Key Takeaways

- In a decade that has seen a number of market moving events, we outline the key factors that have enabled the Global Equity Team to deliver long-term outperformance.

- Our differentiated Future Quality investment approach has seen alpha sourced from unexpected places.

- With several long-term growth drivers being evident, we are confident in our ability to find plenty of upcoming Future Quality opportunites.

A decade of transformation

In the ten years since the Global Equity team joined Nikko Asset Management and launched the Nikko AM Global Equity strategy, the world has changed considerably. In 2014, the Paris Agreement on climate change had not been signed, globalisation was ascending and Donald Trump was primarily a TV star.

The intervening decade has certainly been busy in terms of global events. We have witnessed the organisational powers of social media, sparking the #Metoo movement and anti-government protests in Hong Kong and the Middle East; conversely, we have also experienced its downsides amid the proliferation of disinformation and amplification of political divisions. Meanwhile, increased economic inequality has given rise to populism, and we have endured a pandemic.

From a corporate perspective, we have seen the technology sector intensify its dominance. In 2014, only half of the world’s ten largest companies were categorised as technology (including online retailer Amazon), but in the summer of 2024, eight of the top ten biggest companies were from this sector.

Navigating an evolving landscape

As global equity investors, we are often asked how we have successfully navigated such an evolving market landscape since the strategy’s inception in 2014. And the truth can ultimately be attributed to three key factors.

Firstly, we remain humble. It is just as important to stay grounded during times of good performance as it is to avoid falling into the doom and gloom loop during challenging times. And we have certainly experienced both during the last ten years. Humility helps us question our assumptions and make more objective decisions. When mistakes are made, acknowledge them early to limit losses. These mistakes provide valuable insights for future decisions. Additionally, learning from the experiences of others—both their successes and failures—is equally important.

Secondly, it is essential to surround yourself with people who share the same core team values. A wise Australian CEO once told us you should never appoint anyone you would not want to have a second cup of coffee with. This idea of building a well-functioning team and maintaining strong social bonds has proven to be a very useful asset. Most of the time, we all sit together around a huge 20-foot desk—which encourages healthy debate and the occasional dispute, usually centred around our differing football allegiances!

Like many businesses, our setup was disrupted by the pandemic. Nearly three years of predominantly working from home, with minimal face-to-face communication, created strains that could have been far more damaging if we were not already such a tightly-knit group.

Thirdly, having a robust investment philosophy and adhering to it through both good and bad times is crucial. Joining a larger organisation that has faith in your culture and philosophy, in our case Nikko AM, has given us the stability and opportunity to build a team structure centred around our core values, and has empowered us to develop and reinforce our Future Quality investment philosophy.

Thinking differently to outperform: the Future Quality approach

When we first started, it was clear to us that to outperform as stock pickers, we needed to think differently. Rather than focusing on the starting point of a company’s journey, we felt that it was the direction of future travel that really mattered. Essentially, we find Future Quality. Those companies beating the fade or are on a path to leadership. Companies that are efficient with capital, not only today but more importantly for tomorrow, who will seek to attain and sustain rewarding returns. Our goal of investing in quality companies that can attain and sustain high returns on investment has not materially shifted since our start. At the same time, we have worked with our Nikko AM colleagues to refine our Future Quality articulation, and we find that it helps our clients better understand our approach. It can also help explain why our portfolio is quite differentiated from other traditional quality growth portfolios while still delivering long-term outperformance. In the ten years to 2024 our portfolio has delivered a gross annualised return of 12.47% versus 9.24% for the benchmark MSCI ACWI Net Total Return Index.1

For us to categorise a company as a Future Quality investment, it must meet our four pillars of Future Quality: Franchise—it has a lasting and sustainable competitive advantage; Management—who demonstrates the ability to make sound strategic and capital allocation decisions; Balance Sheet—growth prospects must be properly financed and not reliant on the issuance of new debt or share offerings; and Valuation—in our view paying too much for a high-quality company can turn into a low-return investment, so maintaining a disciplined approach to valuation is essential. While zeroing in on these pillars helps us construct a quality portfolio, it can also lead us down a road far less travelled.

1Past performance is not a guide to future returns. Inception date for the Nikko AM Global Equity Composite is 01 October 2014. Data is as of 31 August 2024. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. There can be no assurance that any performance will be achieved in any given market condition or cycle. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon.

Differentiated alpha

In the last decade, we have sourced alpha from some unexpected places. While the technology sector may have gathered the most headlines due to its sometimes extraordinary growth, the strategy’s largest sectoral contributors in the last ten years were actually consumer discretionary and financials. This differentiation stems from our prioritisation of individual stocks over sectors. Essentially, by not subscribing to a narrow definition of growth, we have been able to find genuine alpha from the less obvious places—US insurance technology leaders, Australian medtech innovators, US agricultural equipment manufacturers and Chinese automakers, to name a few.

Moreover, while we regularly analyse long-term macro drivers and structural themes in order to identify potential sources of growth, we will not invest in a theme if we are unable to find companies that meet our Future Quality criteria. In fact, many of our outsized past performers have been driven by idiosyncratic stories. For example, a new management team may operate in a radically different way from the previous incumbents or stocks in a relatively unloved part of the market can benefit from their relatively low valuations.

The portfolio’s longest-held position is an example of a change in business operations that had a real impact on future growth. Sony, the Japanese entertainment conglomerate, was a notably diversified and somewhat undisciplined business ten years ago that was spread too thinly across too many areas. By prioritising three or four of its most promising business strands, Sony has been able to establish market leadership in those areas and return to sustainable growth.

The other feature of our alpha track record has been the ability to source it widely across regions, sectors and market capitalisation. Whilst some commentators have questioned the success rate for active investors in the US, this large market has been a notable source for the winning future quality companies we seek. Whilst technology is a notable feature of that market, particularly in more recent times with the emergence of AI, our success has just as much been about other areas of that market.

The US insurance sector is a case and point, with the competitive dynamics back in 2015 being quite rightly a turnoff for the industry overall. However, within many industries, growth in market share can be a more important dynamic than the market overall, and Progressive Corp was testament to this. Unusually led by a female CEO this company has been able to differentiate itself through better use of data analytics and a differentiated direct delivery to customers. The result has been superior growth, high ROE and the ability to sustain this over the whole period until today.

Disciplined investment

The ability to be able to step back and re-evaluate our investment decisions has been another contributor to our long-term outperformance. This pragmatism does not just apply to buying decisions, but it is also a key part of our selling discipline.

An important part of our team structure is that we do not just rely on individual sector experts to make investment decisions concerning specific stocks. Our culture encourages all team members to express their views as it is only together that we can best find and challenge ideas; in our view, there is no monopoly on truth. In practice, we find a team-based approach makes us less emotionally invested in individual stocks, enabling a more critical assessment of when to buy and sell.

And while there have certainly been times when we held on to a stock for too long or did not invest quickly enough, our process has been designed to recognise these mistakes rapidly.

The discipline of strictly sticking to our Future Quality investment philosophy has also resulted in a relatively low portfolio turnover. We believe it is important not to overtrade and, over the last decade, our average stock holding period has been around three years. Rather than tracking the prevailing macro conditions, the drivers supporting our four pillars of Future Quality tend to be of a longer duration, with valuation variability (of which there have been some extremes in the last five years) being an appropriate catalyst for appropriate portfolio changes

What’s more, the durability of our Future Quality pillars provides an element of shock absorbency that can dampen stocks’ reactions to past and future periods of volatility.

An eye on the future

The “Future” element of our Future Quality approach is just as fundamental as our focus on “Quality”. Even though stock selection remains our number one priority, it would be remiss to ignore important macro and structural drivers of future growth. After all, stocks rarely operate in a vacuum.

Looking ahead, we see three long-term thematic opportunities.

Enablers of the energy transition

The need to reduce humankind’s reliance on fossil fuels and create cleaner alternatives through renewable energy sources and greater electrification is irrefutable, but the transition is not straightforward. Existing energy supplies will need to be maintained and supported, cleaner and more sustainable energy sources introduced, and accelerated investment into electrical infrastructure to cater for AI driven datacentre build outs . We have identified investment opportunities in all of these areas, although limited fiscal spending and fickle political support mean that the pathway will likely remain bumpy.

Providers and enablers of healthcare efficiency

With an ageing global population, providing sufficient and efficient healthcare, and reducing the cost of these services, will be one of the most important challenges going forward. This sector is proving to be a great hunting ground for investment ideas, as healthcare companies rapidly innovate to deliver much-needed solutions.

AI adoption

The emergence of AI has become impossible to ignore. Our research shows that while AI contains an element of hype, it likely to be the transformative technology for the next generation. It is too early to define the long-term winners, but there are market leaders already benefitting from the capex rollout underway that fit our Future Quality criteria.

Yet, no matter how enticing the theme, it is important to reiterate that we will only harness these opportunities if the representative companies align with our Future Quality philosophy. We have been unwavering on that standard for ten years and we will remain steadfast well into the future.

Adherence to values as team evolves

It is also important to us that the culture we have established over the last decade is maintained as we move forward. Founded on the principles of diligence—we only invest in companies we fully understand and trust; respectfulness —we treat clients, colleagues and peers with mutual respect; mindfulness—we always aim to do what is best of our clients; and transparency—we are open about everything we do; this culture is the foundation of our process, and it is integral to maintaining the trust and goodwill of our clients.

Where we do anticipate change is within the team. Over the last ten years, our team has already expanded, with the purpose of building out the team to ensure continuity for when some of our older members look to retire (which is unlikely to happen for some time). In our view, by selecting the right team members now, and instilling in them the foundations of our Future Quality ethos we will have established the right building blocks to ensure our portfolio will continue to outperform.

And future growth does not daunt us. Since we joined Nikko AM in 2014, the size of our team’s assets under management has grown from USD 250 million to USD 5 billion, and we are hopeful that it will continue to be trusted with more client assets. From day one, we factored in liquidity considerations as well as how we could best avoid concentration risk and are confident that we still have plenty of capacity.

Ultimately, our ten-year story adheres to the adage: that if you plan for success, you are more likely to deliver it. We look forward to continuing our investment journey along the road less travelled for the next decade and beyond.

The Nikko AM Global Equity investment team

Nikko AM Global Equity Strategy Composite Performance

(October 2014 – August 2024)

*Past performance is not a guide to future returns.

The benchmark for this composite is MSCI ACWI Net Total Return Index. The benchmark was the MSCI ACWI ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014.

Returns are based on Nikko AM’s (hereafter referred to as the “Firm”) Global Equity Strategy Composite returns. Returns for periods in excess of 1 year are annualised. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. Copyright © MSCI Inc. The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it. Data as of 31 August 2024.

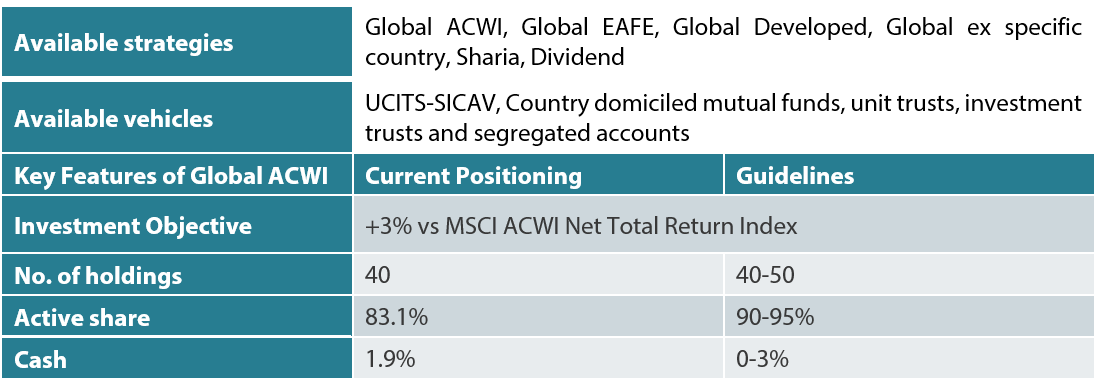

Nikko AM Global Equity: Capability profile and available vehicles (as at August 2024)

Target return is an expected level of return based on certain assumptions and/or simulations taking into account the strategy’s risk components. There can be no assurance that any stated investment objective, including target return, will be achieved and therefore should not be relied upon. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon.

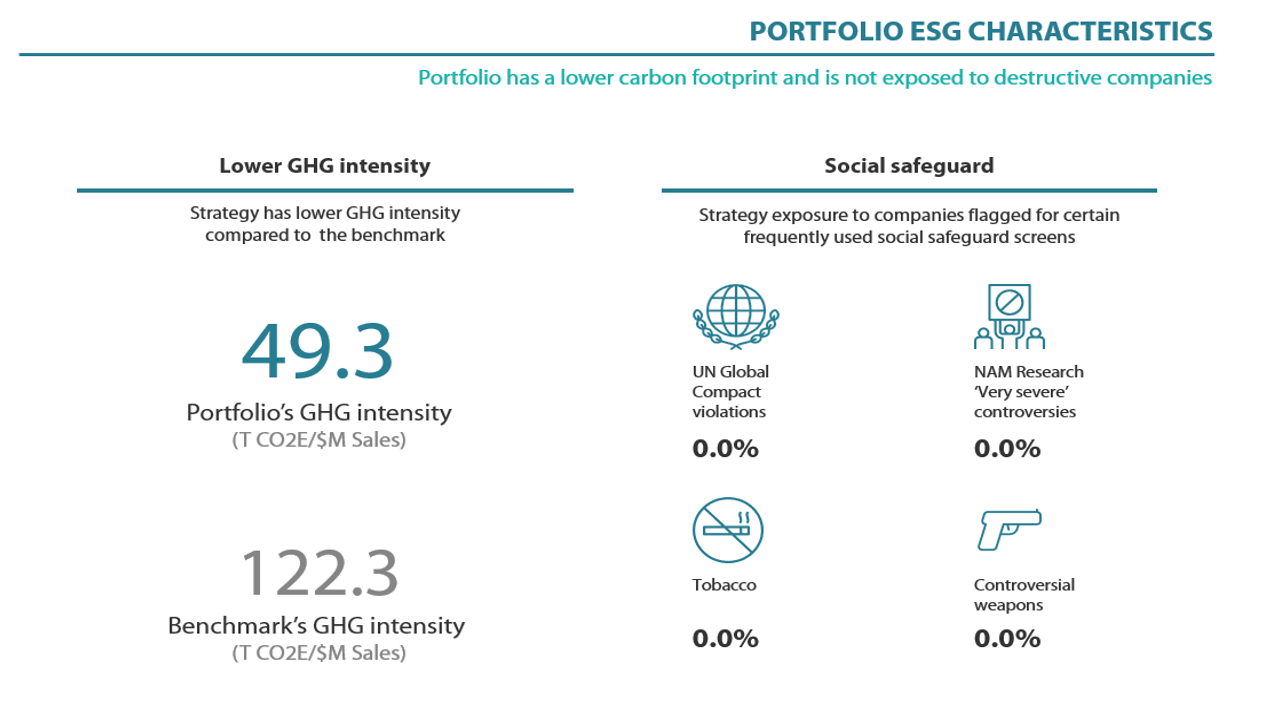

Past performance is not indicative of future performance. This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

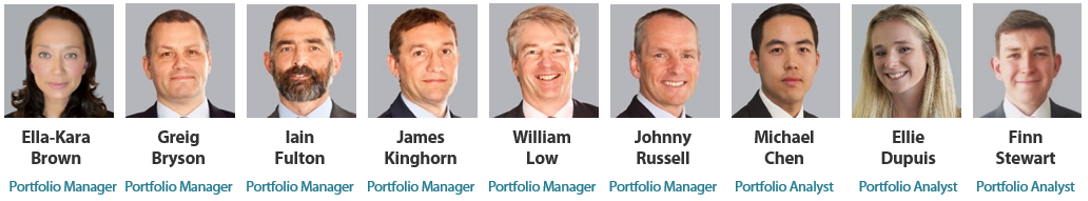

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don’t see.

There are four key areas that make our strategy different:

- a focus on Future Quality companies – a different and clear philosophy

- a distinctive team culture – a tight-knit team with a process built on openness and respect

- unique execution, including rigorous team challenge of every idea

- differentiated portfolios, with a strong track record in stock-picking and ESG integration

Future Quality companies

We believe that companies with superior long-term returns on investment will deliver better performance. We call these Future Quality companies, and it is only these companies that make it into client portfolios. We search for Future Quality through analysis and financial modelling of companies that we expect to deliver over the next five years, and beyond. This approach is supported by academic evidence that businesses with high and improving returns on invested capital provide superior compound performance over the long term. With this investment time horizon, the sustainability of returns is a crucial ingredient of our Future Quality approach. We have found that companies developing solutions to ESG issues and management teams providing value to all stakeholders are more likely to be successful at sustaining high returns on invested capital over the long-term.

Distinctive team structure and culture

We believe that our collective knowledge and experience are powerful tools for delivering investment performance. Since 2011, we have operated a team-based approach to uncovering Future Quality investment ideas and have fostered a strong group dynamic. Individually, each Portfolio Manager is an expert investor with a broad skillset and experience of many market cycles.

We work in a flat structure, where all our Portfolio Managers have a dual role that combines investment analysis and investment management responsibilities. With individual analytical coverage split along industry lines, each Portfolio Manager is a specialist in the stocks and sectors they cover.

We all actively challenge the ideas and analysis of colleagues throughout the investment process, in an open atmosphere of vigorous and constructive debate. Portfolio Analysts work alongside Portfolio Managers, typically researching thematic trends that could influence and uncover future investment opportunities.

We take collective responsibility for approving stocks for the portfolio, and therefore there is joint accountability for performance. As such, it is in everyone’s interest to ensure that the investment analysis is thorough and that no stone is left unturned in the search for Future Quality.

We believe that the broad experience of our Portfolio Managers and distinctive team-based approach that sees everyone contributing to the strategy, increases the probability of successfully uncovering Future Quality.

Unique execution

Our tight-knit team approach and flat structure enable us to execute in a transparent way, including a rigorous team challenge of every idea. By using our strict Future Quality standards, we can identify long-term winners from the broader universe, to narrow down a comprehensive watch list and around 100 deep dive researched ideas. This is within a unique framework of individual accountability for the underlying analysis and company research, combined with the collective challenging of assumptions at the team level. Our proprietary ranking tool creates a disciplined process to compare and rank attractive opportunities and ensures that at the portfolio construction phase, only our best-ranked ideas receive the most committed weights in client portfolios. We believe our culture is key, and the collective ownership of our research process brings the best portfolio outcomes for clients.

Differentiated portfolios

We deliver a high-conviction Global Equity strategy for clients that is not constrained by benchmarks. As such, Future Quality can be sourced from listed businesses across any geography or sector. And, in a world awash with investment prospects, our disciplined, accountable and transparent process helps us to focus solely on building portfolios from companies that best meet our specific Future Quality criteria.

In terms of balancing risk and reward, our track record shows that we consistently deliver attractive returns on a lower risk-adjusted basis compared with peers and the global reference benchmark. The high active share and concentrated number of holdings help ensure that our Future Quality stock-selection process delivers differentiated portfolios.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the strategy will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way. There can be no assurance that any performance will be achieved in any given market condition or cycle. Past performance or any prediction, projection or forecast is not indicative of future performance.

There can be no assurance that any performance will be achieved in any given market condition or cycle.