By Iain Fulton, Portfolio Manager, Global Equity

Like many other households during the global COVID pandemic, we welcomed a new resident into our home: a small furry pooch named Benji (pictured). As our eldest son was leaving the family nest, getting a dog was a shameless act of replacement. It is not that our son Jamie used to follow us around the house and beg for food (at least not all the time) but the sense of quiet at home when he moved away to university became even more acute during the pandemic lockdown. Like many, we found solace in the comfort, loyalty and affection that dog owners will understand only too well.

Source: Iain Fulton

For those of you wondering what relevance this has in an investment article, it might be worth noting that Benji is now approaching the ripe old age of four. Although still a puppy at heart, he is moving through his adolescent phase and entering the human equivalent of his 20s. He is in his prime, but not for much longer. In the next couple of years, the millions of pets around the world adopted during lockdown will start to reach middle age. As humans of a certain age know only too well, this is when medical bills begin to rise.

In short, we believe that there is a coming boom in pet healthcare never seen before (if only my son had studied something practical like veterinary medicine). In our view, the coming boom will not only benefit veterinarians but also present opportunities for companies in the animal pharmaceutical industry—a sector where we have been doing some additional research recently.

As an investment team, this link between the pandemic and pet healthcare got us thinking about other industries that were impacted by COVID-related demand cycles. We were prompted to consider how this might be currently unfolding and whether it is creating opportunities for long-term investment.

The first thing that struck us during our reflections was the apparent existence of a COVID-related cycle in human memory, which seems to hamper our attempts to remember certain parts of the past. This could be the continuation of an existing trend, although we could not quite remember. Have we been systematically outsourcing our memory to Google for the last 20 years? In my case, almost definitely. Are we about to outsource our imagination to AI? Very possibly.

Psychologists attest that we remember events to which we attach emotions, like the pain of a stock investment that went wrong. So why is it so hard to remember the details of the pandemic? Almost two years of our lives were turned upside down, yet we struggle to recall precisely what happened and when. According to one theory, we were overloaded with emotion during the pandemic as we grappled with stressful daily updates about death rates, lockdown rules and restrictions on liberty. Faced with such a daunting picture, the theory goes that it is much easier for us to simply forget.

With the aid of Google and a bit of Chat GPT, it is possible to piece this tricky bit of history back together and remember the industries that were impacted the most. So here it is—the painful (though not exhaustive) top 10 or so activities we did or saw during lockdown. For those with a nervous disposition who still wish to forget, feel free to look away now…cue the music please Benji.

Let us start with the things we saw more of….

- Video gaming and increased consumption of digital media

- On-line shopping / scramble for consumer essentials (remember the toilet paper wars?) / digital payments

- Work from home / video communication

- Home improvement

- Home fitness workouts

- Outdoor pursuits (golf, running, cold water swimming)

- Pet ownership

- Home cooking / meal kits

- Athleisure

- Investing in Bitcoin and loss-making growth stocks

- Increased spending on drug and vaccine development

Then the things we did less of….

- Travel

- Paying in cash

- Eating out / socialising

- Shaking hands

- Wearing ties

Source: Iain Fulton

While the examples above may seem somewhat light-hearted and anecdotal, the consequences of these demand cycles are still being felt in many cases. Take, for example, Mark Schneider, the outgoing CEO of Nestle, or Laxman Narasimhan, recently ousted CEO of Starbucks. Both were leaders of multinational consumer brands who struggled to adapt to the post-COVID world of volatile inflation and shifting consumer preferences.

In fact, the list of consumer-facing businesses struggling with these issues is extensive. Companies like Diageo, Remy Cointreau, LVMH, L'Oreal, Estee Lauder, Burberry, Kerry Group and Kering, to name a few, have all suffered sharp share price reversals after the pandemic. The virtuous cycle turned vicious, and while these companies will likely recover, the dismissal of otherwise talented executives with successful track records shows the difficulty of distinguishing between cyclical trends and structural changes.

We are likely witnessing these consumer-facing industries going through a classic long-tailed inventory cycle. Investors, including ourselves in the case of Diageo, became overly optimistic about the trajectory of demand for luxury goods, cosmetics and spirits in the reopening phase of the pandemic. Investors appear to have mistaken a stimulus-fuelled acceleration in demand, further boosted by inventory restocking, as a structural shift rather than a cyclical one. Currently, it is possible that the reverse is starting to occur. As tighter monetary policy hurt consumption, an inventory destocking phase began. Weaker demand, inventory destocking and falling valuations could be creating a compelling long-term investment opportunity. However, we may need patience—a virtue that is in short supply in this post-pandemic world.

These consumer-facing companies will likely bounce back, just as those left in the wake of the 1990s tech bubble emerged as some of the leading stocks of the early 2000s. One industry that may be springing back to life is video gaming. After a pandemic-induced boom in gaming, growth rates naturally moderated in the aftermath. Sony, for example, saw their operating margin within its gaming division drop from over 10% to just 5%, causing their share price to stagnate while the rest of the Japanese equity market surged. However, demand is now recovering, as evidenced by Sony's most recent results, with the company posting a gaming operating margin approaching 14%. The gaming recovery has been further confirmed by positive earnings reports from Tencent's gaming division and sports-related software producer Electronic Arts. We should not forget that all cycles turn eventually.

The medical device sector is another industry that experienced a COVID boom followed by a dramatic post-pandemic slowdown in the last few years. While we were busy consuming alcohol, buying luxury goods and playing video games during the pandemic, the pharmaceutical and biotech industries were spending record amounts on developing new drugs.

This created an excess inventory in equipment used to discover and produce these new therapies. Companies like Danaher and Biotechne have struggled to contend with high inventories in their key end markets and a moderation in demand. Fortunately, this trend appears to be turning a corner, with an acceleration in orders and shipments being seen across the industry. This shift has been welcome news for the companies in which we are invested. Patience indeed seems to be a virtue.

Source: Iain Fulton

Finally, it would be an oversight not to mention politics, which was impacted the most by COVID. It is hard to explain how a candidate who, while president, suggested that COVID could be defeated by ingesting bleach, could subsequently be re-elected even after alleging that citizens were eating their neighbours' pets (I'll let you know when it's safe to come out from under the sofa Benji). Collective amnesia brought upon by COVID could have played a part; however, the shift in the US political landscape may have more to do with the impact inflation had on the real incomes of the lower-income households. Perhaps for the first time in recent history, the Republicans attracted majority support from less affluent voters, a sobering thought for Democrats reflecting on their last four years.

The outlook for the post-election world remains uncertain. The impact of a truly "America first" policy could be far reaching. However, it appears that the tail risks of such a policy are inflationary rather than deflationary. As such, we feel more strongly than ever that investors should strive for a diversified global portfolio of quality companies that can thrive in an environment where the cost of capital may be higher than previously expected. Our collective experience of the pandemic reminds us that such an approach is a fairly good idea.

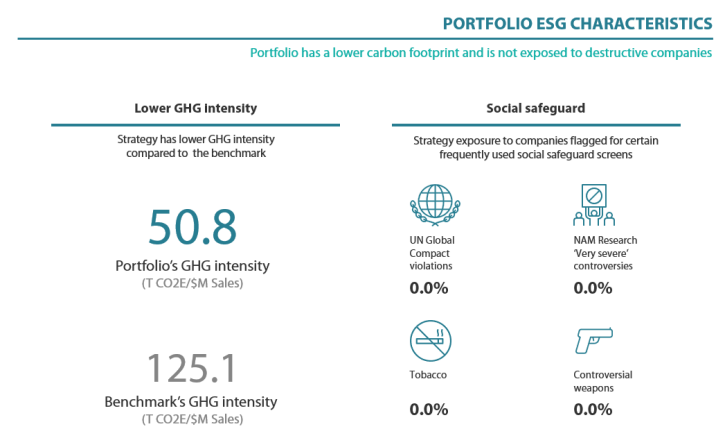

Source: MSCI ESG Research, NAM Research 31 October 2024. Data is shown for representative account of the Nikko AM Global Equity Strategy. Benchmark is the MSCI ACWI. Net Total Return Index. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon.

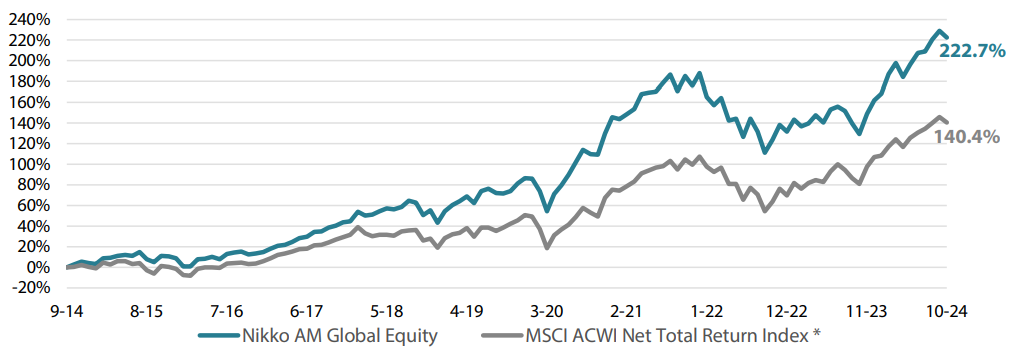

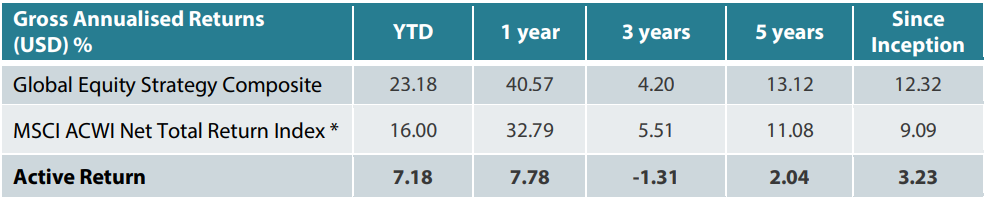

Global Equity strategy composite performance to October 2024

Source: Nikko AM, FactSet. Data as of 31 October2024.

Past performance is not a guide to future returns.

*The benchmark for this composite is MSCI ACWI Net Total Return Index. The benchmark was the MSCI ACWI ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014. Returns are based on Nikko AM’s (hereafter referred to as the “Firm”) Global Equity Strategy Composite returns. Returns for periods in excess of 1 year are annualised. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®). GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. Copyright © MSCI Inc. The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it.. Data as of 31 October 2024.

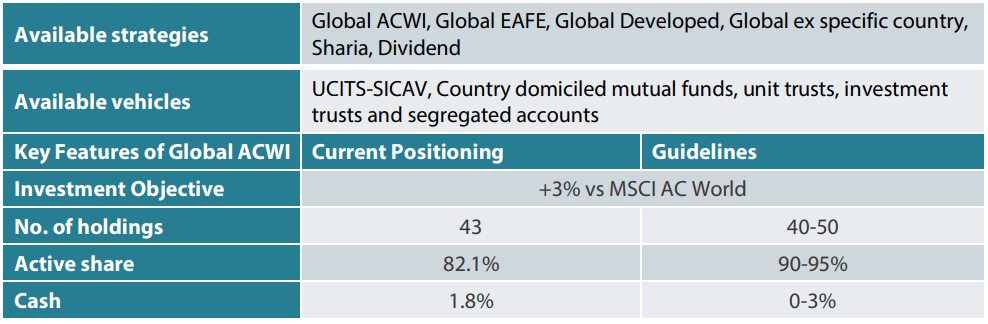

Nikko AM Global Equity: Capability profile and available vehicles (as at October 2024)

Target return is an expected level of return based on certain assumptions and/or simulations taking into account the strategy’s risk components. There can be no assurance that any stated investment objective, including target return, will be achieved and therefore should not be relied upon. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon.

Past performance is not indicative of future performance. This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

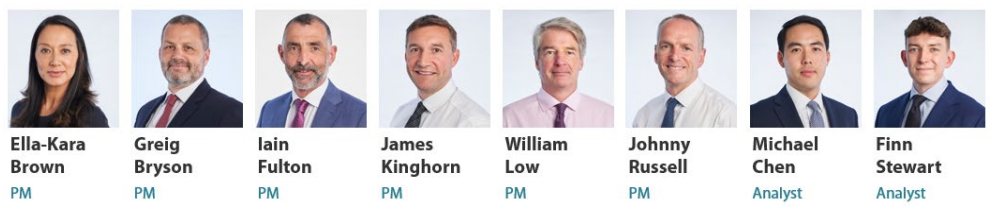

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually "joining the dots" across geographies, sectors and companies, to find the opportunities that others simply don't see.

There are four key areas that make our strategy different:

– a focus on Future Quality companies – a different and clear philosophy

– a distinctive team culture – a tight-knit team with a process built on openness and respect

– unique execution , including rigorous team challenge of every idea

– differentiated portfolios , with a strong track record in stock-picking and ESG integration

Future Quality companies

We believe that companies with superior long-term returns on investment will deliver better performance. We call these Future Quality companies, and it is only these companies that make it into client portfolios. We search for Future Quality through analysis and financial modelling of companies that we expect to deliver over the next five years, and beyond. This approach is supported by academic evidence that businesses with high and improving returns on invested capital provide superior compound performance over the long term. With this investment time horizon, the sustainability of returns is a crucial ingredient of our Future Quality approach. We have found that companies developing solutions to ESG issues and management teams providing value to all stakeholders are more likely to be successful at sustaining high returns on invested capital over the long-term.

Distinctive team structure and culture

We believe that our collective knowledge and experience are powerful tools for delivering investment performance. Since 2011, we have operated a team-based approach to uncovering Future Quality investment ideas and have fostered a strong group dynamic. Individually, each Portfolio Manager is an expert investor with a broad skillset and experience of many market cycles.

We work in a flat structure, where all our Portfolio Managers have a dual role that combines investment analysis and investment management responsibilities. With individual analytical coverage split along industry lines, each Portfolio Manager is a specialist in the stocks and sectors they cover.

We all actively challenge the ideas and analysis of colleagues throughout the investment process, in an open atmosphere of vigorous and constructive debate. Portfolio Analysts work alongside Portfolio Managers, typically researching thematic trends that could influence and uncover future investment opportunities.

We take collective responsibility for approving stocks for the portfolio, and therefore there is joint accountability for performance. As such, it is in everyone's interest to ensure that the investment analysis is thorough and that no stone is left unturned in the search for Future Quality.

We believe that the broad experience of our Portfolio Managers and distinctive team-based approach that sees everyone contributing to the strategy, increases the probability of successfully uncovering Future Quality.

Unique execution

Our tight-knit team approach and flat structure enable us to execute in a transparent way, including a rigorous team challenge of every idea. By using our strict Future Quality standards, we can identify long-term winners from the broader universe, to narrow down a comprehensive watch list and around 100 deep dive researched ideas. This is within a unique framework of individual accountability for the underlying analysis and company research, combined with the collective challenging of assumptions at the team level. Our proprietary ranking tool creates a disciplined process to compare and rank attractive opportunities and ensures that at the portfolio construction phase, only our best-ranked ideas receive the most committed weights in client portfolios. We believe our culture is key, and the collective ownership of our research process brings the best portfolio outcomes for clients.

Differentiated portfolios

We deliver a high-conviction Global Equity strategy for clients that is not constrained by benchmarks. As such, Future Quality can be sourced from listed businesses across any geography or sector. And, in a world awash with investment prospects, our disciplined, accountable and transparent process helps us to focus solely on building portfolios from companies that best meet our specific Future Quality criteria.

In terms of balancing risk and reward, our track record shows that we consistently deliver attractive returns on a lower risk-adjusted basis compared with peers and the global reference benchmark. The high active share and concentrated number of holdings help ensure that our Future Quality stock-selection process delivers differentiated portfolios.

About Nikko Asset Management

With USD 246 billion* under management, Nikko Asset Management is one of Asia's largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income, Multi-Asset and Alternative strategies. In addition, its complementary range of passive strategies covers more than 20 indices and includes some of Asia's largest exchange-traded funds (ETFs).

*Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 31 October 2024.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the strategy will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.

Reference to any particular securities or sectors is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way. There can be no assurance that any performance will be achieved in any given market condition or cycle. Past performance or any prediction, projection or forecast is not indicative of future performance