The US and most other authorities’ reaction to the Global Pandemic was to flood the financial system with cash, principally via the act of central banks buying government bonds. The sums involved were massive, in part because the authorities understandably did not know “just how bad the crisis would be” but also because there was a need in March 2020 to ensure that some financial institutions that were “the wrong side” of the bond market did not perish. There were fears of a repeat of the LTCM fiasco of 1998.

The central banks’ purchases of bonds also allowed governments to spend almost unprecedented amounts of money, with the (intended) result that nominal aggregate demand was boosted even as the pandemic compromised the economies’ supply potentials. Unsurprisingly, the unintended result was higher inflation. Forecasting higher inflation from 2021 onwards was not a terribly difficult call…

In the USA, the official headline CPI has increased by 21% since 2019 but the median income CPI is up by a few points more, suggesting that the CPI for lower income groups is up by >25%. We have seen estimates as high as 30%. Inflation is, unfortunately, often highly regressive.

Over the same time period, average wages have increased by around 22%, with low income groups doing a little better. Essentially, there has been no real wage growth since 2019. Since the Pandemic, there has been much talk of “excess saving” but the influential Pew Foundation reports that most of these are now exhausted and that even two years ago it appeared that the savings were becoming increasingly concentrated within higher income of wealth families. The Pandemic response increased the recent long term trend towards greater inequality.

Less well known is that lower income groups face the increasing prospect of being both uninsured and de-banked. Rising insurance premia (in part a long-lag response to too much QE…) are becoming prohibitively expensive for some, while banks are increasingly hesitant about providing banking services to low income groups.

The rising tide of bank regulation that was intended to make banks “safer” is increasing the costs of servicing lower income groups, and thereby making this an unprofitable enterprise. Without access to the financial system – or at least the mainstream part of it – many households will find themselves on a very slippery slope – another unintended and adverse result of too much government interference.

Against this background, it is not surprising to find that the low income US economy has been in a quiet recession for a while but, as the election date looms, the plight of this part of the electorate (perhaps a fifth of the electorate) is becoming more significant to policymakers. Moreover, there is now increasing evidence that the “mainstream” economy is also slowing.

It is our belief that “dodgy data” has painted a more robust picture of the economy this year than existed in truth, but the seasonal adjustment problems that caused this divergence between perception and reality is reversing and we expect to hear more talk of an economic slowdown over the coming weeks. Former President Clinton’s oft-used maxim that “it’s the economy stupid” will no doubt be starting to haunt his old Party and the occupants of the White House. Unsurprisingly, many commentators are expecting a policy reaction to be forthcoming.

According to the official Treasury Forecast, the US Budget Deficit will total just shy of $1 trillion between July and September. This may sound a lot, but it is actually down on the same period last year. However, on a recent trip to the USA, virtually everyone with whom we spoke expected a bigger deficit via extra spending, student loan forgiveness, and weaker tax receipts. Even the Congressional Budget Office seems to be expecting a bigger deficit. It seems that everyone is expecting yet another round of fiscal stimulus ahead of the election.

Budget deficits must of course be financed. The official Department of the Treasury forecasts suggests that there will be virtually no issuance of longer dated securities (“coupon”) but heavy issuance of Treasury Bills. Significantly, the Treasury has also stated that it does not intend to draw on its own substantial cash reserves – it may need to keep these in case of any volatility in the debt markets following an unclear election result. However, few in the markets expect the Treasury to keep this promise, most expect the Treasury to draw on its sterile money holdings held in the NY Federal Reserve and release them into the wider economy by spending the funds. This will boost liquidity and the money supply.

It will be interesting to see just who buys the intended mountain of issuance of T bills. If these are purchased by households as (extra) savings instruments, then this could depress private sector demand – an obvious case of crowding out. However, it seems that a small number of US Money Market Funds are still holding a substantial amount of deposits at the NY Federal Reserve (in fact, they are “Reverse Repos”).

Just like the government’s deposits at the Fed, these funds are currently sterile but, if the MMF were to redeem these assets and then use them to buy T bills, the proceeds of which the government then spent, then this sterile money will also have been released into the money supply.

In summary, if there were to be a bigger budget deficit that was monetized through either a drawdown in the government’s cash balances and / or a further draining of the Reverse Repo Reservoir, then the US broad money supply would likely expand at a double-digit rate. This might not match the 2020 Pandemic Response in terms of quantum, but in character it would be very similar.

At the same time, the weaker economic data already seems to be leading to a softening in the Federal Reserve’s public rhetoric. While we do not expect the FOMC to signpost an imminent rate cut in its near-term pronouncements (in fact, it can’t for operational reasons, it needs to keep T Bills cheap relative to the Reverse Repo), it is quite likely that either the July or September FOMC meetings will yield a cut in the Fed Funds.

Given the plight of the lower income groups – which seems almost unprecedented in the modern era, and the signs of a more generalized slowdown in the economy, it seems rational to expect a “big easing of monetary and fiscal policy from July onwards.

Most are assuming that this will provide further fuel to the markets, particularly since we now know that much – if not most – of any extra monetary injections from the public sector into the money supply are being recycled into new leverage within the markets. We have no doubt whatsoever that there is a partially hidden financial engineering / credit boom occurring within the private markets that at present is proving highly advantageous to risk markets.

We do however foresee three possible problems with the hypothesis that the easing will represent good news for markets. Firstly, given that everyone is already expecting such an event, might not it already be in the price? Markets are after all supposed to discount the future…

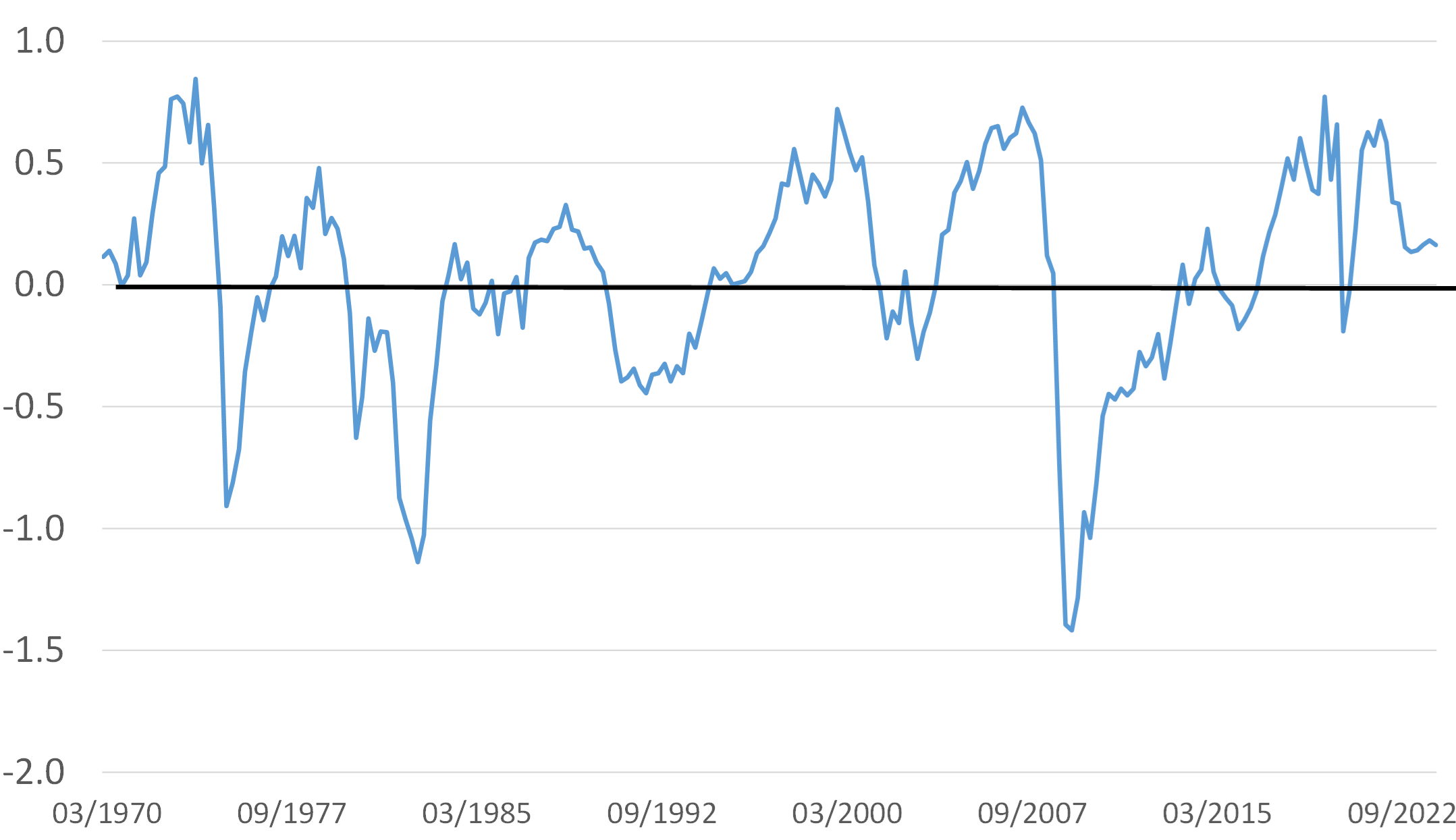

Secondly, any easing of policy can be expected to boost aggregate demand (why else do it?) but we are concerned that, yet again, this could overwhelm the economy’s supply potential and so lead to higher inflation, again. Our in-house measure of capacity utilization still shows the US operating with a small positive output gap, thereby implying that any easing could rekindle cyclical (“Type One”) inflation as soon as early 2025. Markets might not like such an outcome.

USA: Demand Pressure Index

1970 - 2024H1

Thirdly, we must wonder whether following the Pandemic Response, higher inflation, unintended consequences of public policy, and the ongoing political theatre, any further overt inflationary boost to the economy could lead people to lose faith in the government and public sector in general?

History suggests that if people lose faith in the state, they also tend to lose faith in the currency that the state issues. How many Emerging Markets have witnessed a political crisis that soon morphed into a currency and inflation crisis? Specifically, if people begin to lose faith in the state’s ability to protect the real value of their money, they will try to diversify into other stores of value, either domestically or abroad.

Gold and Crypto would seem likely to be likely beneficiaries of such a shift, and the USD might lose vis-à-vis other currencies that are deemed as being Hard Currencies (perhaps the Swiss franc?). However, the more damaging aspect of this would be that people would require a “price premium” for accepting the US dollar as a form of payment for goods, services and even the supply of labour. Persistent inflation or stagflation are born of such outcomes.

Given the plight of many lower income households, this election was always going to be fraught and open to unusual factors. The signs of an economic slowdown will only exacerbate this, and so a final policy push will seem a very obvious temptation to the incumbent authorities. However, if the authorities are as exuberant as the markets are currently expecting them to be, then we run the risk of the return of inflation.

The Pandemic Response was clearly inflationary, and so too was last year’s “second half mini fiscal expansion” that caused growth to surge in late 2023 and inflation to re-appear in early 2024. Moreover, another inflationary push might just shake people’s confidence in the government and therefore give rise to a much more malevolent form of inflation as confidence in the currency slips.

For equities, the prospect of yet another stimulus might seem positive and they may already be discounting it but we would suggest that once again travelling may be better than arriving, and that one should be careful what one wishes for…

Disclaimer: These views are given without responsibility on the part of the author. This communication is being made and distributed by Nikko Asset Management New Zealand Limited (Company No. 606057, FSP No. FSP22562), the investment manager of the Nikko AM NZ Investment Scheme, the Nikko AM NZ Wholesale Investment Scheme and the Nikko AM KiwiSaver Scheme. This material has been prepared without taking into account a potential investor’s objectives, financial situation or needs and is not intended to constitute financial advice and must not be relied on as such. Past performance is not a guarantee of future performance. While we believe the information contained in this presentation is correct at the date of presentation, no warranty of accuracy or reliability is given, and no responsibility is accepted for errors or omissions including where provided by a third party. This is not intended to be an offer for full details on the fund, please refer to our Product Disclosure Statement on nikkoam.co.nz.