Summary

- We believe that the biggest fundamental change for Asian markets in the medium term is a shift in the interest rates regime. Amid a slew of softer labour market data and benign inflation numbers, the US Federal Reserve (Fed) is soon expected to begin cutting interest rates, which we believe will have significant implications for Asia.

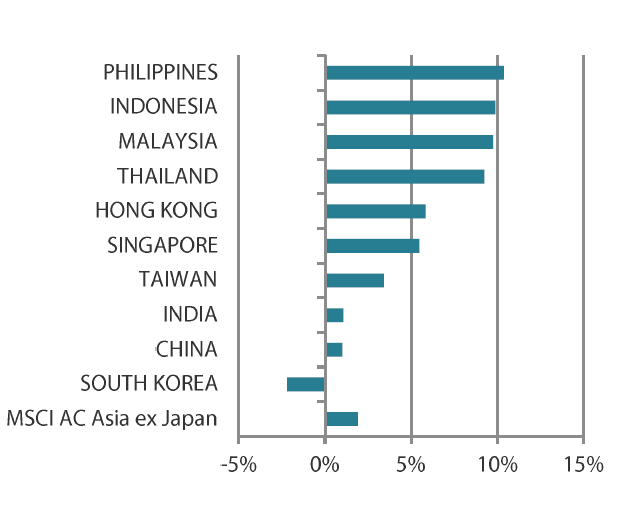

- In August, the MSCI AC Asia ex Japan Index returned 1.9% in US dollar (USD) terms, recovering from heavy selloffs earlier on as investors turned their attention to Fed Chair Jerome Powell’s speech at the Jackson Hole symposium. The Philippines (+10.4%) and Indonesia (+9.9%) spearheaded the region’s advance while China (+1.0%) and South Korea (-2.2%) trailed.

- In China, we continue to expect the external environment to be a stronger driver of returns. Domestically, fund flows should be more positive and monetary policy will be increasingly supportive alongside rate cuts in the US. However, where we remain more constructive is in South Korea, India and ASEAN. In South Korea, the government continues to make progress in its “Value Up” program, boosting the prospects for equity holders of businesses with underutilised, undervalued balance sheets. In India, we continue to see leading indicators of a rise in private capital expenditure (capex) investments, which should drive the next wave of structural growth in the country.

Market review

Asian markets rebound over the month

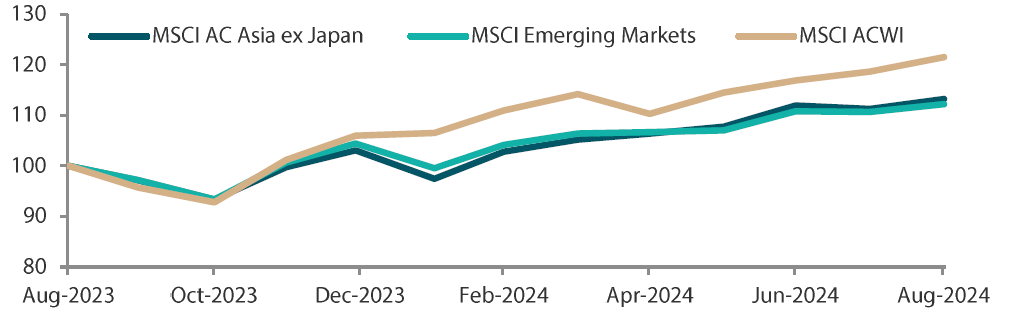

Global equities took a beating early in August as major indexes plunged following a disappointing US July jobs report, culminating in a severe meltdown in Tokyo’s markets as traders rushed to unwind popular carry trades. The whiplash was short-lived, however, as stocks quickly recovered and the MSCI AC Asia Ex Japan Index advanced 1.9% in USD terms from the end of July. Investors focused on Fed Chair Powell’s speech at the Jackson Hole symposium, where he gave his clearest signal yet that interest rate cuts are coming soon.

Chart 1: 1-yr market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

Rescaled to 100 on August 2022.

Source: Bloomberg, 31 August 2024. Returns are in USD. Past performance is not necessarily indicative of future performance.

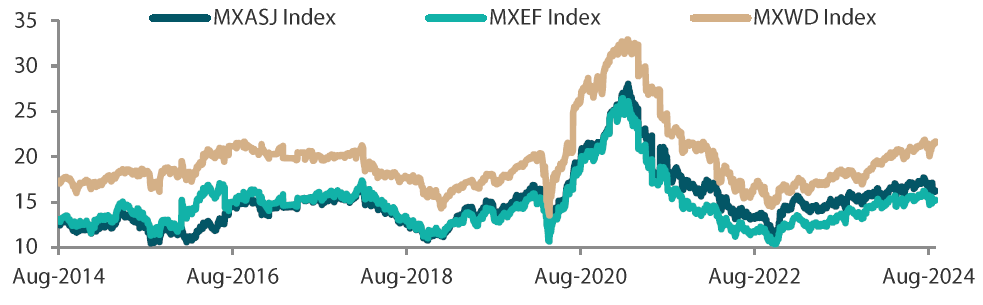

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 31 August 2024. Returns are in USD. Past performance is not necessarily indicative of future performance.

North Asian markets mostly higher

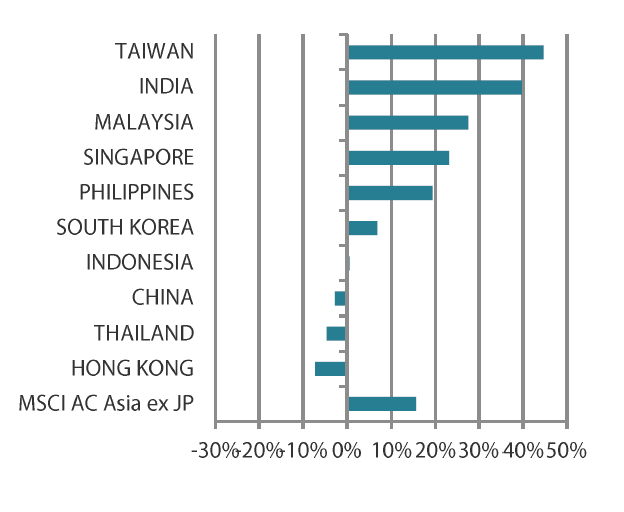

Chinese shares gained 1.0% in August, trailing the rest of Asia as the country’s economic recovery remained slow. The latest Chinese economic indicators continued to point to an unbalanced recovery, with retail sales growing at a faster pace in July, while industrial production and fixed-asset investment slowed. The Caixin Manufacturing Purchasing Managers’ Index also dropped to 49.8 in July from 51.8 in June, as China’s manufacturing activity shrank for the first time in nine months. Aside from the ongoing European Union-China spat over electric vehicles (EV) tariffs, Canada has also imposed new tariffs on Chinese-made EVs, aluminium and steel, lining up behind Western allies. China’s housing regulator pledged to speed up the purchase of unsold apartments and turn them into affordable housing, as part of its latest effort to end the country’s property slump. Meanwhile, Hong Kong stocks added 5.8% as the economy expanded 3.3% year-on-year (YoY) in the second quarter. However, Hong Kong’s private consumption remained weak.

South Korean shares lost 2.2%, weighed down by technology stocks. South Korea’s Cabinet approved the proposal for the 2025 budget amounting to South Korean won 677.4 trillion, outlined by a plan to increase government spending to support an economy that is expected to cool. The budget plan will include greater financial support for semiconductors and other growing sectors such as K-pop; it also aims to advance nuclear-energy projects.

In Taiwan (+3.4%), gains were driven by positive global cues with easing concerns over the US economy and hopes of a rate cut by the Fed. Separately, global index provider MSCI announced that it will trim Taiwan’s weighting in two of its major indexes: the MSCI Emerging Markets Index and the MSCI All-Country Asia ex-Japan Index. The weighting of Taiwan Semiconductor Manufacturing Co will be increased, given that the contract chipmaker would emerge as a major beneficiary of the artificial intelligence (AI) boom.

ASEAN shares continue to rally in August

ASEAN markets once again outperformed their North Asian counterparts amid an impressive rally in Southeast Asian currencies versus the US dollar. Singapore (+5.5%) has established a review group to revive its flagging stock market amid growing calls for initiatives to tackle poor liquidity. Thailand (+9.2%) ushered in a new prime minister with Paetongtarn Shinawatra, the head of the ruling Pheu Thai Party, assuming the role days after her predecessor Srettha Thavisin was dismissed by the country’s Constitutional Court. Malaysia (+9.8%) expects economic growth to accelerate towards 5% this year, as its second-quarter GDP rose 5.9% YoY, spurred by robust consumer spending and exports. In Indonesia (+9.9%), outgoing President Joko Widodo unveiled a state budget for fiscal year 2025 that promised continuity of signature economic programmes under his successor Prabowo Subianto, while keeping to a deficit that would likely reassure investors for its fiscal soundness. In the Philippines (+10.4%), the Bangko Sentral ng Pilipinas became the region’s first central bank to cut its policy rate. The key policy rate was reduced by 25 basis points to 6.25%, kicking off a much-awaited loosening cycle to preserve the momentum of economic growth.

Indian equities edge up

Indian equities edged up 1.1% in August, led by Information technology and pharmaceutical companies. The Reserve Bank of India (RBI) left its benchmark interest rate unchanged at 6.50% as expected, with policymakers worried that high food prices will continue to keep inflation above its target. Data released soon after the RBI’s decision showed that India’s consumer price index inflation eased sharply to 3.54% YoY in July. This was the lowest print in nearly five years and it also fell below RBI’s 4.0% medium-term target.

Chart 3: MSCI AC Asia ex Japan Index1

|

For the month ending 31 July 2024

|

For the year ending 31 July 2024  |

Source: Bloomberg, 31 August 2024.

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market view

Examining the impact of impending rate cuts

We believe that the biggest fundamental change for Asian markets in the medium term is a shift in the interest rates regime, notably that of the US; amid a slew of softer labour market data and benign inflation numbers, we expect to see the Fed initiate interest rates cuts in September. This will have significant implications for Asia. Not only will Asian central banks be afforded more space for interest rates cuts, a possible weakening of the US dollar will also be a strong tailwind for the Asian region. In particular, capital importers such as India, Indonesia and the Philippines could become some of the biggest beneficiaries. We may also see the unwinding of carry trades across countries such as Japan, China, and South Korea. Such moves could drive a reversion of global risk pricing as capital gets repatriated back from pockets of developed markets with stretched valuations.

External environment key to returns amid lack of significant policy shift in China

In China, we continue to expect the external environment to be a stronger driver of returns. We believe that domestically, fund flows should be more positive and monetary policy will be increasingly supportive alongside rate cuts in the US. We also expect more policy aimed at consumption to patch up the weakness caused by the property downturn. The efficacy of these consumption policies, however, remains uncertain given the current administration’s track record of favouring a piecemeal approach towards supporting the economy. We remain selective in China in the absence of a significant policy shift towards a more sizeable support for consumption and housing.

Government policy and innovative companies provide tailwind for South Korean equities

We remain more constructive towards South Korea, India and ASEAN. In South Korea, the government continues to make progress in the “Value Up” program, boosting the prospects for equity holders of businesses with underutilised, undervalued balance sheets. A potential tax incentive package for shareholders and companies participating in the program could bolster shareholder returns. We also continue to find attractive opportunities in innovative South Korean companies in the areas of pharmaceutical contract manufacturing and global AI supply chain. These areas offer strong positive fundamental changes and high sustainable returns.

Private capex to underpin future growth in India; Malaysia shines in ASEAN on improving fundamentals

In India, we continue to see leading indicators of a rise in private capex investments, which we see driving the next wave of structural growth in the country. We continue to favour companies exposed to the improving domestic infrastructure and domestic consumption; we also maintain our preference for online consolidators.

In ASEAN, Malaysia stands out with a combination of political stability and better top-down policy making, enhancing its advantage of having a cheap and well-educated labour force in a strategic location. These are the reasons the Malaysian state of Johor is growing to be a data centre hub, and Penang a budding semiconductor hub with foreign direct investments estimated to have surpassed the total amount from the previous seven years combined.

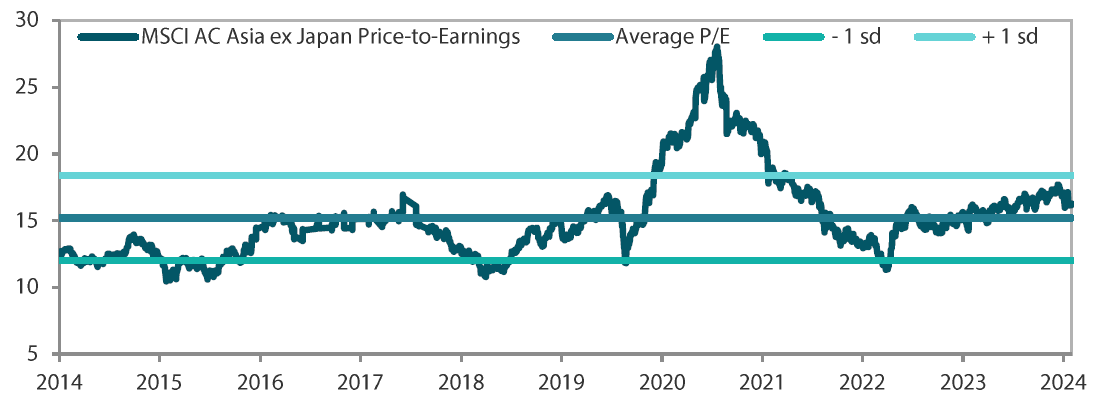

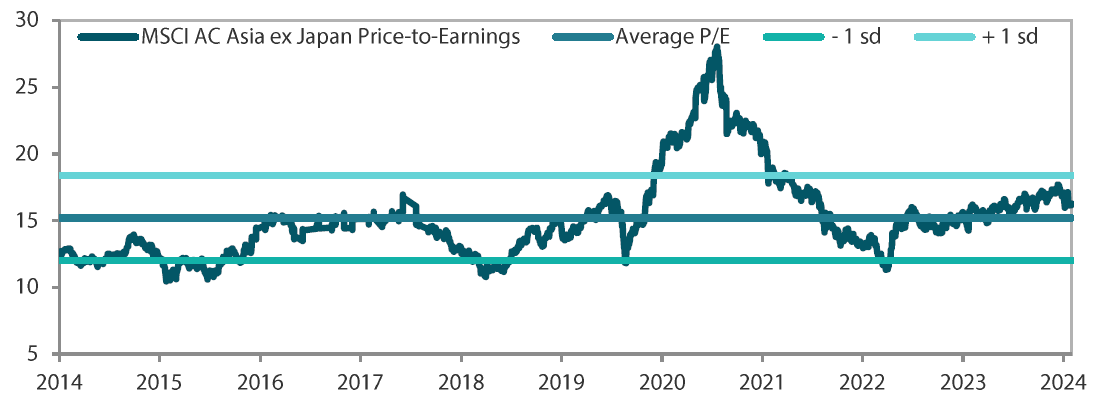

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 31 August 2024. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 31 August 2024. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way.