Snapshot

Markets have continued their strong growth through 2024, as odds continue to grow that central banks are able to walk the tight rope and avoid any real slowdown of global growth. Within the US, inflation has remained above expectations. However, some marginal softness is now appearing to flow through consumer spending and employment. This has now put in sight the end of the restrictive interest rate setting, with the US Federal Reserve (Fed) now expecting one cut to occur in 2024. This goldilocks outcome will potentially bring with it a strong US economic environment, whereby inflation lands in the 2–3% range and growth continues on above trend. The market is now forecasting robust earnings growth from the S&P 500 over the next 12 months, as globally the PMI cycle is turning and investments into artificial intelligence (AI) increases. After some nervousness in 2023 about the growth outlook, it now appears that the global economy has turned the corner.

Outside of the US, other central banks should continue to ease, as Europe and Canada have now kicked off the rate-cutting cycle. In our view, this makes sense. It was our long-held view that the US would not lead the rate-cutting cycle, as growth has been anaemic in Canada and Europe with inflation moving back towards 2%. We expect the end of restrictive rates outside the US to buoy markets, supporting countries such as Germany which have been struggling over the past 18 months. Markets may remain volatile. However, we see the end of restrictive rates aiding earnings growth in economies outside the US and help propel global risk markets higher.

The outlook for defensive assets has also marginally improved, as rate cuts will be positive for the fixed income markets. Spreads have tightened considerably over the past 12 months; however, some compression can still be achieved, particularly as markets are supported by falling rates. More importantly, currency hedging costs for investors in lower-yielding countries such as Japan are likely to continue falling, which will increase the number of markets where positive hedged yields can be achieved. Over the past 12 months, Australia has been the go-to location for fixed income allocations, as the steep yield curve and lower cash rate meant that a positive yield could be generated. However, as rates fall across Europe, Canada and the UK, more options will become available to generate a positive hedged yield. This should see funds expand into wider credit allocations, using short-dated exposures in countries where cash rates are likely to fall to generate consistent yield. That said, in the emerging market (EM) local currency (LC) space, the recent Indian and Mexican elections have shown that volatility remains, with the Mexican peso dropping precipitously. While we are still positive on EMLC allocations, this highlights the need to keep a watchful eye on any currency that has been used to generate carry.

Cross-asset1

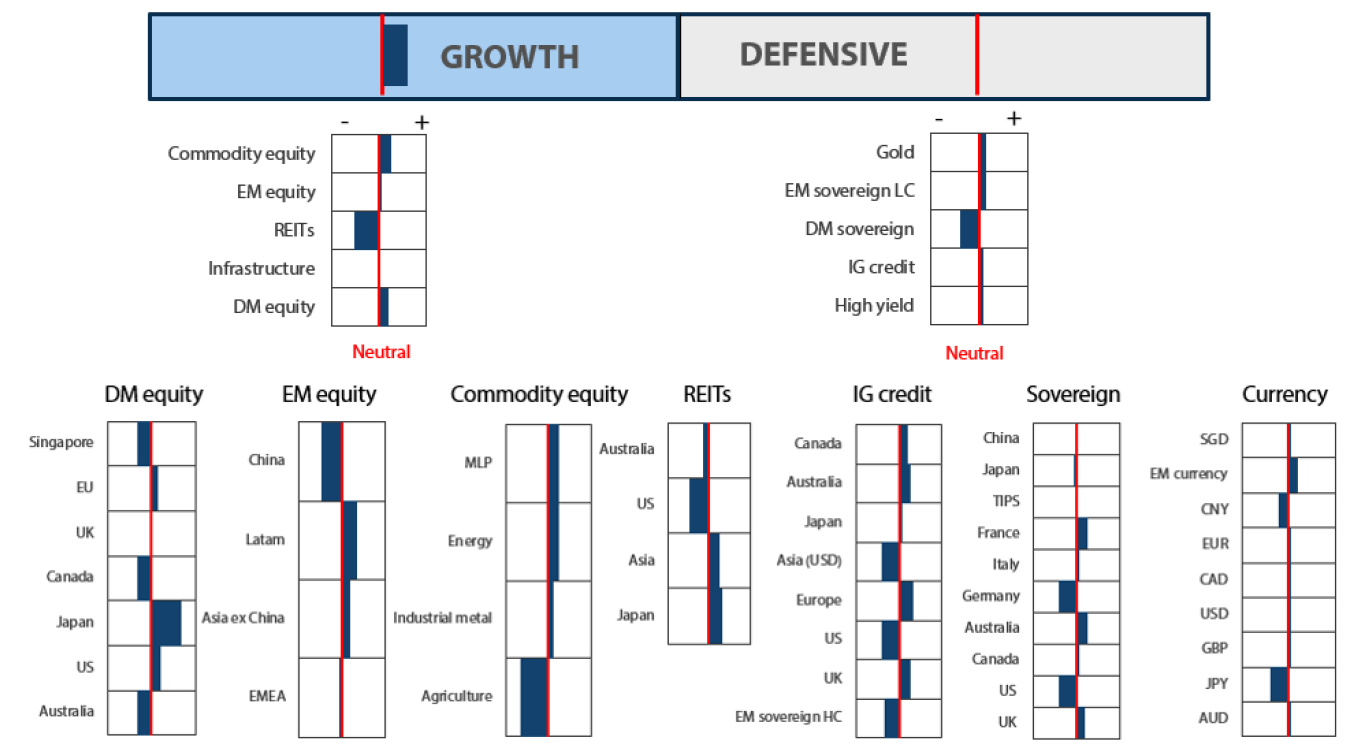

Through May we have again retained an overweight to growth assets, coupled with a neutral position on defensives. The outlook for growth continues to be positive as the developed world enters the first leg of a rate-cutting cycle, led first by easings occurring in Europe and Canada. As rate cut expectations are more grounded in reality and inflation expectations appear to be contained, a more positive risk environment may come to light. In terms of global growth, the PMI cycle appears to be turning and investment has been picking up, particularly with respect to the opportunities that can be generated in AI and green initiatives.

Within the cross-asset scores of growth, infrastructure was upgraded substantially this month to neutral, while developed market (DM) equities, commodity equities, EM equities and REITs all saw downgrades. Infrastructure was upgraded to neutral to reflect the opportunities that are critical to the future development of AI, which is highly dependent on energy. This is, in part, connected to commodity equities. The reduction that occurred on EM equities reflects the soft opportunity set that is available, particularly in China where earnings growth has not yet lifted the market. Outside of China, we see better opportunities in Latin America (LatAm); however, political uncertainties make this a tougher area to take advantage of. Additionally, the downgrades that occurred in DM equities and commodity equities were more reflective of the room made to neutralise the underweight in infrastructure, as both assets classes remain overweight allocations.

Within defensives, investment-grade (IG) credit was reduced marginally and is now a smaller overweight, while DM sovereigns were increased but remain underweight. IG credit spreads have continued to tighten, and in certain countries (such as the US), spreads have now hit levels that are relatively tight. Outside of the US, locations such as Australia, Canada and Europe remain attractive and this leads to the score still being slightly overweight. For DM sovereigns, the recent bond sell-off and potential for rate cuts make the sector more attractive. However, the highly inverted bond yield curves mean we prefer to remain underweight on long-dated bonds.

1 The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View2)

2The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

Growth assets continued to maintain the lift that began in mid-May, buoyed by a more balanced pricing of rates and inflation, in addition to a sustained revival by the manufacturing cycle. However, any hint of a cyclical recovery reflected in equity markets was significantly overshadowed by outsized gains in tech—semiconductors, in particular. Triple-digit gains over several months rightfully raise the possibility that the market may be entering, or already in, a bubble. There is undoubtedly a surge of excitement around AI in terms of opportunity, but how real is it in terms of actual earnings? So far, signs of real earnings growth are supportive, but market gains remain concentrated among the largest cap companies. The question then is, where do we go from here?

Tied to the AI theme is fast-growing demand for energy that is likely to reach multiples of current supply in the years ahead, just to power the AI infrastructure used to train models and the increasing provision of inference applications. Utilities have transformed overnight from sleepy yield producers to hot growth opportunities. Again though, the question remains: how real are the earnings and growth expectations that would justify these elevated valuations?

Bubble check-up on AI

AI has been with us for some time, but it was the launch of ChatGPT in late 2022 that captured the world’s broader imagination against the backdrop of an extremely depressed market due to fast rising interest rates. While interest rates continued to rise into 2023, one could not ignore the exceptional growth in earnings and cash flow exhibited by chipmaker Nvidia. Earnings growth has exceeded price growth, meaning that valuation based on the measure of price-to-earnings (P/E), Nvidia actually looks cheaper than a year ago.

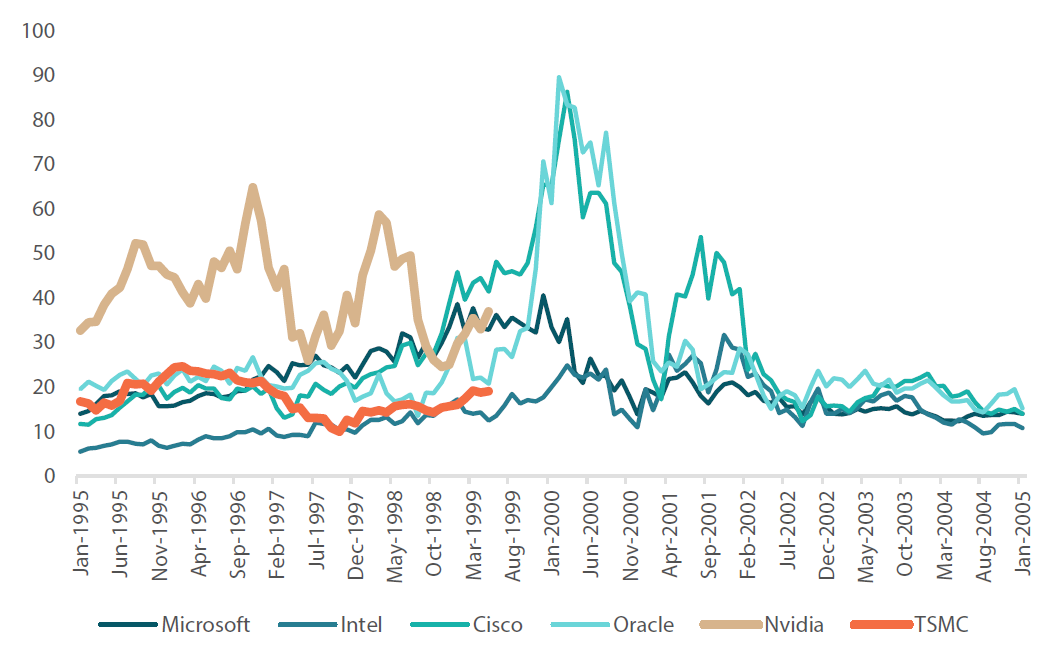

As shown in the chart below, the P/Es of the two largest semiconductor companies, Nvidia (in brown) and TSMC (in orange), are compared to largest cap stocks through the boom-bust DotCom cycle.

Chart 1: P/Es of AI semiconductors* vs. P/Es of large “DotCom” stocks

*The period covered for Nvidia and TSMC is January 2020 through May 2024 and is shown overlapping with the DotCom era for comparison.

Source: Bloomberg, June 2024

So far, the P/Es appear reasonable, at least through their simple valuation lens. However, are earning growth expectations reasonable? Unlike growth built on future possibility, actual current earnings have continued to surprise very significantly to the upside. Capital expenditure (capex) in AI infrastructure is high, and semiconductors, as one of the key beneficiaries, have been able to support exceptionally high margins.

Less certain are the winners and losers in the software space, and whether expensive capex will ultimately measure up to the promised productive gains. This is among the key questions to be answered in the quarters ahead. AI is the biggest tech theme since the dawn of the internet. However, like all emerging platforms, sometimes those that provide the necessary parts, like Nvidia and TSMC, emerge as the biggest winners.

Another interesting dynamic is simply the vast quantities of energy required for AI training and inference. Demand for electricity is growing exponentially through existing infrastructure while tech companies are in a virtual arms race to build the world’s most powerful AI data centres, each with an energy demand equivalent to that of a new city.

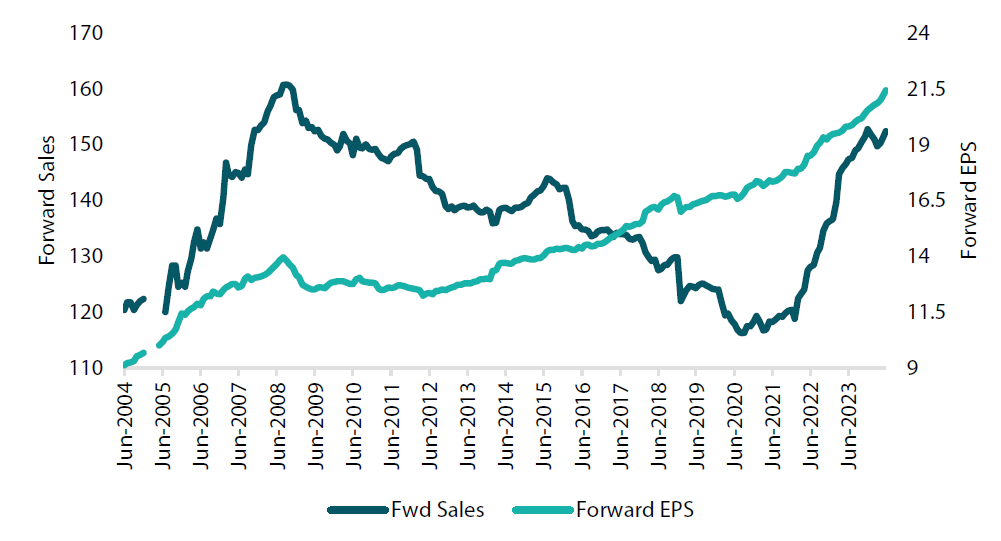

As a result, the utilities sector is being upended—shifting from a high-yielding defensive asset to one that could potentially experience high growth in demand thanks to significant operational leverage provided by a large capital base. We have improved our outlook on utilities, and prospectively it will be important to take a deeper look into this sector given its highly regulated nature.

Chart 2: S&P 500 Utilities sales vs. EPS

Source: Bloomberg, June 2024

Our take is that we are not yet in an AI bubble. But we are likely in the early stages of potentially creating one, as excitement and greed overcome caution and measured speculation. We are particularly fond of the AI theme due to the strong fundamentals of the companies involved and the promises for productivity gains that could eventually come next. We also acknowledge the immense difficulty in predicting the winners and the losers, so we favour the broad class that encompasses those generating current and potential high-growth cash flow.

Conviction views on growth assets

- Toned down commodity-linked equities: We reduced to more of a neutral stance, given the more balanced pricing of inflation and commodities. We still like the fundamentals of the sector, though with better cyclical and secular fundamentals, it is fair to lean more heavily into other segments.

- Reaping some profit in Japanese equities: We reduced the overweight in Japan to add to elsewhere. Without a doubt, Japanese equities offer the best FX hedged yield, which exceeds 7% (dividend and carry) in US dollar terms. We also still believe in Japan’s structural reform story, and while the country’s equities have recently settled at relatively flat levels, we are comfortable given the yield and growth opportunities that potentially lie ahead.

- Stopping at just keeping an eye on political risk in Europe: Elections in France did not go the way President Emmanuel Macron had hoped and, to make matters even worse, his call for snap elections seemed to have quickly backfired, likely resulting in putting more extremists into power. Political risk is always important, but in most cases it can be overlooked in terms of equity performance, particularly when an easing cycle is just beginning.

Defensive assets

Changes within defensive assets were relatively small this month, with some adjustments made within Australian and European IG credit. Currently, rate cuts in Canada and Europe offer benefits. We view these two locations as the most likely to adjust interest rates due to their below-trend growth and inflation returning closer to the targets of their respective central banks. This contrasts with the US, where inflation still remains above 3%, likely prompting the Fed be more hawkish than the market expects. In this month’s Balancing Act we take a look at the EM LC space, with a particular focus on the election outcomes in India and Mexico.

Two key elections in emerging markets

Over the past month, several important elections have taken place, propelling EMs into the limelight. Two notable elections took place in Mexico and India, with the market taking a far more pessimistic view of the Mexican result than India’s. After being one of the strongest performing currencies through 2023, the Mexican peso reacted particularly harshly to the election outcome, dropping by as much as 10% and undoing the majority of the 2023 rally in a number of days.

The Mexican election saw an overwhelming win for Claudia Sheinbaum, the candidate from the incumbent Morena Party and successor to President Andres Manuel Lopez Obrador. Although the market and pundits had predicted a win, the stunning margin of victory took many by surprise. The Morena Party won a super majority in the lower house of Congress and fell just short of the numbers required to have a super majority in the Senate.

The market viewed the landslide win negatively as it opens up the possibility of the Morena Party changing Mexico’s constitution. A proposed amendment aims to change how judges are elected, which could lead to a more politicised Supreme Court. Given that this could drastically alter the rule of law in the country, markets were understandably unnerved by the outcome, leading to extreme volatility in the market. In light of these developments, we have recently taken a more cautious view on Mexico, as the super majority could be a destabilising force and Sheinbaum will need additional time to win the respect of investors should the Morena Party seek to fast track judicial reform.

Chart 3: Mexican 10-year yield and peso (MXN)

Source: Bloomberg, June 2024

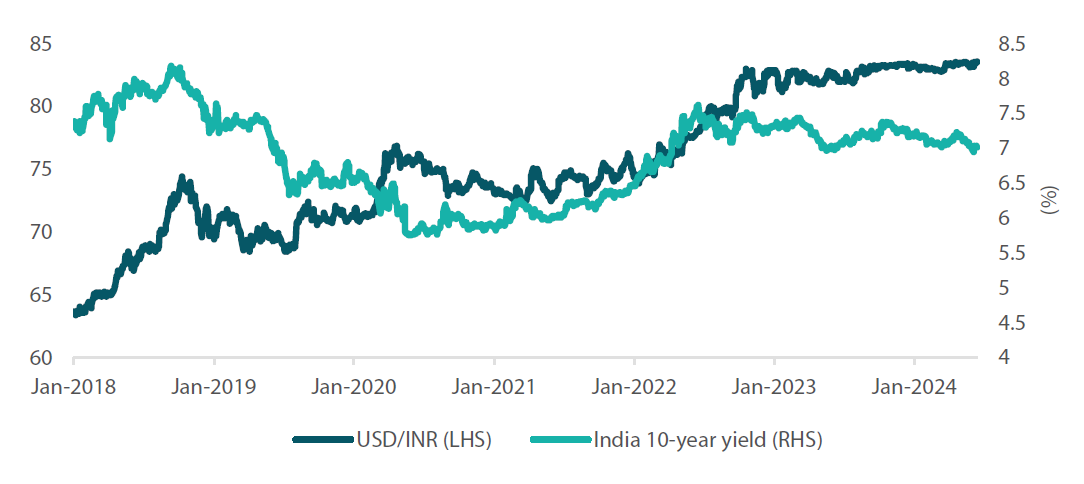

The market reacted differently to India’s election, which saw incumbent Prime Minister Narendra Modi secure a third term in office. Unlike in Mexico, Modi’s Bharatiya Janata Party (BJP) failed to achieve an outright parliamentary majority and required the support of allies to form a coalition government. This will likely make policy making more challenging, as the BJP will be restrained from pursuing controversial issues, unlike Mexico’s Morena Party. While the market initially faced a bout of volatility as the election news flowed in, ultimately the outcome was viewed as positive for markets, with investors seen favouring the stability associated with continuity. From a defensive side perspective, we continue to favour Indian bonds. India’s relatively high yield, managed currency, high level of growth and stable government offer a relatively positive environment for the short to medium term.

Chart 4: Indian 10-year yield and rupee (INR)

Source: Bloomberg, June 2024

Conviction views on defensive assets

- Short-dated IG credit: Credit spreads remain at fair levels, but many markets still exhibit inverse yield curves, making longer-dated credit less appealing. Until curves steepen, shorter-dated credit is likely to remain our preference.

- Gold remains an attractive hedge: Gold has been resilient in the face of rising real yields and a strong dollar, while proving to be an effective hedge against geopolitical risks and persistent inflation pressures.

- Attractive yields in EM: Real yields in this sector are generally very attractive, and we have a preference for quality EM currencies which can provide strong levels of yield, such as India.

Process

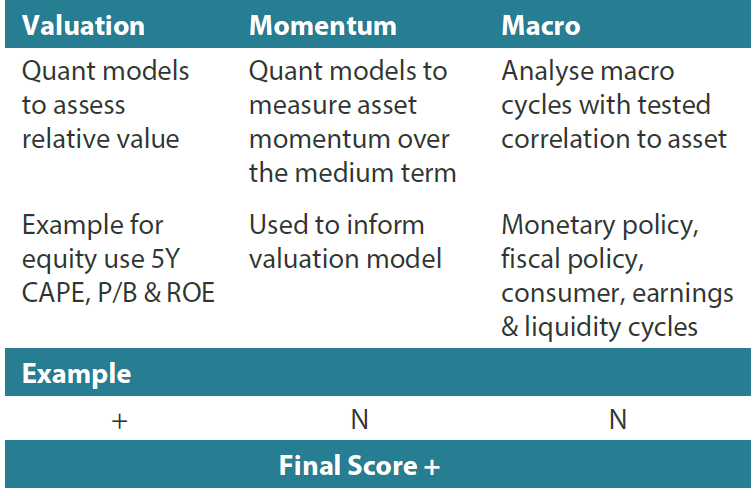

In-house research to understand the key drivers of return:

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way