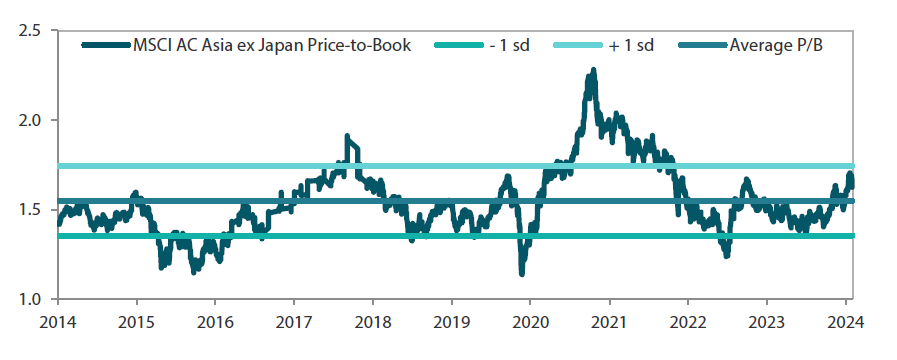

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 31 May 2024. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.