Following the surprise result of the snap election in October 2024, Japanese politics has entered a very unique phase. We discuss how the fluid political situation could positively impact the Japanese market, which is already feeling the benefits of corporate governance reform, and assess how engagement could play a role in improving shareholder returns in such an environment.

Minority government and hung parliament: politics in a beneficial phase

Japanese politics is currently in a unique and potentially beneficial phase. The ruling coalition, which has fallen short of a majority and faces a hung parliament, is in a position where it may need to adopt the policies proposed by a dynamic opposition. The opposition, as the holder of the decisive casting vote, can potentially underpin the self-reinforcing virtuous cycle of rising prices and wages which is nudging Japan out of a deflationary spiral.

Why Japanese politics is so interesting right now

Japan's often staid political scene suddenly became interesting in October, when the newly appointed Prime Minister, Shigeru Ishiba, called a snap election for the parliament's lower house to consolidate the position of his ruling Liberal Democratic Party (LDP). However, Ishiba's gamble failed, and the LDP and its junior ruling coalition partner, Komeito, lost their parliamentary majority.

What makes current Japanese politics so interesting is that we are witnessing a minority government for the first time in recent memory. Perhaps more importantly, we have also witnessed the emergence of a new type of opposition in the form of the Democratic Party for the People (DPP), which the ruling coalition has aligned with in order to pass bills in parliament. Unlike the traditional opposition parties, the DPP is more focused on tackling issues than on devoting its energies to criticising the ruling coalition. By forming a partial alliance with the LDP, the DPP can potentially correct the negative effects caused by many years of LDP rule and steer policy in a positive direction.

"Increase take-home pay"

The DPP is a small party, formed just four years ago, which quadrupled its lower house seats to 28 from just seven following the October snap election. One reason for the surge in support for the party, particularly among younger voters, is its simple agenda to “increase take-home pay”. The DPP wants to increase take-home pay by lifting the ceiling on tax-free income from the current level of JPY 1.03 million. The JPY 1.03 million threshold has been unchanged for 29 years. This was not a major issue when Japan was stuck in deflation, but with inflation firmly taking hold, the ceiling has become a hot topic.

Raising the tax-free income ceiling will be crucial for the virtuous economic cycle to continue. A higher ceiling will help consumers cope with the “bracket creep” phenomenon. Bracket creep refers to a process in which inflation pushes income into higher tax brackets. This results in an increase in income taxes for consumers but no real improvement in their real purchasing power due to inflation. This causes a decline in real wages, which in turn leads to weaker consumption, thereby threatening the virtuous cycle. As of this writing, deliberations between the ruling coalition and the DPP over raising the tax-free income ceiling are continuing. The DPP's proposal to lift the tax-free income ceiling is attracting a significant amount of public interest and support. The ruling coalition is not in a position to brush off the DPP's proposals as doing so may result in a loss of votes at the upper house election scheduled in 2025.

A record year for Japanese equities amid ongoing reforms

As we summarised a year ago in “Corporate governance reform points to opportunities ahead in Japan equities”, developments in the country's corporate governance over the last 10 years have shown that once changes are set in motion, they can have a deep and lasting impact. Notably, the TSE's request in 2023 for listed companies with price-to-book ratios below 1x to disclose the reasons for their underperformance and present solutions has had a lasting effect. With corporate Japan more focused on capital efficiency and improving shareholder value, the Nikkei Stock Average climbed to a record high in 2024, rising above the record peak set in 1989.

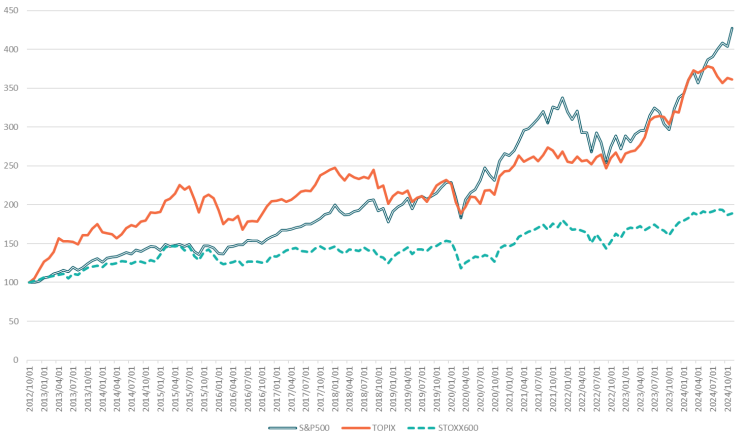

The chart below shows that Japan's TOPIX index has performed strongly since the initiation of the “Abenomics” economic policies in 2012

Chart 1: TOPIX has performed well since 2012

Past performance is not a reliable indicator of future results.

Source: Nikko AM based on data deemed reliable

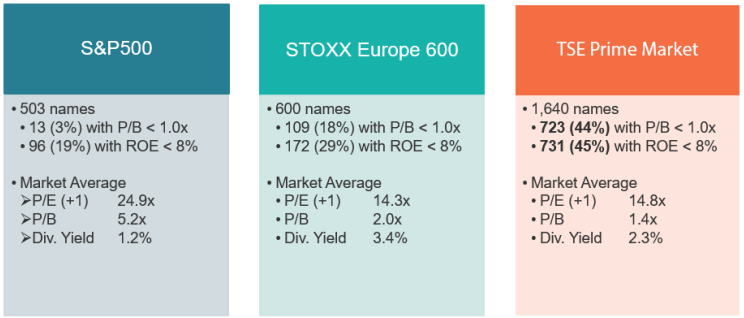

While we believe that improved governance has played a significant role in the strong performance by the TOPIX, governance reforms in Japan still have a long way to go. Given that 44% of TSE's Prime Market-listed companies are still trading with their P/B ratios below 1x, there is still plenty of room for improvement from a governance perspective. The Prime Market, in essence, offers a low hanging fruit.

Source: Bloomberg as at 29 November 2024

Japan Equity Engagement Strategy: “unlocking value” through engagement

The ongoing corporate governance reforms described above have created unprecedented opportunities from an investor perspective, in our view. Amid the reforms, the importance of constructive dialogue between shareholders and companies is becoming more widely understood. Even investors who do not fall under the “activist” category are now expected to engage more actively with companies. Against such a background, we are in the process of introducing Nikko AM's first engagement strategy.

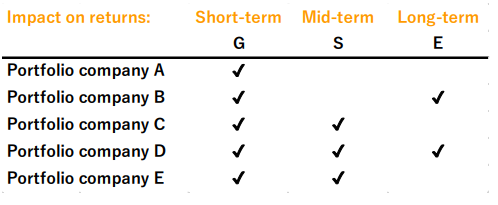

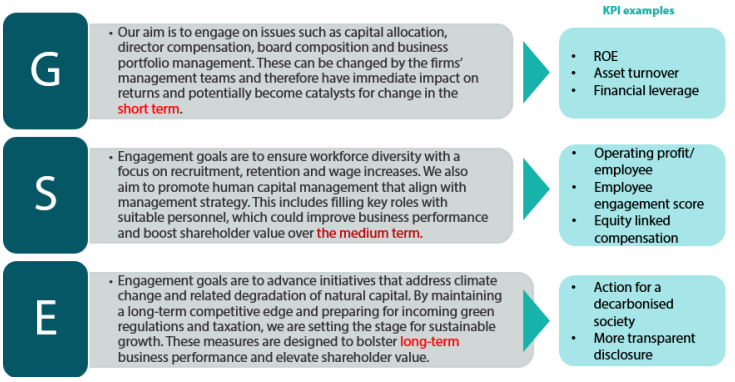

Through this sustainable investment strategy, we aim to generate absolute return through rigorous, constructive engagement with company management teams. Our investment philosophy is based on “unlocking value” through ESG engagement and securing returns by improving the governance of companies. Our unique selling proposition is the strategy's aim to begin by securing short-term returns through improvements in the governance of companies. Once short-term returns are secured, the strategy focuses on generating medium- to long-term returns by improving the companies' social and environmental aspects.

As shown below, we begin by investing in firms that have room for improvements in their governance and generating short-term returns by helping to improve their practices in this area. We then engage on social and environmental issues with some of the companies to secure medium- to long-term returns.

We illustrate this “GSE” engagement strategy in detail below.

* The contents of the strategy could be subject to change; there is also a possibility that the strategy may not be commercialised.

The type of firms the strategy is focused on

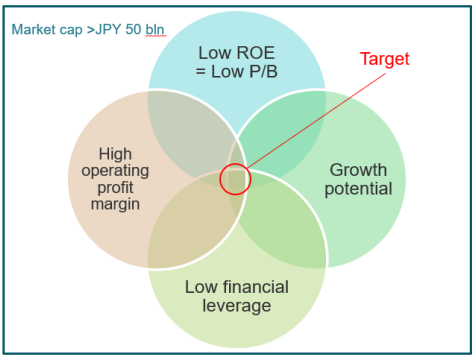

The strategy will focus on companies with market capitalisation above JPY 50 billion. Specifically, the strategy will target companies with high operating profit margins. This includes many firms that boast high domestic and global shares in their respective industries. Additional target criteria are that firms are to have low financial leverage and low ROE. Even if they have a high operating profit margin, companies with a low ROE either have a low asset turnover, low financial leverage, or both. This indicates problems with their balance sheets, which we believe can be improved through engagement. The last criterion is that companies are to have growth potential. Since the strategy emphasises engagement, the main targets will be companies that are expected to display stable growth.

What the strategy aims to achieve

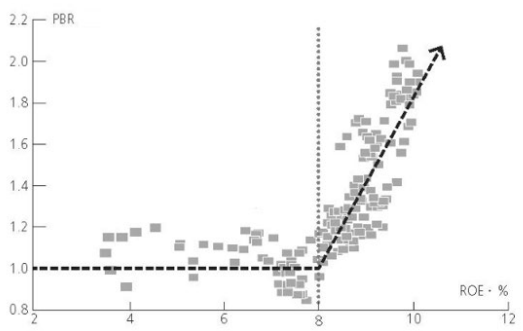

We expect engagement-led improvements in the ROEs of companies to lead to higher P/B ratios as well. The P/B ratios of Japanese companies show a tendency to rise proportionally when their ROEs exceed 8%, as illustrated below. Therefore, we believe that improving ROEs through engagement will increase shareholder value via improvements in P/B ratios.

Chart 2: Japan's P/B ratios rise proportionally when ROEs exceed 8%

Plotting 12-month forward forecast ROEs and P/B ratios (monthly) for the TSE's first section since 2014

Source: JP Morgan

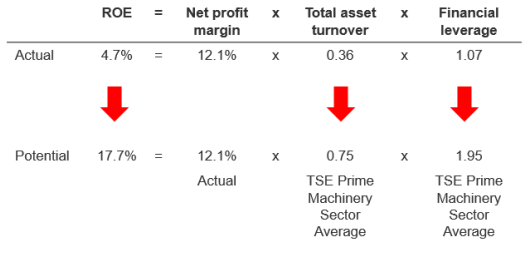

Example of the strategy in practice

Below, we provide an example of how engagement can improve the shareholder value of a company through a DuPont analysis. This company belonging to the TSE Prime market's machinery sector has high operating and net profit margins. However, it has a low total asset turnover ratio of 0.36, and because of its very high equity ratio, the company's financial leverage ratio is a very low 1.07. As a result, the company's ROE remains at 4.7%, well below 8%, the cost of shareholders' equity. If the company was to raise its total asset turnover and financial leverage ratios to its sector's average while retaining its operating and net profit margins at the current levels, its ROE is estimated to rise to 17.7%. This is the kind of result we aim to achieve through engagement.

Assisting companies in conveying a more compelling growth narrative

A company's P/B ratio can also be improved by enhancing its P/E ratio. The P/E ratio is a function of the expected growth rate. Therefore, an increase in the expected growth rate will naturally lead to a rise in the P/E ratio. It is vital for a company's management to present an attractive narrative and boost the expected growth rate; this is an area where many US CEOs excel. In contrast, many Japanese companies hold the belief that market forces determine share prices and they often do not do enough to convey their growth narratives to investors. Assisting the management of Japanese companies in delivering more compelling growth stories to the market is an important aspect of engagement.